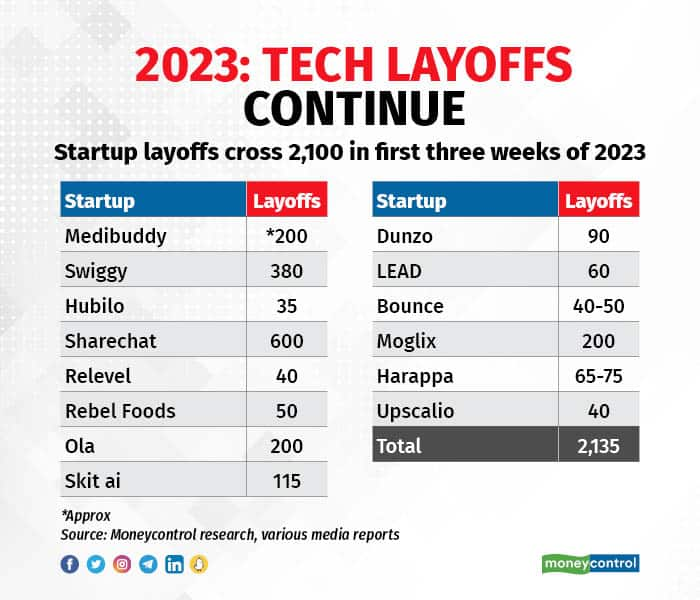

The start to 2023 has been an eye-opener. ‘The Great Resignation’ has given way to ‘The Great Layoff’ and ‘Quiet Quitting’ has transformed into ‘Quiet Firing’. About 14 startups in India have laid off over 2,100 employees in the first three weeks of 2023, according to data compiled by Moneycontrol.

Also Read: 14 Indian startups have sacked over 2,100 employees in the first three weeks of 2023

Meta, Google and Microsoft, once known as havens of stable jobs, have also joined the ranks of companies conducting mass layoffs. The number of layoffs in 2023 so far has crossed the first three-week average a year ago.

There have been three aftereffects of the recent development: the Tech sector has lost its sheen in terms of talent demand, it's not an employees’ market anymore, and startups are no longer everyone’s first choice as career starters.

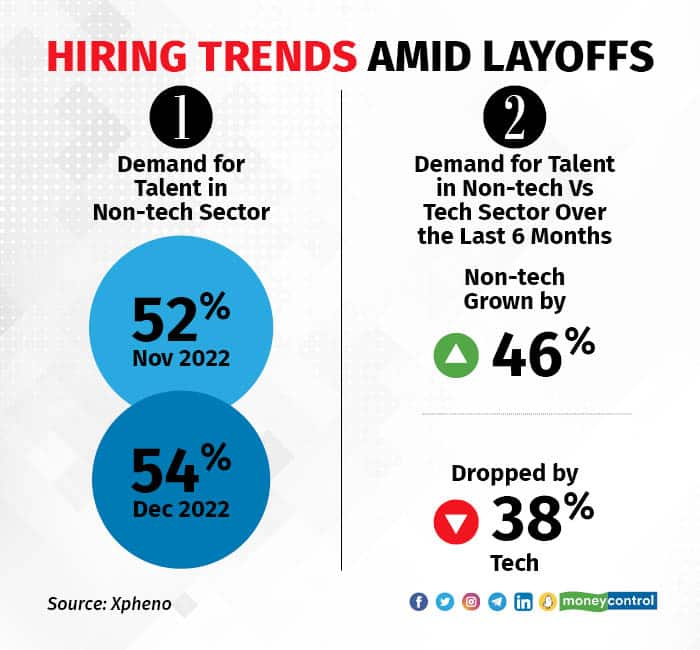

IT sector loses its dominaceThe single largest shift in the job market over the last three months is the Information Technology (IT) sector's loss of its dominant position in talent demand. Since October 2022, the IT Sector’s contribution to overall active openings continued to be below 50 percent, according to data compiled by Xpheno, a specialist staffing company.

“This is a huge shift for a sector that had earlier held dominance with more than 80 percent contribution to active job openings,” Anil Ethanur, co-founder of Xpheno told Moneycontrol.

“Currently in the 46 percent-48 percent contribution, the tech sector continues to lose its position as the primary hiring sector for white-collar openings.”

Also Read | Avoiding layoffs: Here are the crucial checks before joining a company

A related shift observed over the last three quarters is the non-tech sector's demand rising.

Xpheno’s data suggested that sectors like Banking, Financial Services and Insurance (BFSI), Consulting and Professional Services, Education, Media and Advertising, Manufacturing, Health and Wellness, Infrastructure and Telecom continue to have active openings and make up for the drop in numbers from the Tech sector.

Other sectors like Retail, Goods and Logistics, Business Process Outsourcing, and Consumer Services and Automotive continue to contribute by adding more active openings.

Quess IT Staffing predicts that non-tech sectors like BFSI, Retail and Automotive are expected to grow up to 20 percent in 2023 in terms of active demand for tech professionals, said Vijay Sivaram, CEO of Quess IT Staffing.

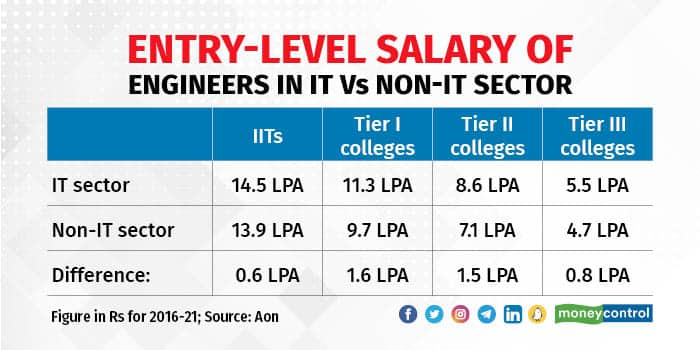

Moneycontrol has reported that traditionally, non-tech firms have had to pay a premium to hire IT talent but this is now changing because of the downturn in demand for tech talent, according to professional services firm Aon.

Recent upheaval in the tech sector has transformed the market from employee-driven to employer-driven. In the Global Capability Centre (GCC) sector, Talent500 has seen an about 40 percent increase in applications coming from product companies, especially in junior roles.

Talent500 is a talent acquisition partner for Fortune 500 companies.

Also Read | Ashneer Grover’s suggestion to avoid layoffs: Band-aid or long-term solution?

TeamLease Digital, which offers specialised staffing across IT, IT-enabled Services, has also noticed that job seekers are willing to work in any sector provided it matches their skills. According to its estimates, the non-tech sector will hire 1 million people in the next four years with at least 50 percent of them being tech roles.

“While there has been an increase in hiring in the non-tech sector, the numbers do not match the volumes which were getting hired in IT. However, there is definitely some talent shifting to the non-tech sector but handling tech roles,” said Sunil C, Chief Executive Officer of TeamLease Digital.

No more fan-following of startupsTalent experts say the “body language of recruitment conversations” has changed in favour of the employer, with tighter screening and package negotiations.

“The heydays of exorbitant offer hikes and unusual joining bonuses are now in the rearview mirror,” said Xpheno’s Ethanur.

For Vikram Ahuja, co-founder and CEO of Talent500, there has been an “evident shift” in the candidates’ mindset as they look for more stable opportunities with larger companies.

Startup layoffs cross 2,100 in first three weeks of 2023

Startup layoffs cross 2,100 in first three weeks of 2023“Startups have been attracting the top talent for more than a decade, but now the pendulum is swinging in the other direction,” Ahuja said.

TeamLease Digital’s Sunil C observed that job seekers are cautious and choose start-up jobs based on the companies' funding status, the current stage of their career, and the type of compensation offered.

Where are laid-off employees going?During the early stages of the pandemic, Xpheno had visibility of and access to talent identified as COVID-linked layoffs. This enabled tracking of movement patterns of laid-off talent.

Ethanur said the current layoffs are nearly being treated as ‘Business as Usual’ and identifying the laid-off talent pool separately is a challenge. But one of the observations in the tech sector is that the IT Services enterprises have been fueling and feeding off each other's attrition.

Also Read | More CEOs jumping ship as India Inc gauges post-COVID business scenario

“The high attrition levels at a sector level, with minimal net headcount additions, points to a mutual exchange of talent within the sector,” he added.

In terms of absorbing laid-off employees, Talent500 is seeing that many laid-off people have started working with global companies that have remote teams, as they can be based in India and work globally.

“We continue to hire at the same rate for global companies setting up their technology centres in places like Bangalore, Hyderabad, Pune, etc,” Ahuja said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.