Neha Dave Moneycontrol Research

DCB Bank, a small-sized private sector bank, reported a healthy performance in Q2 FY19, aided by loan growth and controlled expenses.

The retail and micro, small and medium enterprise (MSME)-focused bank stands out for its comfortable asset quality in the sector marred by high non-performing assets. It also enjoys strong parentage of the Aga Khan Fund for Economic Development (AKFED), which provides capital as and when required. Its healthy performance makes it a worthy stock to consider in an environment where a large part of the banking system has been rendered weak and non-banking financial companies (NBFCs) are stepping back due to a liquidity crunch.

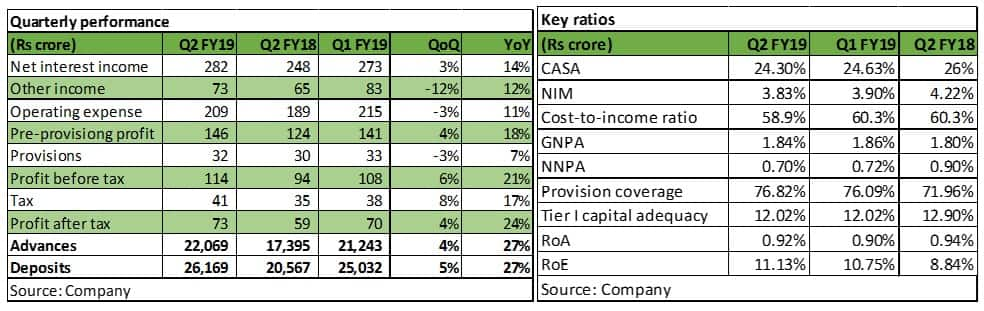

Strong quarter The bank reported strong net profit growth of 24 percent year-on year (YoY) in Q2 FY19. Despite a loan growth of 27 percent, net interest income (NII) growth was muted at 14 percent due to a fall in margin. Net interest margin (NIM) declined to 3.9 percent, down 7 bps sequentially and 39 bps year-on-year. NIM compressed as yields on advances declined due to rise in competition, especially in the corporate and mortgage segment, while cost of funds increased on higher interest rates. The decision to maintain excess liquidity adversely impacted NIMs. The management guided at a margin of around 3.75-3.85 percent for the near future, implying limited downside.

Strong growth in core fee income of 17 percent was partially offset by a fall in treasury income. Consequently, non-interest income growth was subdued at 12 percent year-on-year.

Asset quality is relatively better compared to peers with gross non-performing assets (GNPAs) at 1.84 percent as at September-end. The provision coverage ratio remains healthy at 77 percent.

Thanks to the contained growth in operating expenses at 11 percent YoY, the cost-to-income ratio declined to 58.9 percent in Q2 from 60.3 percent in the same period last year and was one of the key drivers of profit.

Profitability targets intact despite slow progress The management reaffirmed its FY19 guidance, which was comforting. The management had earlier guided to achieve return on assets (RoA) and return of equity (RoE) of a percent and 14 percent, respectively, by Q4 FY19. It sees C/I ratio falling to 55 percent, which will help achieve its targeted profitability. While these targets are achievable, the progress so far has been modest.

Operating leverage key to future profitability DCB has been on an expansion spree in the past five years, doubling its branch count from 154 in FY15 to 318 in FY18. As a result, its C/I ratio and operating expenses remain on the higher side, adversely impacting profitability. Going forward, the bank intends to add 15-18 branches per year over the next two years. As the branches mature, we expect operating expenses to moderate and become more RoE accretive.

Modest size and growth plans Advances growth was healthy at 27 percent YoY and higher than the industry average, albeit on a smaller base. The advances book is granular, with mortgage, agriculture and inclusive banking (AIB), corporate banking and SME/MSME segments constituting 40 percent, 18 percent, 17 percent and 12 percent, respectively, of net advances as on September 30. Loan book has doubled in the last 3 years and the management expects the same run-rate to continue in the future as well. This translates to targeted loan book growth of 22-24 percent for the next 3 years, which is modest considering its size. The bank’s funding profile too is average, with a low share of current account-savings account (CASA) deposits at 24 percent, much lower than the industry average of around 35 percent. However, we draw comfort from the share of retail deposits (retail term deposits including non-resident Indian deposits) which is 51 percent of total deposits as at September-end and lends stability to the bank's resources profile.

Earnings growth to drive the upside The bank’s ability to maintain its margin and stable asset quality as it grows its book are the key monitorables. The big lever can accrue from decline in C/I ratio as newly added branches start generating revenues. Slippage on any of these variables will make the bank’s journey towards its stated target more arduous.

Overall, we see a sure, but moderately paced improvement in return ratios primarily driven by balance sheet growth and operating leverage. However, it may take longer than the next two quarters to deliver the targeted returns.

On the valuation front, the stock is currently trading at 1.6 times FY20 estimated price-to- book which is at a premium to many of its old private sector banking peers. However, the current valuation can sustain with levers for profitability improvement in place. With not much room for a valuation rerating, the upside in the stock will be in tandem with earnings growth. In the interim, the stock would remain rangebound. Nevertheless, long term investors should utilise the languishing stock price as an opportunity to accumulate the stock.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.