Crypto venture funding, which saw a record Q1 in 2022, witnessed the deal pace of Coinbase Ventures slowdown in the second quarter, with the total count decreasing 34 percent, from 71 to 47. Coinbase Ventures is the venture capital arm of crypto exchange Coinbase.

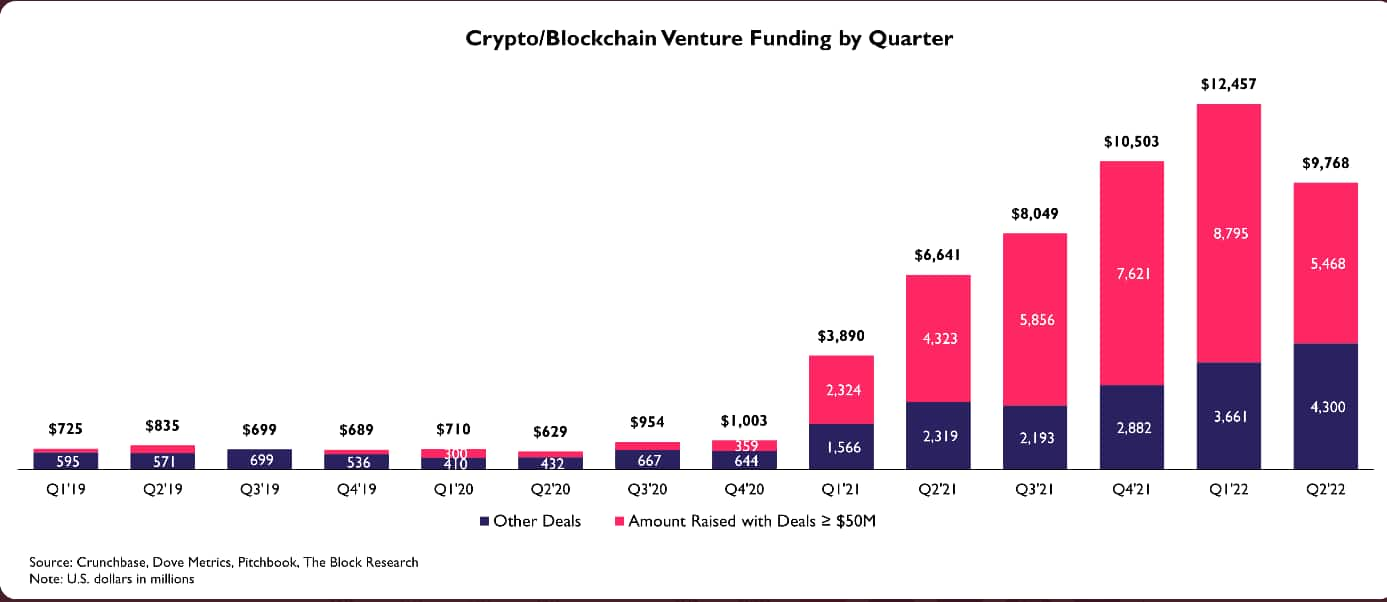

According to data released by The Block, venture funding in the blockchain sector declined 22 percent, from $12.5 billion to $9.8 billion. Before this decrease, investment had increased for seven consecutive quarters.

A quarterly investment report released by Coinbase Ventures shows that despite the slowdown compared to the fervent pace of late CY21 and Q122, Q2 activity still increased 68 percent YoY, indicating overall growth in its venture practice.

The decline in venture funding activity was attributed to the volatility in markets, which saw many founders rethink or put their rounds on pause, particularly at the later stages. “We’re seeing that many companies are foregoing fundraise unless absolutely necessary, and even then, only if they feel confident that they can show the growth needed to justify a new round,” the investing arm of Coinbase said.

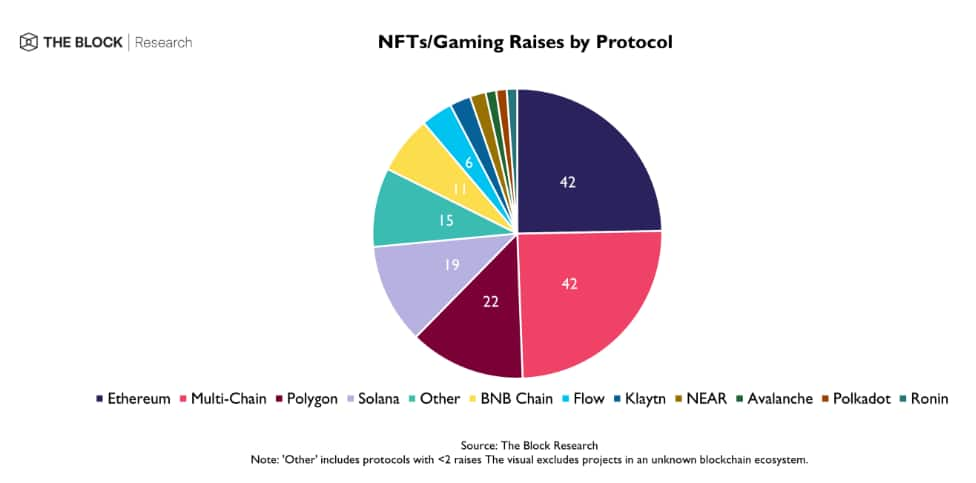

Web3 gaming will on board next wave of crypto usersWhile the overall environment has been negative, Coinbase Ventures is still interested in certain projects, as evident from its investments in Web3/protocol infrastructure, which got 38 percent of the VC's total investment and Platform & Developer Tool, which accounted for 21 percent.

“With an estimated more than 3.2 billion gamers in the world, we strongly believe that Web3 gaming will on board the next massive wave of crypto users. Web3 gaming remained a sector of heavy investment in Q2, with The Block estimating that over $2.6 billion was raised,” Coinbase Ventures stated.

The report noted that while centralised lenders indulged in opaque practices, and misused investors' funds resulting in their insolvency, these entities brought down whole crypto markets. In contrast, blue chip DeFi lenders Aave, Compound, and MakerDAO operated without a hitch, with every loan and its terms transparently on-chain for all to see, the report stated.

“As in previous downturns, detractors are once again confidently pronouncing crypto dead. However, from our seat in the industry, we’re invigorated by the brilliant founders we see working tirelessly to move this technology forward. As the entire financial system and world digitizes itself, we remain convinced that the opportunity within crypto and Web3 is far greater than most realize,” the report stated.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.