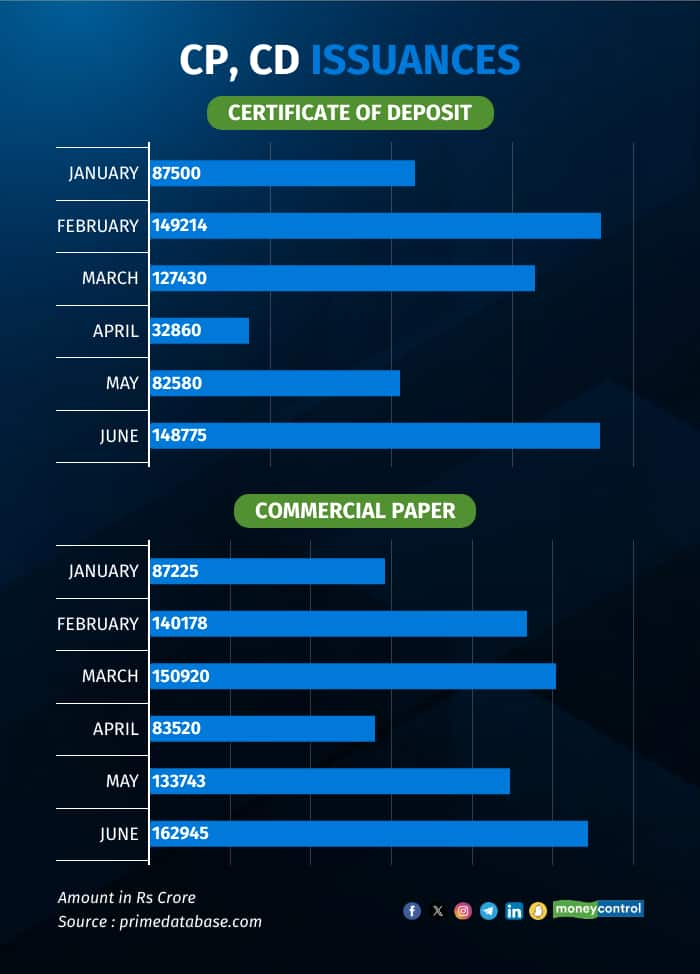

Fundraising through Commercial Papers (CPs) in June rose to the highest level so far in the calendar year, data compiled by Prime Database showed.

Companies raised Rs 1.63 lakh crore in June, as compared to Rs 1.34 lakh crore in May, the data showed.

Experts attributed this to higher borrowings by non-banking finance companies (NBFCs) due to the increase in risk weights, which increased borrowing costs. Also, some companies tap the market to roll over their papers which are due for maturity.

Usually, companies do roll over their papers during the quarter end to avail better rates from the market and increase their maturity tenures.

"Increased risk weights on NBFC exposures by banks pushed the borrowing cost higher for good rated NBFCs. This situation forced NBFCs to tap the money market to fill the funds shortfall," said V Ramachandra Reddy, Treasury Head, The Karur Vysya Bank.

Reddy further added that higher rollovers during the month was also the reason for higher numbers.

Also read: Explained: How will JPMorgan’s inclusion of India bonds impact debt mutual funds?

The numbersOn a yearly basis, issuances of CPs rose around 11 percent. In the year-ago period in June, companies have raised Rs 1.48 lakh crore, data showed.

National Bank for Agriculture and Rural Development (NABARD), Export and Import Bank of India (EXIM Bank), Small Industries Development Bank of India (SIDBI), Bajaj Finance, and Reliance Retail Ventures Ltd were the top five issuers in June.

These entities together raised Rs 63,725 crore through CPs in June, which is around 39.11 percent of the total issuances.

NABARD raised Rs 20,500 crore, EXIM Bank raised Rs 14,675 crore, and SIDBI raised Rs 14,575 crore.

Also read: Bond index inclusion will drive FII flows into Indian markets, lifting liquidity

Certificates of Deposit issuanceAmidst tight liquidity in the banking system, banks have raised Rs 1.50 lakh crore in June. The Certificates of Deposit (CD) issuance has risen over 100 percent compared to a year- ago period

According to Mataprasad Pandey, Vice President, Arete Capital Service, over a 100 percent jump in CD issuances in June is also due to the low base last June when the banking system was flush with ample liquidity after the withdrawal of the Rs 2,000 note.

Punjab National Bank, Canara Bank, Union Bank of India, HDFC Bank, and Bank of Baroda were the top five issuers in June.

These banks together raised Rs 1.10 lakh crore, which was around 74 percent of the total issuances.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.