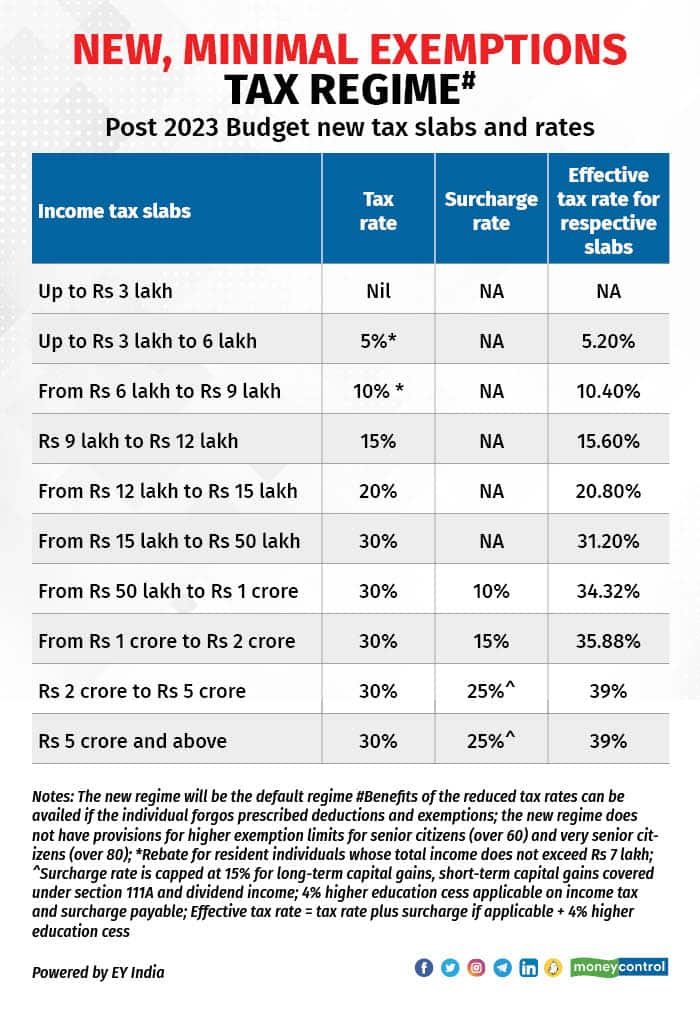

Certain amendments have been proposed New Personal Tax Regime (NPTR) in Budget 2023, in order to provide tax relief to the middle and salaried class and also to align the highest tax rate with global rates.

The budget also seeks to simplify tax compliances and has introduced certain provisions to rationalise some reliefs as anti-abuse measures.

Under the NPTR, the income threshold to claim the rebate has been increased to Rs 7 lakh from Rs 5 lakh.

Further, to align the maximum tax rate in line with global tax rates, it is proposed to reduce the surcharge to 25 percent from 37 percent for income exceeding Rs 5 crore.

As a result, the effective maximum marginal rate will come down to 39 percent from 42.74 percent. Compared to the old tax regime, there is no change in tax rates and the maximum marginal rate.

This offers a choice to individuals to opt for NPTR or the old regime to minimise the tax impact. If no choice is made, the NPTR will apply.

Cap on long-term capital gain tax deduction from residential property

Currently, individuals can claim a deduction from capital gains by investing in a new residential property. It is proposed that the reinvestment in new residential house and deduction therefrom is capped at Rs 10 crore. This move is expected to check the claiming of undue benefits in high-value transactions.

Amount received on life insurance policies

The amount received on maturity of life insurance policies is exempt from tax on meeting some specified conditions. It is now proposed that if the premium paid exceeds Rs 5 lakh, an exemption will not be available. This will apply to all policies issued on or after April 1, 2023. The taxable amount received will be computed in the manner prescribed.

Improving tax administration

There has been a significant increase in the number of appeals filed on account of various accounts such as mismatches of income, non-grant of credit of foreign tax credit, TDS etc. This has led to an increased burden on the Commissioner of Income-tax Appeals to dispose of the appeals.

With a view to expediting the disposal of the Appeals, it is now proposed to introduce a new authority, Joint Commissioner of Income tax (Appeals), who will have all the powers, responsibility and accountability to dispose of appeals involving a small amount.

Market-linked debentures to be taxed as short-term capital gain

Market-linked debentures are debt instruments whose returns are linked to market returns.

Such debentures are listed securities and are taxable at the rate of 10 percent, without indexation. It is now proposed that capital gains arising from the transfer of such debentures will be taxable as short-term capital gain at applicable rates from April 1, 2023.

Conversion of physical gold to electronic gold receipts and vice-versa

In order to promote the concept of electronic gold, it is proposed that any conversion of physical gold to Electronic Gold Receipts (EGRs) and vice-versa shall not be considered a ‘transfer’ for the purpose of computing capital gains.

It is also proposed that the date of acquisition and cost of acquisition of the original asset will be considered as the date of acquisition and cost of acquisition for converted asset.

Extending deeming provision to Not Ordinarily Residents

Currently, a gift worth over Rs 50,000 received outside India without consideration from a person resident in India is considered as taxable income only for a non-resident. It is now proposed that even Not Ordinarily Residents will be taxed in such a scenario.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!