Wonder why your bank's system is down quite often or why you face transaction declines repeatedly?

A Moneycontrol investigation into tech glitches reported by Indian banks across multiple platforms — mobile and internet — over the last few years has revealed major fundamental problems in their operations.

For one, most banks, including bigger ones, continue to use outdated technology platforms, making upgrades difficult. Secondly, these banks severely lack the adequate number of talented tech professionals to support large-scale tech-enabled banking operations, often resulting in major delays in the event of an outage.

Moneycontrol studied the tech outages reported by at least six banks in the recent past and spoke to at least 10 officials from these banks and technology firms.

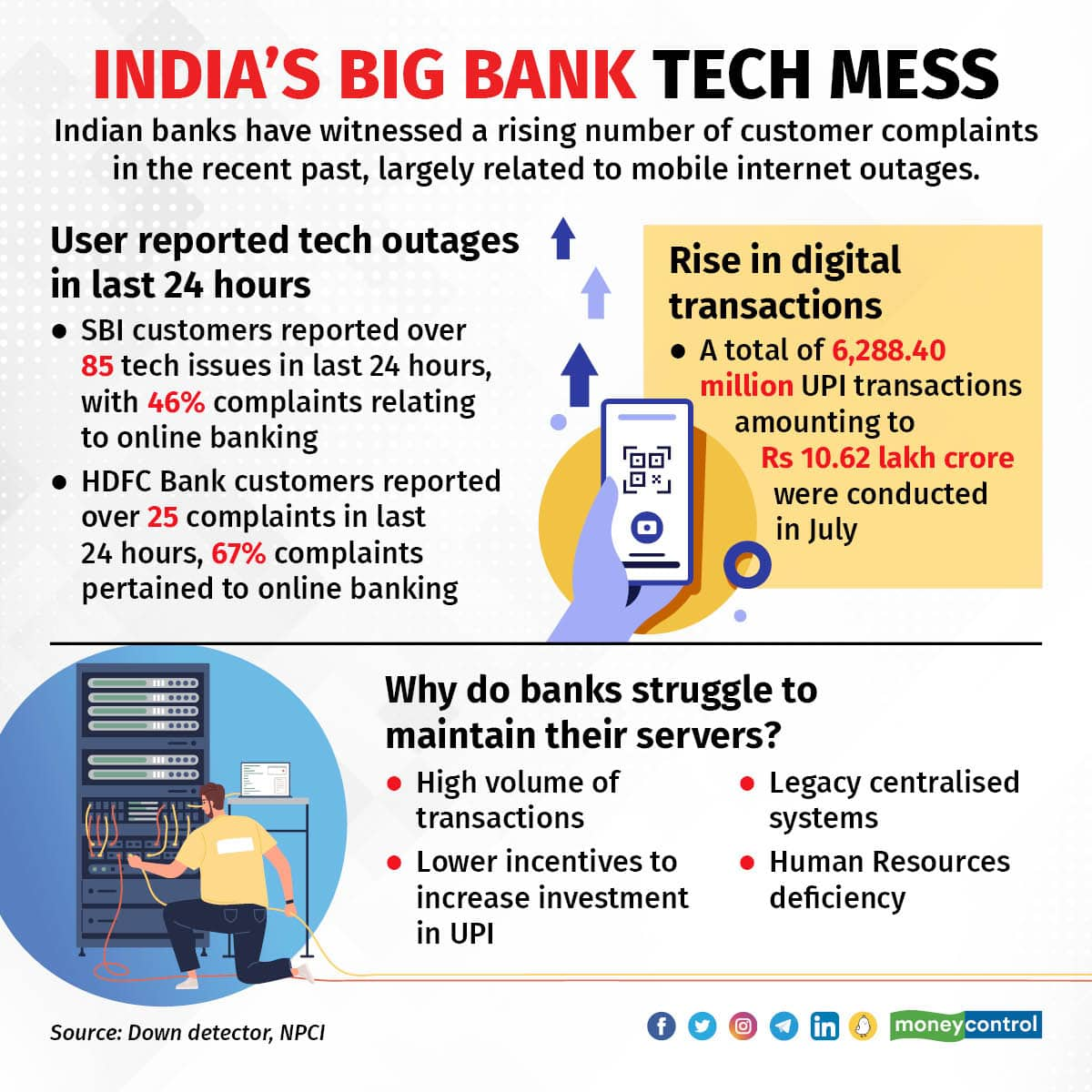

Rising customer complaints

According to the central bank’s 2021 ombudsman scheme annual report, customers submitted a total of 44,385 complaints related to mobile and electronic banking between April 2020 and March 2021, higher than the 41,310 complaints recorded by the regulator in the previous year.

This is at a time when banks continue to launch new digital initiatives and so-called super apps.

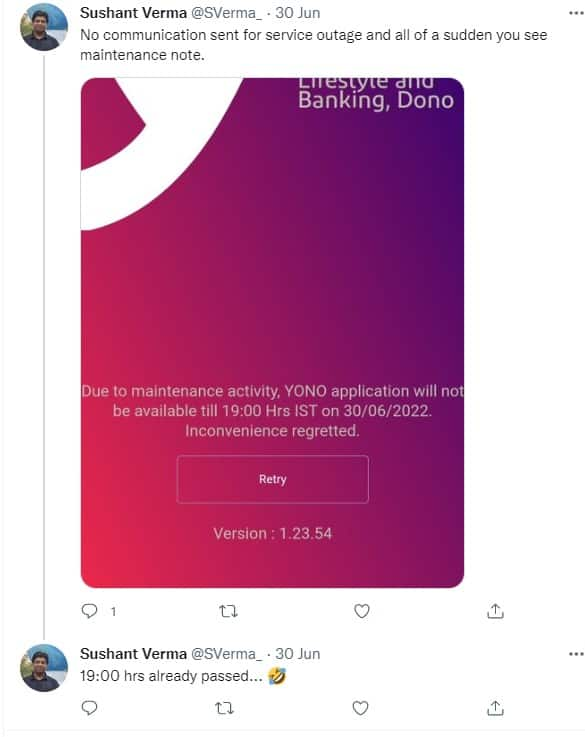

To give an example, on June 30, a Twitter user posted a “maintenance” break screenshot from State Bank of India’s (SBI) banking application YONO. He complained that the bank had shared no communication with customers to alert them of the service outage.

As per the screenshot, the app’s services were not supposed to be available till 7 pm on June 30.

“19:00 hours already passed…,” Verma replied to his original tweet after the maintenance break passed its deadline. The same day saw many similar complaints by users saying that India’s largest public sector bank had not sent any prior notice for the scheduled break at a time when the country is pushing for further digitisation.

Source: Twitter

Source: Twitter

SBI is not the only one facing heat for such issues. On August 17, multiple Twitter users posted complaints of not being able to log into the bank website or app of India’s largest private sector bank – HDFC Bank. Similarly on August 13, many complained that net banking was not working since morning that day.

@HDFC_Bank your netbanking site not working from today morning, please check and resolve the problem— Satish Kumar (@SatishKRoy1976) August 13, 2022

“@HDFC_Bank your netbanking is down since an hour. I have payments to make and your site is just not working. Is it down for maintenance? If yes, no email or messages or any prior intimation was given to me,” tweeted user Ishita Shah.

Last year, the bank faced the wrath of the Reserve Bank of India (RBI) after five major outages between November 2018 and March 2021. While RBI lifted the ban on all launches of its upcoming digital business-generating activities later, RBI’s diktat set the bank behind in competing with its peer ICICI Bank in credit card issuances as well as new digital initiatives.

Both SBI and HDFC Bank did not respond to detailed queries by Moneycontrol on the scheduled maintenance break or on the service outage.

Twitter is full of similar complaints across banks -- multiple users facing problems at once on some days.

What is the core issue?

The biggest strength of India’s largest banks is also the biggest Achilles' heel when it comes to technology – scale. Besides the burden on internal tech systems to handle the rising volumes of digital transactions, these are legacy systems with a heavy dependence on external service providers that plug in each layer of tech for banks.

“The large banks have the issue of using legacy technology from years ago. The bigger you are, the more difficult it is to upgrade. The risk is immense even while migrating from a large old database to a new one,” said the technology head of a leading fintech.

The core banking system of most banks is provided by large information technology players, including Infosys’ Finacle, Oracle and BaNCS by Tata Consultancy Services (TCS). With the core system being operated by tech teams of these IT giants, internal teams of most banks only ensure that these systems are kept up and running.

“In one of our conversations with a smaller private bank that positioned itself as a digital bank, we were told that they have a tech team of 400 people. But not a single one of them wrote any code. Their entire job was to deal with their IT vendors,” the person added.

In such a situation, many experts believe that internal bank teams are largely deployed for ‘requirement management’ and not equipped to fix larger issues or build for evolving needs of customers.

Legacy problems

Aishwarya Jaishankar, who has led digital initiatives at various private sector banks and is now Co-Founder of Hyperface which provides tech stack for credit cards, said, “The core banking systems were built for the back offices and branches of banks and have scaled from there. But now modern customers want to be served digitally, needing a front-end focussed experience that banks are struggling to create with pure-play core banking systems.”

The core banking systems too are legacy software built over the past two decades and have reached a scale that makes it difficult to upgrade these to handle the increasing volumes. Hence, the knowledge required to operate these systems too is similar to what was required years ago.

Harshavardhan Godugula, Partner, Forensic and Integrity Services, EY, said, “Traditionally, core banking platforms are centralised systems – on top of which banks have built newer applications and capabilities, such as mobile banking, Unified Payments Interface (UPI), etc. Sometimes, these legacy systems are unable to perform adequately and face system downtime, vulnerabilities, hardware failures, etc. If banking apps are not built and tested properly, they are bound to throw back errors.”

Another disadvantage for large legacy banks is the difficulty in attracting the right talent and pay disparity as compared to large IT players and startups. “Large financial institutions have a hierarchical structure that makes decision-making difficult,” said another fintech founder.

Hyperface’s Jaishankar added, “While core banking is resilient, it has not evolved at the rate that innovation has taken place. Banks have to plug more third-party switches into the existing systems as the usage of real-time payments and other innovations increase pressure on the system.”

Nilufer Mullanfiroze, who has over two decades of experience working with banks like Standard Chartered and Federal Bank and is now Head of Banking at investment startup Groww argued that the time for technology to become redundant is only becoming shorter. Hence, it is not practical to expect large institutions to redo their systems.

"But what needs to be the practical approach with most banks is to have the right infrastructure to build things on top of their core banking systems. Having the agility to be able to use the core banking system more as the backend system and build the right interfaces with newer age technology is the way to go for the future," she added.

The tide, however, has changed for the better after the regulator took cognisance of major outages across banks. Top management across banks are now more aware of the limitations of their technical capacities and seem to be working with the regulator around challenges.

Finally, the UPI hiccup…

“Since the last few days, when we try to send or receive money through UPI apps, the SBI server is down very often. Nowadays, people carry very less cash in hand. How are we supposed to transact seamlessly in such a scenario,” Sanket Rathi, an SBI customer for more than 10 years told Moneycontrol.

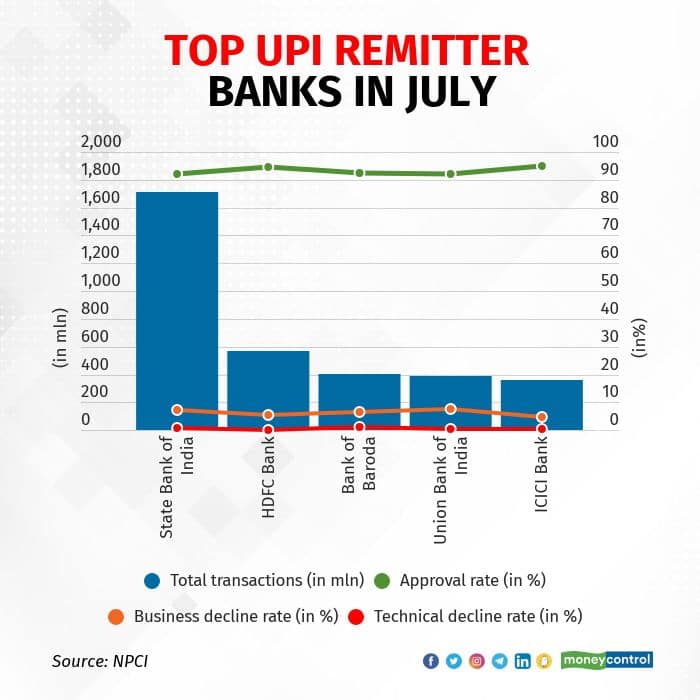

Failures on UPI payment systems are basically of two types, technical decline (TD) and business decline (BD). Technical declines are caused due to issues with the bank's system or NPCI systems, while business declines are caused due to issues pertaining to customers, such as incorrect PINs or transactions beyond stipulated limits.

“If we compare TDs to BDs, the former is always lesser than the latter. This is a clear result of seamlessness,” Venkatraman Venkateswaran, chief financial officer (CFO) at Federal Bank said.

To counter issues relating to reconciliation of timed out and declined transactions on the UPI platform, we might soon see the emergence of a tech that will allow real-time settlement of such transactions, he added.

Numbers don’t lie

The top five UPI remitter banks in terms of volumes in July were SBI, HDFC Bank, Bank of Baroda, Union Bank and ICICI Bank. For example, SBI's approval rate of UPI transactions was at 92.1 percent in July. The bank’s business decline rate stood at 7.26 percent as compared to 6.96 percent in June. The technical decline rate saw a steep drop to 0.68 percent in July from over 5 percent in June.

While the decline rates keep fluctuating every month, for the user dependent on UPI for all transactions, this is a major road bump. So why do UPI downtimes happen with banks?

Banks as well as the RBI have taken cognisance of the burden that the rise in UPI transactions has put on bank servers. Since the pandemic struck in March 2020, UPI monthly transaction values have grown by 5x from Rs 2 lakh crore to Rs 10.62 lakh crore in July 2022. What’s more is that UPI is used for multiple small-ticket transactions, including paying for an auto ride or even your local tea stall owner.

With over 600 crore transactions a month, the stress on bank servers is high.

“To add to that, the innovation is happening faster than the time banks can take to handle the growing transactions. With RuPay credit cards on UPI and UPI 123Pay, the number of transactions is expected to grow significantly,” said a senior executive of a payments company.

So, what are banks doing to address these problems?

Large banks are working towards pre-empting the problems that may emerge in the coming years as digital adoption increases further.

“While other private banks are trying to get their house in order, ICICI Bank is preparing for a wider presence in getting embedded across a large number of platforms where users transact. It is also preparing to scale horizontally and vertically,” said the founder of a fintech and bank infrastructure provider.

ICICI Bank did not respond to Moneycontrol’s request to participate in the story.

HDFC Bank chief executive officer Sashidhar Jagdishan, in a mail to employees in April 2021, had said that the bank has invested heavily in scaling up the infrastructure to handle any potential load that it will encounter for the next three to five years.

The bank is also setting up a digital factory and an enterprise factory to roll out new digital offerings and to help augment the bank’s IT infrastructure.

As for SBI, multiple reports suggest that the bank is in the process of upgrading its YONO app to offer a completely digital banking offering.

Another outlier is Federal Bank. The bank is known to invest heavily in modernising its internal tech capabilities, cloud adoption as well as target growth through tie-ups with fintechs. As per, customers are extensively using the bank’s internet banking platform due to the constant investments it has made.

“The enterprise or individual of today doesn't want to experience buffering pages. The 'lift and shift' model (migrating apps and data to cloud) of ensuring early adoption of tech will ensure that the sector is near glitch-free,” Federal Bank’s Venkateswaran said.

Union Bank of India General Manager Sanjay Narayan, who leads the lender’s digital initiatives, said that the lender has put in place a board-approved compensation policy whereby the bank compensates the customer for any financial loss that they may incur due to deficiency in service on the part of the bank, or any act of omission or commission directly attributable to the bank.

“With the growing customer base and increase in the number of digital products, robust infrastructure is a must. Adding new hardware to accommodate the continuous increase in digital transactions and customer base has become one of the important aspects of providing hassle-free banking services. Cloud is one of the growing spaces being used by entities for expansion of infrastructure,” Narayan said.

The UPI puzzle — To invest or not?

On UPI, industry experts have pointed out that banks see less incentive in investing further for UPI transactions as payment systems don't fetch enough revenues for banks and payment service providers, as per government norms.

“UPI has also introduced an orchestration approach due to its scale, something that was rarely conspicuous in the Indian banking system. But ensuring scalability with the right agility and security has its own costs. Government incentive will be helpful to take care of some of the costs associated with UPI,” Venkateswaran said.

In December 2021, the government had announced a Rs 1,300 crore scheme to incentivise banks, and through them payment gateways and UPI players for transactions. To be eligible for the full incentive, banks were required to show at least 50 percent year-on-year growth in UPI transactions by the end of the last quarter of the scheme.

With the Union Ministry of Finance’s recent clarification that the government has no plans to levy charges on UPI transactions, CRISIL Research Director Aniket Dani said that further government incentives in promoting UPI will aid in the upgradation of the existing services.

“The Ministry of Finance asserted on August 22 that would continue lending financial support to boost the digital payments ecosystem in the country. This help from the government will, in turn, aid the parties in the transaction to get monetary remuneration for the probable expenses associated with the same,” Dani said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.