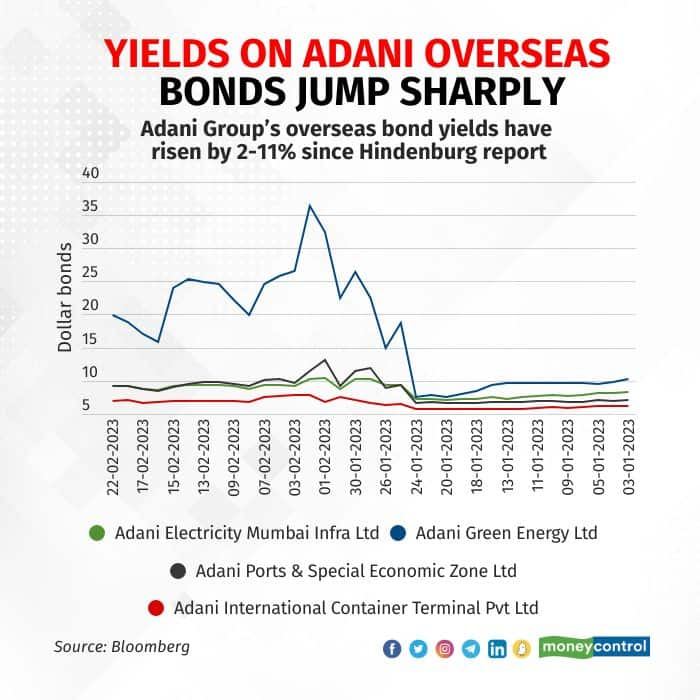

Yields on overseas bonds of the Adani Group continued to rise since the Hindenburg Research report flagged concerns over the group’s high debt level and accounting irregularities, data showed, suggesting a sell-off of the securities in the secondary market.

The yield on the overseas bond of Adani Electricity Mumbai Infra rose to 9.2261 percent on February 22 from 7.2451 percent on January 24, according to Bloomberg data. Adani Green Energy’s bond yield rose to 19.9714 percent from 7.4802 percent on January 24.

Adani Ports & Special Economic Zone and Adani International Container Terminal bond yields rose to 9.201 percent and 6.943 percent, respectively, from 6.7 percent and 5.693 percent before the Hindenburg report came out a month ago.

“Subsequent to the Hindenburg report and scrapping of the follow-on issue, there is a big element of uncertainty prevailing in the market with visible upsurge in overseas bond yields,” said Jyoti Prakash Gadia, managing director of Resurgent India, a merchant bank.

The Adani Group has redemptions of Rs 90,000 crore in the next few years, including overseas bonds and commercial paper, according to Prime Database.

“While the management is trying to handle the far-reaching ramifications, clear and concrete strategies need to be spelled out by the group to stabilise the market and recreate investor interest,” Gadia added.

In the past week, the Adani Group had hired banks to arrange calls with bond investors, according to reports. Market participants said the meetings were called to assure bond investors. However, there doesn’t seem to be any positive impact on the group’s bond yields.

Adani Ports paid Rs 1,000 crore to SBI Mutual Fund and Rs 500 crore to Aditya Birla Sun Life Mutual Fund on commercial paper earlier this week, according to media reports. Bond dealers said most investors in Adani Group bonds will be in a wait-and-watch mode for future developments.

Also read: Adani group unlikely to face any bond repayment problems, say experts

“Investors may also go in for a short-term wait-and-watch stance to properly assess the situation before taking a drastic view. The situation calls for a pragmatic approach and balance on both sides to create a workable solution in general interest,” Gadia said.

Hindenburg report

US-based short-seller Hindenburg Research released a report on January 24, alleging that the Adani Group improperly used offshore tax havens and manipulated stock prices. It said there were also concerns over the group’s high debt levels. Since then, stocks of Adani Group companies have lost more than $100 billion in market value.

Hindenburg said it had taken a short position in Adani Group companies through US-traded bonds and non-Indian-traded derivative instruments.

The Adani Group called the Hindenburg report an attack on India and its independent institutions. It said the report was “baseless” and “driven by an ulterior motive to create a false market.”

Adani Enterprises cancelled a Rs 20,000 crore follow-on public offering of shares, saying that given the volatility of the market on February 1, the board “strongly felt that it would not have been morally correct to proceed with the FPO.”

Also read: Sebi seeks details on Adani Group firms' loans and securities from rating agencies

Developments thereafter

Morgan Stanley Capital International announced weightage changes for four Adani company stocks and then delayed the changes for two of them.

Index provider FTSE Russell said last week it has been monitoring information on Adani Group stocks and would proceed with scheduled index review changes for the securities.

“FTSE Russell would like to confirm that it intends to proceed with the scheduled index review changes for the Adani Group (India) and its associated securities in line with index methodologies and policy guides, effective Monday 20 March 2023,” FTSE Russell said in a release.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.