Hindustan Unilever witnessed a soaring top line, fuelled by price growth since the June quarter of last year. As a fresh chapter unfolds, the company's management anticipates a paradigm shift, expecting volumes to drive sales in the upcoming quarters, shedding reliance on price hikes.

“If commodities remain where they are, I do expect our price growth to be either flat, or marginally negative and growth for next couple of quarters will be fully led by volume,” says Ritesh Tiwari, Chief Financial Officer and Executive Director of Hindustan Unilever, in its Q1FY24 earnings conference call.

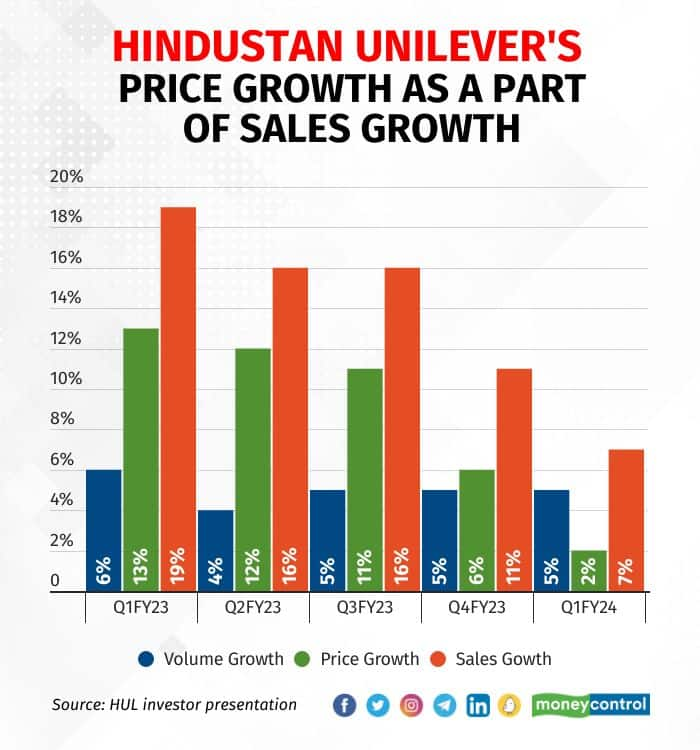

Since the June quarter of the last financial year, Hindustan Unilever’s sales are growing on the back of price growth. Contribution of price growth to the top line was, however, seen declining over the quarters. Here is a chart that shows the trend:

Hindustan Unilever expects sales growth to be led by volumes on the back of easing raw material costs. In Q1FY24, key components like palm oil, mentha oil and coffee exhibited significant price reductions. Palm oil prices dropped 39 percent compared to the same period last year. Mentha oil, essential in soap manufacturing, witnessed a 6 percent year-on-year decline in Q1FY24, while coffee prices dipped by 18 percent over the same period. Sugar prices however increased 3.8 percent year-on-year during the same period but the commodity has eased since Q1FY23.

“Hindustan Unilever is increasing its distribution reach, penetrating in the rural markets, in order to derive volumes for the next few quarters,” says Kaustubh Pawaskar, Director Vice-President of Fundamental Research at Sharekhan. The positive trend in rural demand is visible, with rural volumes increasing by around 3 percent in the June quarter this year, compared to a 10 percent decline in the same period last year.

“Hindustan Unilever’s increased spending on advertisements will bring more volume growth for the company,” says another analyst who wishes to not be named. He further says that in the last one year, Hindustan Unilever was cutting on advertisement spends to minimise costs, but now has a chance to ramp up those spends and gain volumes. The company’s advertising and promotional spends increased 40 basis points on a year-on-year basis and 110 basis points sequentially in Q1FY24.

Pawaskar says the company’s focus on premiumisation would drive volumes for the company in the next few quarters. Hindustan Unilever’s premium portfolio, which makes up almost 33 percent of the total product portfolio, is garnering most of the growth for Hindustan Unilever, and is growing 50 percent faster, the company said in its Q1FY24 conference call.

Hindustan Unilever’s fabric wash portfolio grew in double-digits on the back of premium products like ‘comfort’- fabric softener. The skin care and cosmetics portfolio also grew on the back of premium products during the quarter.

Hindustan Unilever's strategic approach, involving increased investments in advertising and promotions, expansion into untapped markets, and a focus on premium products, is poised to drive significant volume growth.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.