BUSINESS

Brookfield eyes $100 billion India portfolio in five years, says President Connor Teskey

Teskey said that Brookfield expects its global portfolio of around $1 trillion to reach $2 trillion or more in the next five years.

BUSINESS

Temporary blip due to Indo-Pak tensions, but luxury hotels to recover soon: Brookfield ahead of Leela IPO

Brookfield Asset Management-promoted Leela Palaces, Hotels, and Resorts is preparing to list as Schloss Bangalore Ltd in a Rs 3,500 crore initial public offering

BUSINESS

India’s first asset reconstruction firm ARCIL planning to go public

The size of the IPO is likely to be in the range of around Rs 1,000 - 1,500 crore

BUSINESS

Brookfield-backed Avaada plans Rs 4,000-cr IPO for solar module manufacturing arm

In March, it inaugurated a 1.5 GW solar module gigafactory in Dadri, Uttar Pradesh, and laid the foundation for a 5 GW integrated manufacturing facility in Greater Noida.

BUSINESS

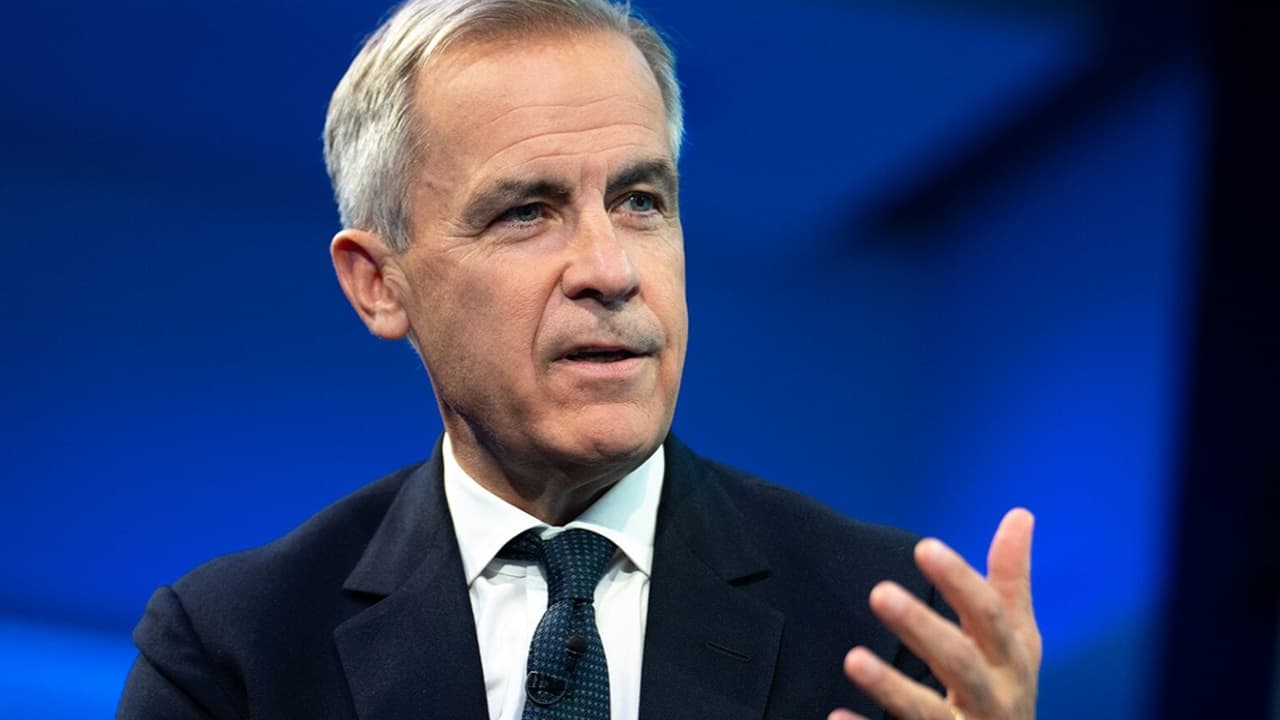

Mark Carney’s win a boost for Canadian pension fund investments in India, say analysts

Pension funds such as CPP Investments and CDPQ and others Canadian funds are major investors in Indian market as well as critical sectors such as infrastructure and renewable energy

BUSINESS

Mumbai realtor Wadhwa plans to raise up to Rs 2,500 crore through IPO

Several Mumbai-based real estate developers such as Macrotech (Lodha group) Rustomjee, Arkade and Suraj Estate have gone public in recent years.

BUSINESS

IPO-bound Shiprocket betting on cross-border commerce, financial & marketing services for growth: Saahil Goel, Founder

A key focus of Shiprocket’s business is to serve India’s long tail — millions of small and midsize sellers who are not served by large marketplaces or enterprise tech providers.

BUSINESS

Bengaluru’s Prestige Group gearing up to launch Rs 4,000-crore IPO for hospitality arm

Investors see real estate and hospitality sectors as a safer bet amid the market turmoil, leading several companies to explore IPOs

BUSINESS

Overburdened local law firms push issuers to hire foreign lawyers for smaller IPOs

Since the start of 2025, more than 60 draft documents have been filed with the Securities and Exchange Board of India, highlighting the frenetic activity in the Indian primary market

BUSINESS

Trump's tariffs will be negative for India's exports, domestic growth: RBI Governor

Governor Malhotra highlighted multiple areas of concerns - investments and consumption, domestic growth, exports as well as impact of tariffs on inflation.

BUSINESS

Expect to hit final close of FLF III fund by mid-year: Avendus FLF's Ritesh Chandra

Avendus’ FLF is a late stage private equity fund that invests in companies that are 2-3 years away from a liquidity event - an IPO or a stake sale

BUSINESS

Cube Highways Trust exploring conversion to public InvIT

Cube InvIT is one of the biggest infrastructure investment trusts in the country, holding a group of 25 road assets with an aggregate length of 1,940 kms spread across 12 states

BUSINESS

KKR’s InvIT Highways Infrastructure Trust raises Rs 8,250 cr debt from Axis Bank, HDFC Bank, ICICI Bank, SBI

The funds will be utilized for meeting the financing needs for the acquisition of TOT Bundle 16 from the National Highway Authority of India (NHAI) and a portfolio of 12 road assets from PNC Infratech.

BUSINESS

Prataap Snacks-acquirer Authum in talks to raise over Rs 2,000 cr through QIP

Authum is working with investment bank JM Financial on the proposed QIP fundraise, people aware of the matter told Moneycontrol

BUSINESS

Adani Group bonds rise on easing concerns over US indictment

Analysts have attributed the upward price movement in Adani Group's bonds to the recent decision by US government to halt FCPA proceedings against foreign companies over alleged violation of US anti-bribery laws.

BUSINESS

Adani Green in advanced talks with SBI-led consortium to raise up to Rs 10,000 crore to refinance dollar loans

The domestic refinancing comes after Adani Green scrapped its $600 million dollar bond offering in November

BUSINESS

Hitachi Energy picks ICICI Securities, HSBC to raise up to Rs 4,000 crore through QIP

The company plans to use the money to fund capex needs, meet working capital requirements as well as for inorganic growth opportunities

BUSINESS

Edelweiss Alternatives plans to raise up to Rs 3,000 crore from roads InvIT

EAAA invests in infrastructure projects through its Yield Plus Funds, which manages assets worth close to Rs 12,000 crore

BUSINESS

Solar cell manufacturer Jupiter International plans $300 million IPO

The funds will be used by the company to fund its capex plans, which will see the company expand its manufacturing capability beyond just solar cells and become an integrated player manufacturing cells, wafers as well as modules

BUSINESS

Budget amendment limiting carry forward of losses can make distressed deals less attractive, say experts

Recoveries under Insolvency and Bankruptcy Code stand at 31-32 percent of the admitted claims

BUSINESS

IPO-bound Hero Fincorp sees 80% rise in losses from bad loans, profit tumbles

As a result of its growing bad-loan problem, the NBFC's gross non-performing assets are seeing an upward trend again

BUSINESS

NHAI in talks to raise Rs 9,000 crore for its InvIT

The funds will be used to acquire a portfolio of road assets from NHAI. The National Highways Infra Trust has a portfolio of 15 road stretches, spanning 1,525 km spread across nine states

BUDGET

India Inc welcomes Budget's booster dose for consumption

The waiver on personal income tax for income up to Rs 12 lakh is expected to ease the financial burden on the salaried class, soften the impact of rising prices, thereby drive consumption

BUSINESS

Moderation in wages and employment despite robust corporate profit a 'serious concern': Economic Survey

According to the survey, corporate profitability soared to a 15-year peak in FY24, fuelled by robust growth in financials, energy, and automobiles.