BUSINESS

Weak global cues will have little impact on resilient Indian markets, says Tridib Pathak of Avendus

In the digital food delivery companies there is scepticism about profitability, said Pathak. "It takes time for these companies to become profitable and even if they do, the ROCE will still be low," he said.

BUSINESS

NSE shares to see limited upside going ahead, say broking firms

Markets experts believe that since NSE enjoys a huge dominant position in the F&O segment, any hit in the volume would impact the financials of the bourse and hence the valuation as well.

BUSINESS

Sebi's new asset class proposal has made Cat 3 AIFs a worried lot

While it is believed that the proposed new asset class could be a game-changer by pulling away investors from unregistered and unauthorised investment products, there is also talk among Category III AIF managers that a potential tax advantage could lead to some of their investors routing a part of their money towards the new option.

BUSINESS

Family offices unfazed by market turmoil

But if the investment approach of family offices is anything to go by, then it would not be wrong to say that while these data points could be worrisome for many, they are certainly not for the sophisticated family office club who are there in the market for the long haul.

BUSINESS

FIIs’ third biggest single day dump ever: Rs 10,000 crore sold on August 5

And DIIs took it all, with Rs 9,000 crore worth purchases in equities.

BUSINESS

AIF industry moots relevant fund manager experience for new asset class, not just absolute

Other suggestions include variants of long-short equity like a equity market neutral and global macro strategies.

BUSINESS

Bharti Airtel Q1 Preview: Revenue to increase 3.1% due to recovery in Africa and India business

The most optimistic estimate sees Bharti Airtel's net profit jumping 114 percent YoY and the most pessimistic projection suggests that net profit will increase 36 percent on a YoY basis.

BUSINESS

SBI Q1 preview: Net profit likely to remain flat at Rs 16,999 crore

The most optimistic estimate sees SBI's net profit jumping 1.8 percent YoY and the most pessimistic projection suggests that net profit will fall 0.2 percent on a YoY basis.

BUSINESS

A mix of market reforms that could help investors save Rs 3,900 crore annually

The introduction of ASBA-based trading in secondary markets will unlock Rs 2,800 crore worth of benefit to investors annually, as per the NSE analysis.

BUSINESS

Here's how much money Radhakishan Damani made in UltraTech Cement-India Cements deal

Data compiled by Moneycontrol shows that Damani, along with his relatives and investment companies, has been consistently increasing his stake in the cement major over the years with his total acquisition price expected to be in the range of Rs 600-700 crore.

BUSINESS

Bahot der ho gayi : Buch calls for mandatory ASBA by qualified stock brokers

Sebi on March 29 had given a green signal for ASBA facility for the secondary market. Currently, ASBA is optional for brokers and investors.

BUSINESS

Pati, Patni Aur Taxmen: Sebi study on women's trading success has a hidden story

Market insiders told Moneycontrol that there is another way of looking at the data, which paints women traders in a less flattering light

BUSINESS

PSU workers see more injuries, have fewer trained staff compared to private firms, says report

Average fatalities were the highest in oil, gas, energy, and allied services at 5. Further, average fatalities were at 1.7 for services and 1.3 for utilities, said the report.

BUSINESS

Tying the knot pays off: Married traders make more money than bachelors

Sebi study shows 7 out of 10 intra-day traders lose money, but some are better-off

BUSINESS

MC Exclusive : Be extra cautious while approving SME IPOs, Sebi tells exchanges

According to persons familiar with the development, the capital market watchdog has told the bourses to enhance the level of due diligence done while vetting these documents even if it leads to a slowdown in terms of the pace of approvals for SME IPOs.

BUSINESS

Shriram Finance Q1 preview : Net profit likely to increase 17% in Q1FY25

Net revenue, however, is likely to fall 37.3 percent to Rs 5,000 crore in the June quarter.

BUSINESS

Five key stocks expected to benefit from the Budget

Godrej Agrovet, Titan Company, Teamlease Services, Adani Wilmar, and Borossil Renewables are set to benefit directly from today's budget announcements.

BUSINESS

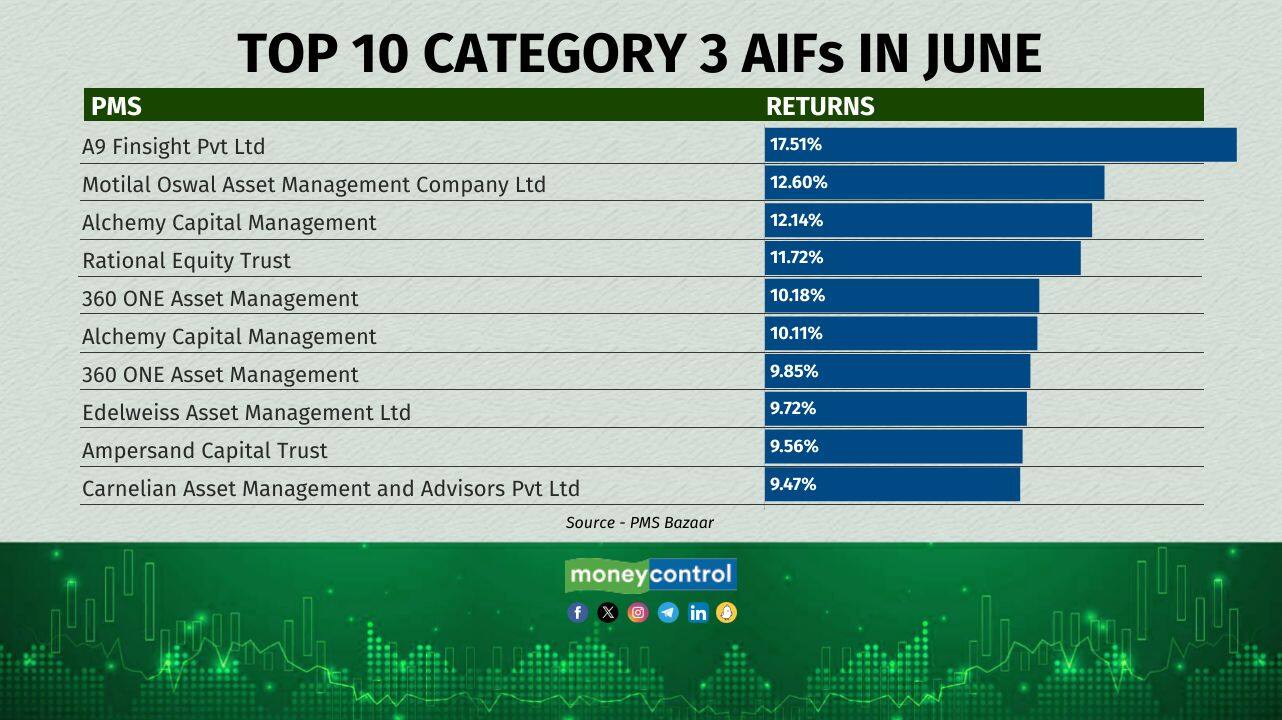

Top 10 Category III AIFs in June: A9 Finsight leads with 17.51% return

The top 10 category III AIFs in June gave returns between 9 percent - 17 percent.

BUSINESS

Clearing corporations of NSE, BSE have 'fridge-like' backup for risk management: Sebi's Madhabi Buch

Sebi's Chairperson used a familiar household event to describe the backup system set up to handle technological glitches at the bourses

BUSINESS

Sector Watch: Brokerages hope Budget does not hike STT, LTCG

Market insiders told Moneycontrol that if STT is increased it will lower the volumes because traders would not trade as frequently as they do now as the overall trading costs would go up.

BUSINESS

MC Survey: CEOs anticipate stable corporate tax regime in budget

Currently, under Section 115BAB, newly established domestic manufacturing companies are subject to a reduced tax rate of 15 percent on their total income.

BUSINESS

Mutual Fund industry seeks tax parity with ULIPs in Budget 2024

Finance Minister Nirmala Sitharaman will announce the Budget for FY24-25 on July 23.

BUSINESS

AIF body to propose flexible strategies for schemes aimed at accredited investors

Among the suggestions to be made by the Indian Venture and Alternate Capital Association (IVCA) include increasing the minimum exposure limit that AIF funds can have to derivatives.

BUSINESS

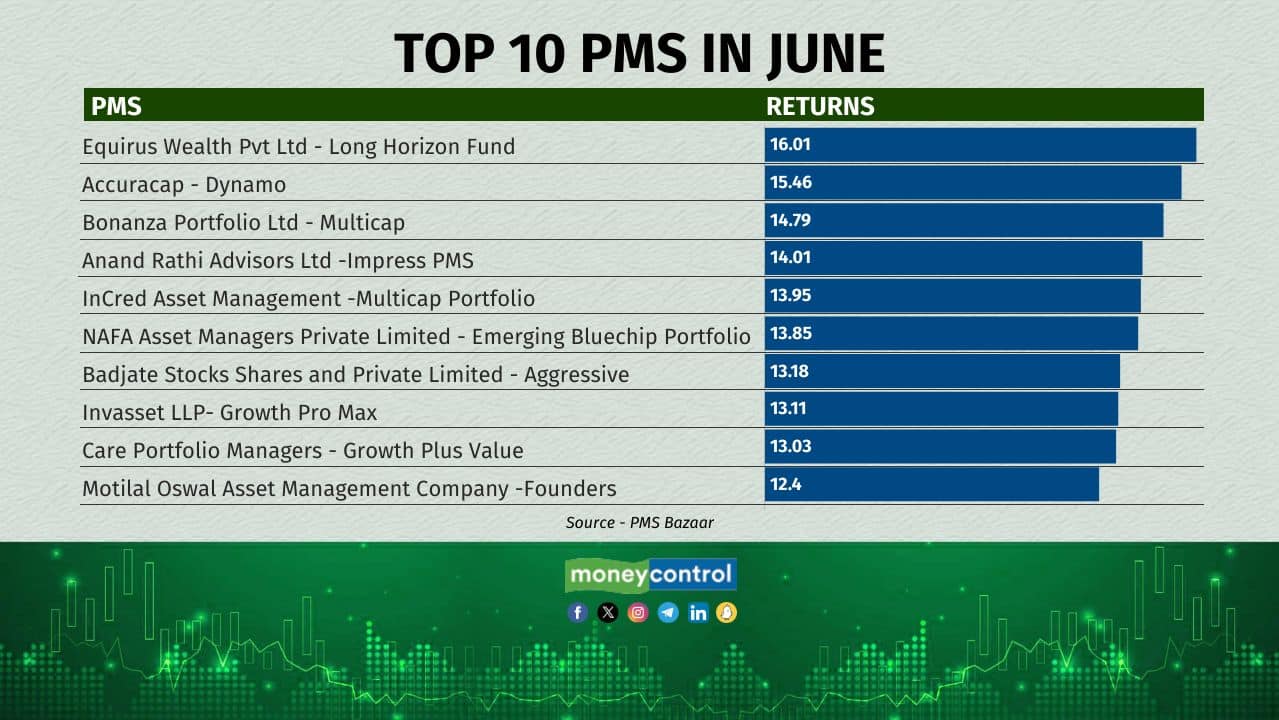

The Top 10 PMSs in June: Equirus Wealth leads with 16% returns

The top ten PMS in June have given returns between 12-16 percent. The first spot was taken by Equirus Wealth, followed by Accuracap, and then Bonanza.