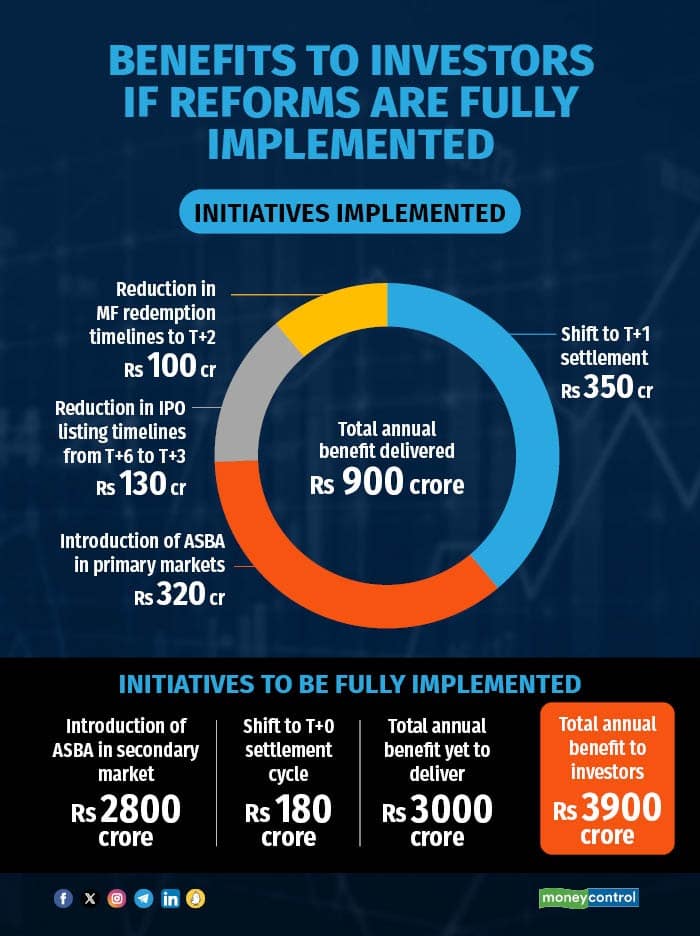

A faster settlement mechanism combined with a shorter timeline for IPOs and ASBA – Application Supported by Blocked Amount -- for the secondary markets could help the investor community save a cumulative amount of around Rs 3,900 crore each year, as per an analysis by the National Stock Exchange (NSE).

The rationale being that money would stay in the investor’s bank account for a longer time and earn interest instead of getting blocked for market transactions.While some of the initiatives like T+1 settlement in the secondary markets and ASBA in primary markets along with a shorter redemption cycle in the mutual fund segment and an overall reduction in the IPO time line have already been implemented, helping investors to benefit to the tune of Rs 900 crore annually, said Mukesh Agarwal, CEO, NSE Indices.

He further clarified that there are quite a few other initiatives as well that are yet to be implemented but once they are, that would add a whopping Rs 3,000 crore to the annual savings for the investor community.

Some of such initiatives that are in the pipeline include migrating to T+0 settlement cycle and ASBA in secondary markets.

ASBA – in the primary market context -- refers to a mechanism wherein money stays blocked in the bank account and is debited only when the shares are allotted in an IPO.

How do investors benefit?

The introduction of ASBA-based trading in secondary markets will unlock Rs 2,800 crore worth of benefit to investors annually, as per the NSE analysis.

This is how it has been computed.

The average daily cash collateral received by trading members from clients during the October to December 2023 quarter is estimated at Rs 79,000 crore. Assuming these funds remain in investor accounts throughout the year and with the annual interest rate fixed at 3.5 percent, investors will save Rs 2,800 crore.

Meanwhile, a shift to T+0 settlement cycle will free up capital totaling Rs 180 crore annually for investors. Assuming that average daily margin levels for cash equities is Rs 4,700 crore and there is an opportunity cost of 3.7 percent, it will generate annual benefits of Rs 180 crore for the investors.

Opportunity cost essentially refers to the loss of other alternatives or income when a particular alternative is chosen.

Meanwhile, ASBA for secondary market enables direct settlement of funds and securities between investors and clearing corporations and enhances client level visibility at clearing corporation level. ASBA system can potentially mitigate the risks associated with misuse of investor funds by brokers and minimize investor loss in cases of broker defaults.

On March 29, the Securities and Exchange Board of India (Sebi) had given a green signal for ASBA facility for the secondary market. Currently, however, ASBA is optional for brokers and investors.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.