BUSINESS

Not worried of the so-called narrative of slowdown in earnings, says Vikas Khemani of Carnelian Asset Management

Khemani said that much of the reallocation to China is behind us and with new capital flows into emerging markets, India is well positioned to continue attracting positive inflows.

BUSINESS

Carnelian sold Ola shares within just one week of buying in the IPO; Here's why

Khemani currently favours sectors like private banks, select NBFCs, insurance companies, IT, cybersecurity, pharma, chemicals, CDMO, and others.

BUSINESS

T+0 settlement cycle sees tepid response even after eight months of launch

Market participants believe that till the time T+0 settlement cycle remains optional and the operational issues are not resolved, there will not be much traction.

BUSINESS

C2C Advanced listing to be postponed after SEBI asks company to appoint independent auditor

The company specialises in delivering customised software and software-enabled systems that control mission-critical defence applications for military and security apparatus.

BUSINESS

Markets rebound but correction not over yet, say experts

According to experts, the correction is likely not over yet. They believe the current rally is primarily driven by short-covering rather than fresh buying, suggesting that the market's downtrend may still persist.

BUSINESS

Mutual funds take a hit but still 80% of equity funds fare better than the benchmarks

According to a latest report by PL Capital, out of the 240 open-ended equity diversified funds, about 80 percent of the funds were able to outperform their respective benchmarks in October.

BUSINESS

Not sure if it is the start of a bull market or a rally in the bear market, says Vikash Jain of CLSA

One reason for the rally could be the historical market performance in December. Data from the past 20–30 years show that three out of every four Decembers have delivered positive returns, he said.

BUSINESS

Top category III AIFs deliver up to 9.72% returns in October

The top 10 Category III AIFs in October delivered up to 9 percent returns to investors.

BUSINESS

CLSA bets on platforms over specific companies to play consumer theme

Sonam said that quick-service restaurants are underperforming because food delivery aggregators like Swiggy and Zomato are allowing lot of the local restaurants to come into picture

BUSINESS

Urban growth isn’t slowing down; we’re simply looking at the wrong data, says CLSA's Aditya Sonam

Consumers in metro cities are opting for quick-commerce and e-commerce platforms over traditional FMCG channels. If urban consumption was truly slowing, concert ticket sales and fast fashion would not be thriving as they currently are, Sonam said.

BUSINESS

Top 10 performing PMS schemes of October: InCred and Abakkus top the list

All the top performers outperformed their respective benchmarks, which registered losses during the month.

BUSINESS

FIIs selling due to 'pathetic' earnings, not US or China reallocation, says Samir Arora of Helios

Weak earnings might not change in the next three months and rather, it would take another six-to-nine months for the earnings to come back, Arora said

BUSINESS

Compounding and patience: Market veterans share key lessons for new investors

Backing the right businesses is important, however, one should be careful with the price that it pays for the company, said Manish Chokhani, director of Enam Holding

BUSINESS

Saurabh Mukherjea’s Dharamsankat when FII clients ask when to put money in India

Mukherjea said that the earnings slowdown could continue for the next few quarters, indicating this is a cyclical downturn. He added that India has seen strong earnings growth for the last three years and hence some bit of slowdown is expected.

BUSINESS

Orange becomes the new black as Swiggy lists; Company's rise is kind of a miracle, says founder Majety

The CEO also said that India’s next decade is going to be full of economic growth.

BUSINESS

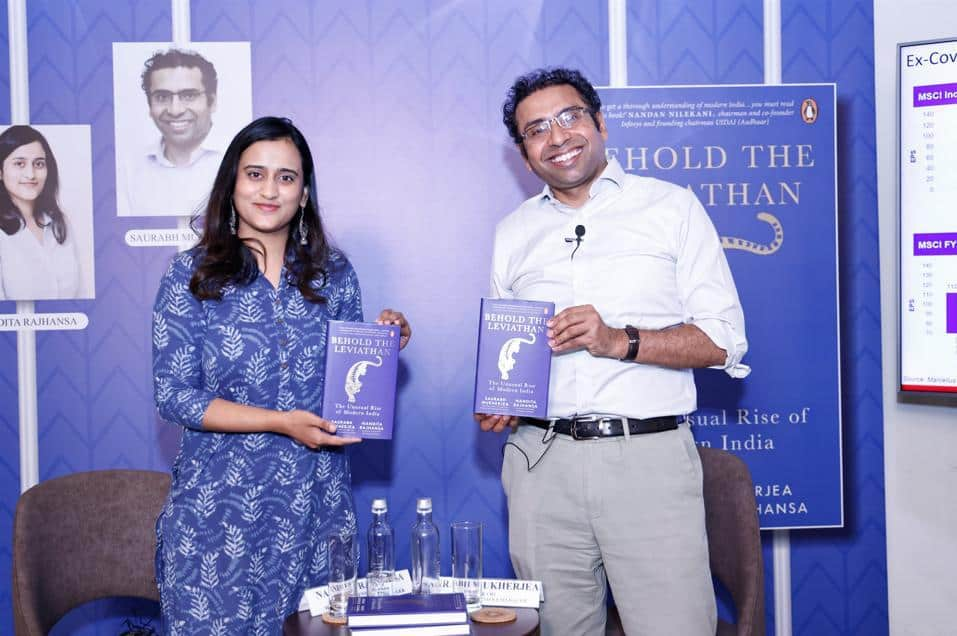

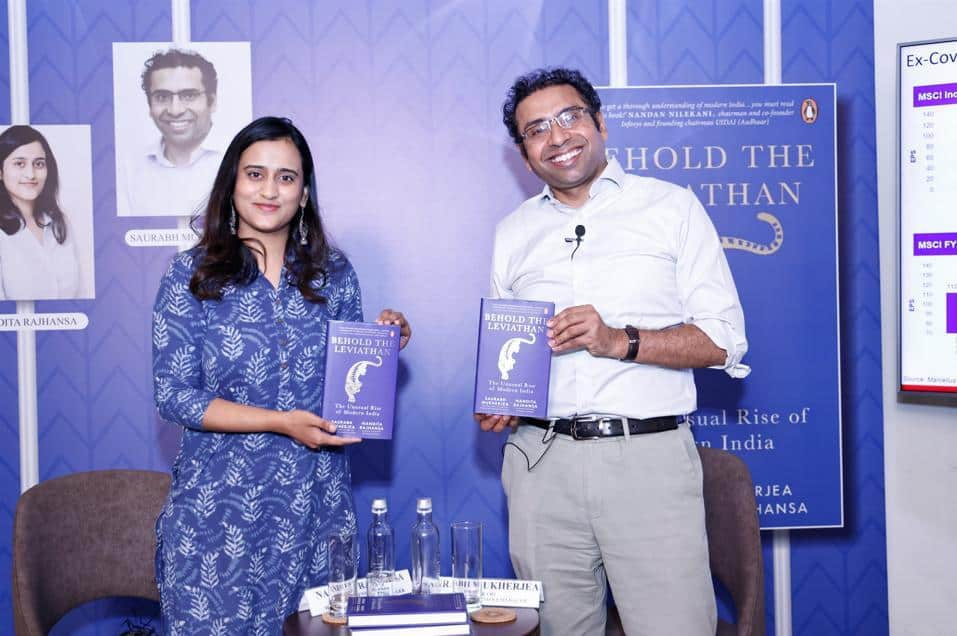

Women, rise of new elite, and India’s China plus one strategy: Saurabh Mukherjea highlights key economic shifts

Mukherjea said that India's elite is moving beyond the traditional South Bombay or South Delhi types. Today, the influential elite is increasingly from smaller towns and regions, often SME owners, many of whom are not from top-tier institutions like IITs or IIMs.

BUSINESS

SEBI’s F&O risk disclaimer hasn’t affected derivatives volumes, say industry people

Only one percent of the individual traders managed to earn profits exceeding Rs 1 lakh, after adjusting for transaction costs.

BUSINESS

SME IPOs: Small town stars steal the spotlight from big cities

Among the emerging hotspots, Noida was at the top in terms of highest number of IPOs from non-metro locations with 11 SME IPOs this year. It is followed by Thane in Maharashtra with nine IPOs and Jaipur with eight.

BUSINESS

Despite ban, brokers find loopholes to pay referral fees to unregistered finfluencers

People familiar with the matter say that such transactions are now being recorded in the books under various innovative names and are not mentioned as referral fees

BUSINESS

Metals, OMCs, manufacturing could gain with Trump win; IT could face headwinds

Market experts in India believe that a Republican majority in the US could cast a strong spotlight on specific sectors in Indi

BUSINESS

Near-term strategy: Book profits in high PE stocks and reinvest in value stocks, say fund managers

In October, FIIs have been on a selling spree and have sold shares worth Rs 85,000 crore. However, DIIs have been acting as a strong counterforce by buying shares worth Rs 1.07 lakh crore.

EARNINGS

Not just quick delivery, digital firms need to show quick profitability too, say bankers as Swiggy IPO is about to launch

They add that public markets would value companies that are able to show profits in two to three quarters post listing.

BUSINESS

Swiggy's IPO price band is attractively valued, says banker

Swiggy's competitor Zomato is currently trading at a trailing P/E of 297x, whereas the former's ratio stands at -35.23x. However, Swiggy's price range is positioned higher than Zomato's current trading price of Rs 247 at the close of the session on October 30.

BUSINESS

Client exodus: ASK Investment Managers lose more than 3700 PMS clients since January

Distributors are of the view that while Bharat Shah, the whole-time director of ASK Investment Managers, has long been known for his commitment to quality stocks, this focus has led to underperformance in various strategies of ASK Investment Managers, making clients re-think their loyalty.