The SME IPO arena is buzzing with activity with the current calendar year setting a new record in terms of fund raising, but an interesting aspect this year has been the entry of companies from the far flung corners of the country.

Data from Prime Database shows that till a couple of years back most of the SMEs that came to the public markets had their origins mostly in metros, but now the balance seems to be shifting towards Tier 2/3 locations as an increasing number of companies from such places are coming to list on the bourses.

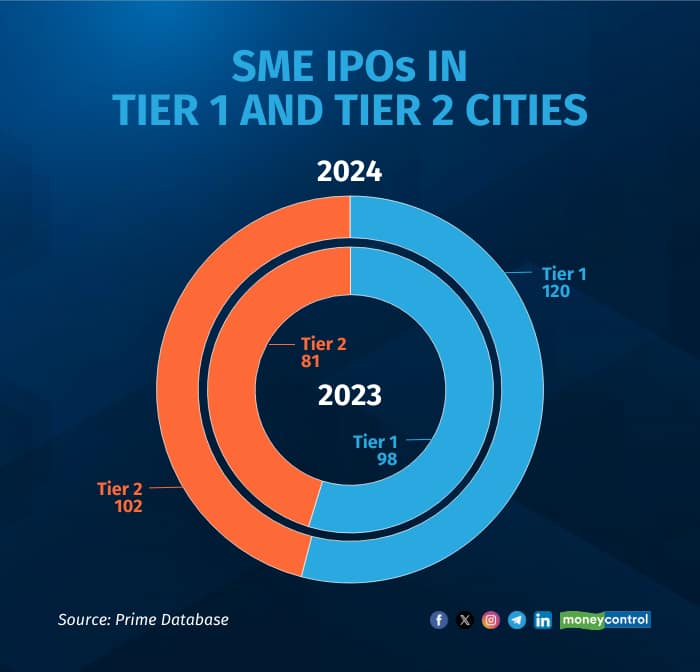

In the current calendar year, for instance, the number of SME IPOs from Tier 2/3 cities has outpaced that of the metros. The number of IPOs from Tier 2/3 cities rose by 25 percent compared to last year, while those from metros saw a 22 percent increase, per data from Prime Database.

Experts attribute this trend to the fact that some of the sectors like manufacturing, which has a huge SME representation, are typically based in non-metro locations and such firms are now looking to list in the public markets.

“Manufacturing-oriented companies are predominantly set up in Tier 2/3 locations, where industrial corridors and Special Economic Zones are more readily available. This is why we are seeing a significant number of IPOs emerging from these regions as large metros do not have that kind of space to set up industries,” says Nirav Karkera, Head of Research at Fisdom.

Pranav Haldea, Managing Director of Prime Database Group says that several MSME's especially in the manufacturing sector are in non-metro cities. This also includes MSME clusters which focus on a specific industry, he added.

"With the inflows of domestic funds, the capital markets have opened up fund raising avenue through an IPO for several companies, especially through the main board listing for scaled up companies. We are seeing a lot of companies from Tier 2 and Tier 3 cities which have scaled up and with good business models, tap into this source of raising funds," said Bhavesh Shah, Manging Director-Head, Investment Banking, Equirus. He added that in several cases, the IPOs have been able to give better outcomes to companies rather than private equity, depending on the strategic objectives of the company.

Among the emerging hotspots, Noida was at the top in terms of highest number of IPOs from non-metro locations with 11 SME IPOs this year. It is followed by Thane in Maharashtra with nine IPOs and Jaipur with eight.

In 2023, Thane, Jamnagar, and Vadodara had the highest number of SME IPOs. Thane city saw nine IPOs, while Jamnagar and Vadodara saw five each in the previous calendar year.

In terms of size as well, some of the largest SME IPOs came from non-metro locations. Danish Power, a Jaipur-based company had an issue size of Rs 188 crore. Thereafter, Surat-based KP Green Energy had an issue size of Rs 180 crore, followed by Noida’s Sahasra Electronic Solutions with an IPO size of Rs 176 crore.

Incidentally, in the current calendar year till October, as many as 215 SME IPOs have been launched with the cumulative fund raising pegged at a record Rs 7,663 crore — significantly higher than the previous record of Rs 4,686 crore raised last year.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.