BUSINESS

Make-in-India and China-plus-one stocks plunge — Time to book profits or invest more?

Transforming the local manufacturing ecosystem will crucially hinge on the fresh policy push by the new government at the Centre

BUSINESS

Concor: Q4 results point to a positive outlook

New terminals likely to drive incremental volume growth

BUSINESS

Is it the right time to book profit in PSU stocks ahead of the poll verdict?

The valuation of stocks in railway, defence and electronic manufacturing have run way ahead of fundamentals?

BUSINESS

PG Electroplast: Aggressive revenue growth guidance

Impressive revenue growth in Q4FY24 on the back of expanding product portfolio

BUSINESS

V-Guard Q4: Robust performance across categories

VIL’s growth trajectory looks promising on the back of its financial track record, geographical diversification strategy, and competitive market positioning

TRENDS

Sirca Paints Q4: Outlook strong for this paint company

Expanding product portfolio and adding distribution network

BUSINESS

Amber Enterprises Q4 FY24: Soft quarter, long-term outlook strong

The contract manufacturer continues to focus on diversifying revenue mix

BUSINESS

Crompton Consumer Q4: Right levers in place for future growth

Focus on the premium product portfolio during summer and a revival in the lighting business will be key growth drivers

BUSINESS

Berger Paints Q4: why we see limited upside

Current valuation and potential competition take shine off the stock

BUSINESS

Dixon Technologies: Aggressively tapping favourable market conditions

The company has a long growth runway owing to massive opportunities in the industry, but the stock is expensive

BUSINESS

Radico Khaitan — Should you raise a toast to Q4 earnings?

The stock appears to have priced in the strong performance of the liquor maker

BUSINESS

Voltas Q4: Strong off-take in RAC, but margins remain under stress

Though the company continues to maintain its market leadership in RAC, the sluggish performance in the EMPS business drags the bottom line

BUSINESS

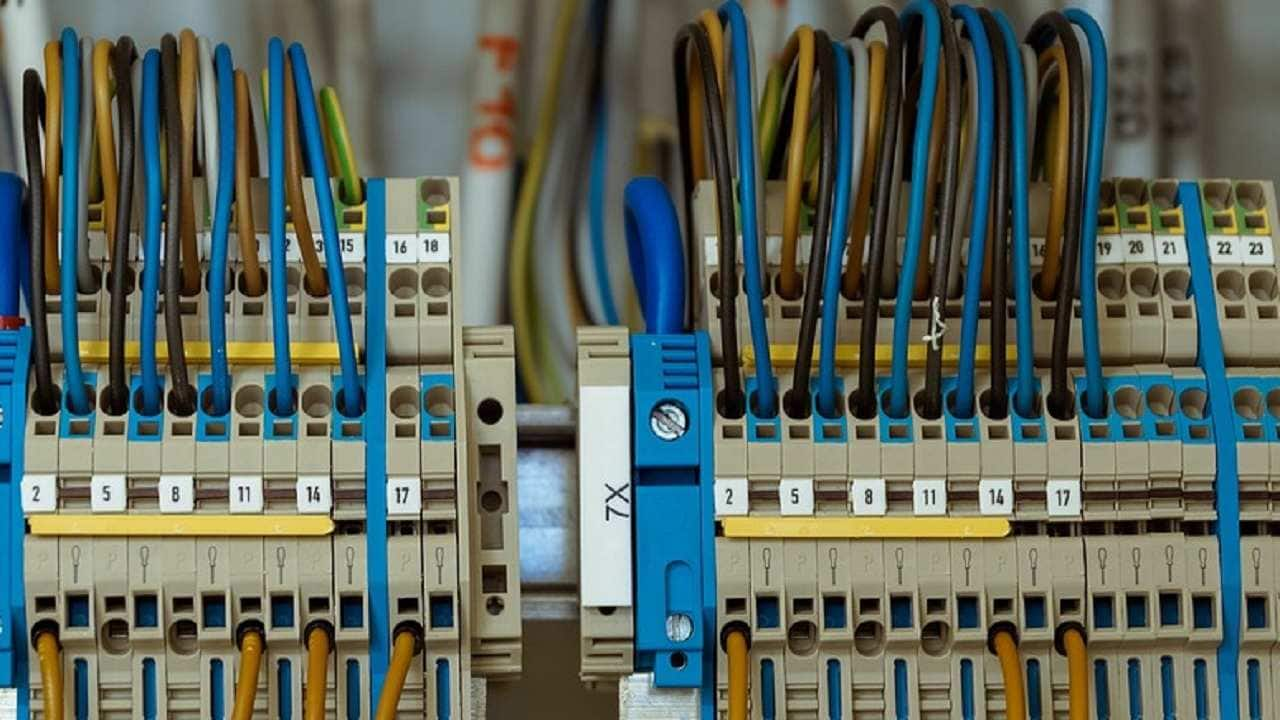

Polycab India Q4: Asserting dominance over competitors

Favourable demand momentum from infrastructure and power sectors supporting the strong performance of wires & cables

BUSINESS

Asian Paints Q4 FY24: Dull show despite strong volume growth

Though Asian Paints is a quality business, the competitive intensity in the sector is likely to jump manifold in the medium term

BUSINESS

Pidilite Q4: Encouraging volume trends

Operating margins improve, but PAT declines

BUSINESS

Market Outlook: Are stocks overdue for a big correction?

The outcome of the ongoing election could be the pivotal moment for the Indian capital market

BUSINESS

Blue Star: Q4 results soothe investors amid harsh summer

Revenues jump, operating margins expand but PAT dips

BUSINESS

Havells India: Q4 tops Street expectations

Revenues and EBITDA both showed improvement on the back of a rebound in the ECD business

BUSINESS

UltraTech: Another solid quarter for this market leader

Operating leverage, benign fuel prices, and cost control measures drove the improvement in margins in Q4

BUSINESS

Corporate India: Initial signs of excess capacity build-up across sectors

Supply overhang is likely to persist, affecting the profitability of players in several sectors

BUSINESS

Dalmia Bharat Q4: Stellar volume growth partially offsets other setbacks

The commissioning of new capacities and the fight for market share gains are putting intense pressure on realisations on a pan-India basis

BUSINESS

RIL Q4: Superb execution, upbeat outlook

RIL’s consumer businesses now contribute to nearly half of consolidated operating profit. Meanwhile, a strong capex pipeline will sustain its growth momentum through newer verticals such as renewable and clean energy

BUSINESS

GM Breweries Q4 FY24: Underwhelming performance, compelling valuation

Robust business fundamentals and attractive valuations make it an attractive bet

BUSINESS

Solar Energy: Investors vulnerable to getting singed

Over-capacity has led to a huge fall in solar panel prices and countries are scrambling to arrest the downfall