BUSINESS

How Indostar Capital’s share prices went into a free fall

On August 5, Indostar Capital reported its highest ever quarterly net loss for the quarter ended March at Rs 767.2 crore.

BUSINESS

India’s Cooperative Bank Mess Part-5: Life savings at stake, Pune’s Shivajirao Bhosale Sahakari Bank depositors question RBI, government

The RBI first issued directions to the cooperative bank on May 3, 2019, freezing deposit withdrawals at Rs 1,000 per account holder

BUSINESS

RBI fresh circular on recovery agents largely a reiteration, unlikely to resolve customer complaints, experts say

Overall complaints relating to credit cards, failure to meet commitments, and Direct Selling Agents (DSAs) and recovery agents increased during July 1, 2020 to March 31, 2021 as against the previous year, with complaints related to DSAs and recovery agents surging 61%, the RBI said.

BUSINESS

NBFCs return to bank loans as main funding source as credit demand revives

Banks’ outstanding credit to the NBFC sector increased 21 percent year-on-year to Rs 11.01 lakh crore as on June 17.

MCMINIS

What are electoral bonds?

BUSINESS

India’s cooperative mess | Why issue license to UCBs if you can’t repay depositors on time, PMC Bank depositors ask

While the Deposit Insurance and Credit Guarantee Corporation (DICGC) cover has helped a majority of depositors, others with deposits above Rs 5 lakh are still waiting to get their money back.

BUSINESS

'Quite okay' with lowering stake in Yes Bank to 26% by March 2023, says SBI chairman

As bond yields soften, SBI will recover most of the mark-to-market losses made in Q1, Dinesh Kumar Khara said

BUSINESS

RBI Monetary Policy | Bankers predict up to 50 bps hike in lending rates after repo rate reaches 5.4%

A 50 bps rate hike may seem hawkish, but it was required to control inflation, South Indian Bank MD & CEO Murali Ramakrishnan said

BUSINESS

No successful data breach yet, but tighter third-parties checks must for preventing privacy breach, HDFC Bank CISO says

More awareness among customers and employees essential to prevent data leakage, the CISO said

BUSINESS

Yes Bank open to acquiring microfinance entity as $1.1 billion fundraise gains pace, MD says

The private lender aims for conscious growth this fiscal and is open for acquisitions

BUSINESS

India’s top 25 wilful defaulters owe about Rs 59,000 crore to banks, says Centre

Mehul Choksi promoted Gitanjali Gems Ltd is the top wilful defaulter with Rs 7,110 crore in dues

BUSINESS

Asset quality to improve going ahead: M&M Finance MD Ramesh Iyer

Possible to maintain 94 percent-95 percent collection efficiency this fiscal, the MD said

BUSINESS

Cost pressure keeps big NBFCs away from launching credit cards despite RBI provision

Leading NBFCs continue to focus on conventional lending products such as consumer durable finance and personal loans, experts say

BUSINESS

Interview: PSU banks out of the woods; IndiaFirst Life Insurance IPO likely by March, says Union Bank MD

Bank is in talks with premier institutes to extend education loans and wants to double disbursements under this head from Rs 7,000 crore currently, the MD said

BUSINESS

Centre says 27 cooperative banks were liquidated in past five years, 42 merged

Ten cooperative banks were closed due to liquidation in FY22, double the number in FY21

MCMINIS

What is the CASA ratio?

BUSINESS

Shriram Group may sell minor stake in housing finance arm in next fiscal, says Shriram City Union Finance MD

As on June 30, Shriram Housing Finance’s AUM stood at Rs 5,803 crore

BUSINESS

Fino Payments Bank approves re-appointment of Rishi Gupta as MD & CEO for 3 years

Board also approves the appointment of Rakesh Bhartia as independent director for five years

BUSINESS

MC Exclusive | Shriram Group receives IRDAI approval for merger

The merged entity would have a combined AUM of over Rs 1,50,000 crore, over two crore customers served till date and a distribution network of over 3,500 branches

BUSINESS

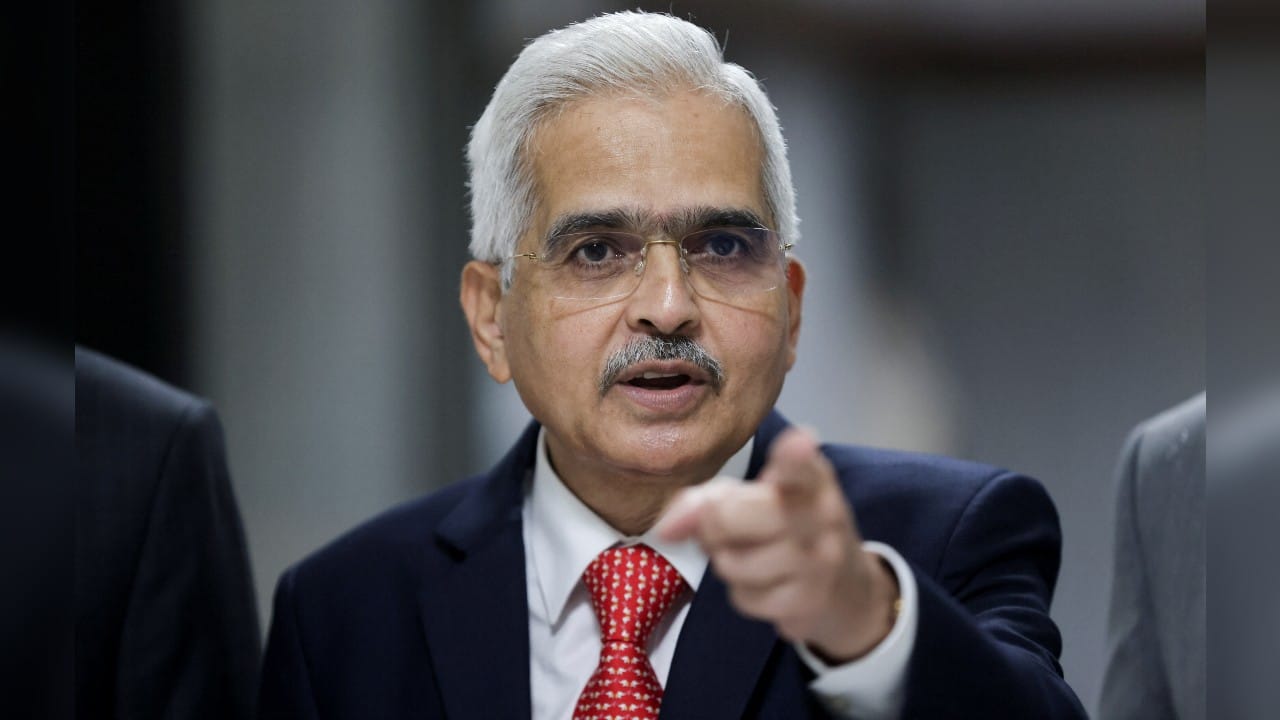

This is how much RBI governor and his deputies earn

What is the monthly salary of RBI governor Shakitkanta Das and his deputies? Read on to find out.

BUSINESS

Union Bank CEO says aiming for Rs 15,000 crore of recoveries in FY23

The state-led bank on July 26 reported its net profit for the quarter ended June at Rs 1,558 crore, up 32 percent on a year-on-year (YoY) basis and 8.2 percent on quarter, backed by lower provisions and stable asset growth.

BUSINESS

Micro loan collections back at pre-Covid level; net NPAs may improve from 1.92 percent, says Bandhan Bank MD

Chandra Shekhar Ghosh said that 99 percent of the total microfinance loans disbursed by Bandhan Bank since June end last fiscal were being repaid on time

BUSINESS

Will raise up to Rs 7,000 crore more this fiscal; credit card subsidiary launch likely by Q3, says Canara Bank MD

The bank will continue reporting a “decent” double-digit growth, with a focus across retail, MSME and corporate loans, managing director and chief executive officer LV Prabhakar has said

BUSINESS

Received two EoIs for Rs 48,000 stressed loan pool auction: Prashant Kumar, YES Bank MD

YES Bank Board had on July 15 approved US based JC Flowers Asset Reconstruction Company's bid to be considered the base bid for the proposed sale of stressed assets via Swiss challenge auction.