In China’s rural province of Henan, depositors are fighting to get their lives’ savings back. Their savings are stuck with five of China’s small rural banks which froze deposits amounting to $1.5 billion, as per reports.

At the core of small banks’ problems in China is misgovernance by the management of the lenders, lack of regulatory disclosures by these entities and unclear ownership patterns.

China’s regulator has vowed to repay as much money back to customers as it can, but the bank failures led to a rare sight where depositors protested against the strict Chinese authorities in large numbers.

Not far away from China, a similar story is playing out in India.

As per Union Minister of State for Finance Bhagwat Karad, a total of 27 small-sized cooperative banks were liquidated in India in the last five years, while 42 cooperative banks were closed on account of mergers.

The Union Minister on July 26 informed Parliament that 10 cooperative banks were liquidated in the previous financial year, doubling from a year earlier. Maharashtra accounted for seven of the 10 cooperative banks liquidated in FY22. Among these were Shivajirao Bhosale Sahakari Bank, Independence Cooperative Bank and Mantha Urban Cooperative Bank.

While the Deposit Insurance and Credit Guarantee Corporation (DICGC) cover has helped a majority of depositors, others with deposits above Rs 5 lakh are still waiting to get their money back.

Bony Lal, a 44-year-old Mumbai resident, is one such impacted person. A cancer survivor, Lal takes five tablets a day to keep herself healthy.

“Hospitalisation, surgery, radiation and other miscellaneous expenses exceeded Rs 8.5 lakh. Because of restrictions on withdrawal on PMC Bank by RBI (Reserve Bank of India), we could not use our own money for my treatment. My father even tweeted that he is ready to donate his eye or kidney for his daughter’s treatment,” Lal said.

Lal’s parents had deposits amounting to over Rs 10 lakh with Punjab and Maharashtra Cooperative Bank (PMC Bank) before crisis hit the lender and the RBI superseded its board in September 2019, capping withdrawals at Rs 1,000 initially, and extending it to Rs 1 lakh per depositor later. After upgrading the deposit withdrawal ceiling to Rs 1 lakh, over 84 percent of depositors were eligible to withdraw their money from PMC Bank, RBI said.

As per the government approved scheme of merger of PMC Bank with Unity Small Finance Bank, all eligible depositors will get Rs 5 lakh under the DICGC scheme as the first round of payment. After that, there will be staggered payments over a period of 10 years. During this period, the depositors will get amounts ranging from Rs 50,000 to Rs 5.5 lakh from the first to fifth years, and the remaining at the end of 10 years.

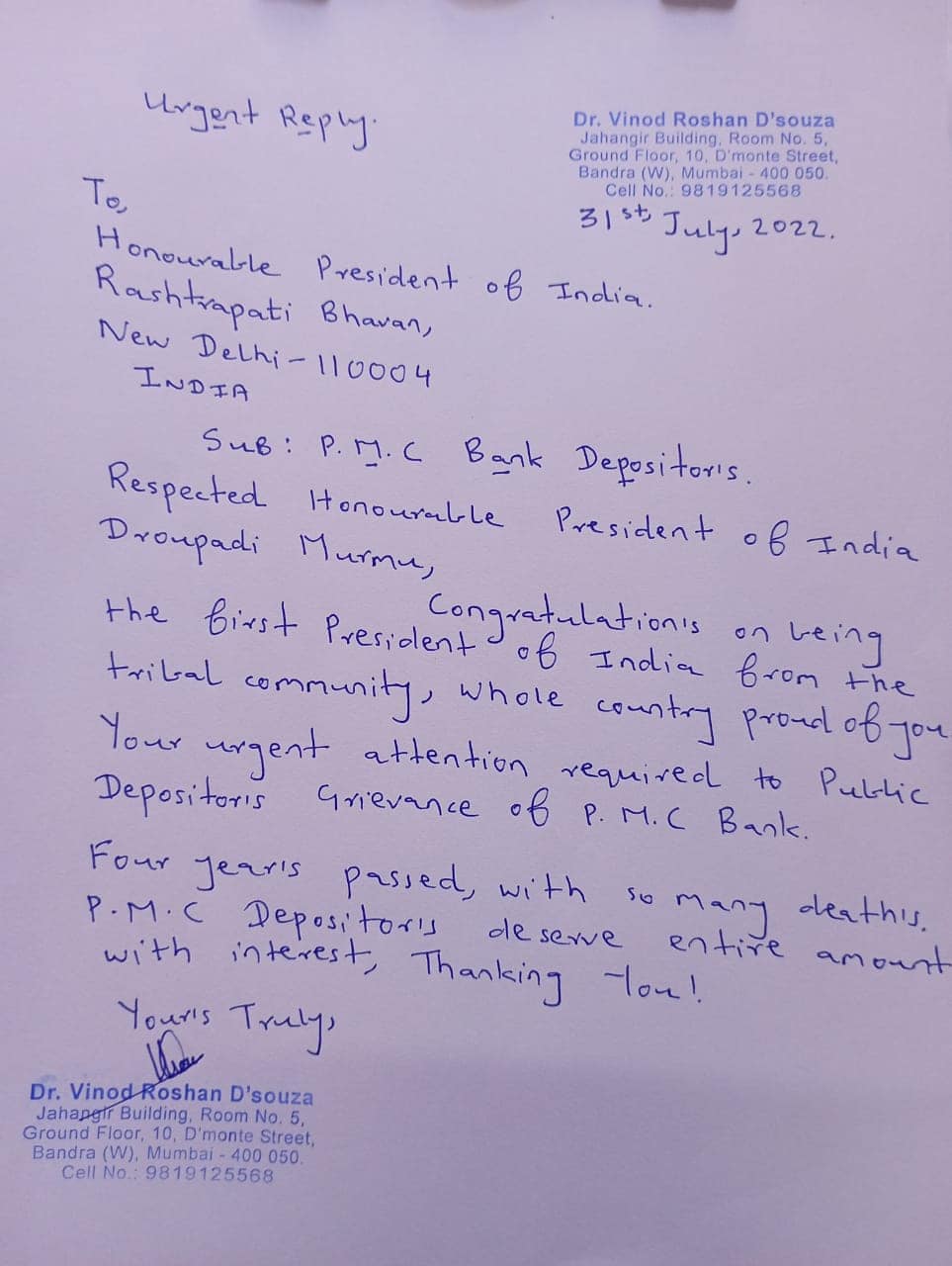

PMC Bank depositors however, say the timeline is too long for retrieving their money. They have staged protests in front of Finance Minister Nirmala Sitharaman, the RBI headquarters, political party leaders, and several social media platforms. A letter written to the newly-elected President of India Droupadi Murmu regarding PMC Bank depositors by an activist can be seen below.

“I am a cancer survivor. The cancer treatment got completed in November 2018. On 27th November 2019, I got paralytic attack and in MRI report, brain tumour was detected,” Lal says.

“My father got prostate problem in September 2020. The doctor denied surgery because of his age. He is a super senior citizen. He only continued his medicines and injections for three months so that the amount can be used for my post treatment blood tests, MRI brain contrast, mammography and other tests,” she added.

Sunny Fernandes, a customer of PMC Bank since 2017 with over Rs 10 lakh in outstanding deposit, says he was unaware of the dual regulation code of urban cooperative banks before he invested his money with the lender.

“I had to sell my wife’s jewellery to send my son to Canada for education,” Fernandes said.

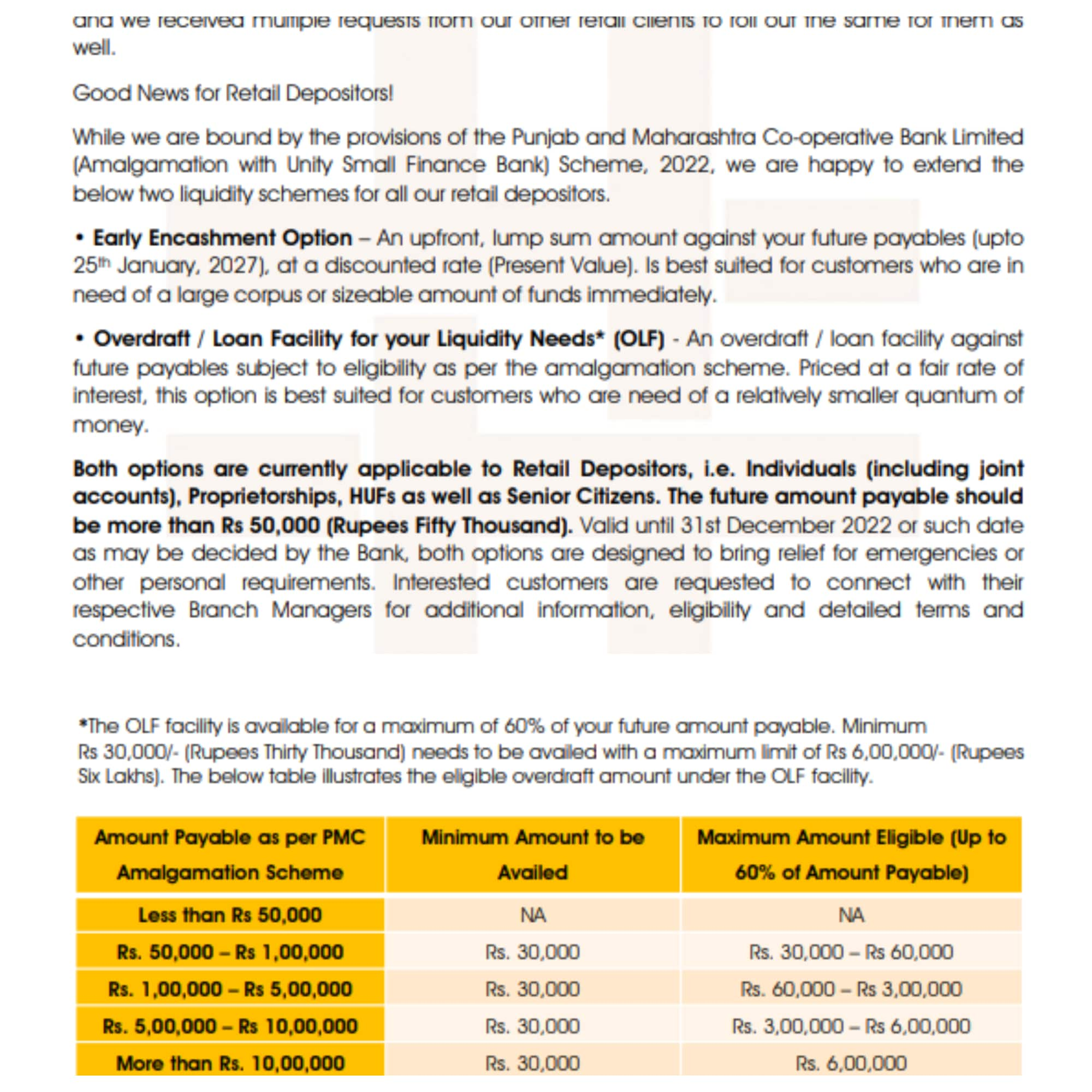

Unity Small Finance Bank, on its part, has introduced a special scheme for senior citizens of PMC Bank wherein they will receive a one-time settlement of their dues or be provided an overdraft facility for loans. For institutional depositors, on and from the appointed date, 80 percent of the uninsured deposits outstanding is proposed to be converted into Perpetual Non-Cumulative Preference Shares (PNCPS) with dividend of 1 per cent per annum payable annually.

Following is the letter sent to one of the depositors by Unity SFB, reviewed by Moneycontrol.

Better regulations needed

A significant challenge for cooperative banks in India is their dual regulation — they are overseen by both the state registrar of societies and the RBI. This does not allow the RBI to scrutinise the accounts and exposures of UCBs as thoroughly as it does with other fully regulated lenders.

“For the matter, many educated people still do not know,” Fernandes said on the nature of dual-regulation of cooperative banks in India.

“The RBI had regulatory oversight on the banking activities of UCBs and DCCBs and its powers were limited to some extent, which impacted its ability to take timely action in case of irregularities,” said Sanjay Agarwal, Senior Director at CARE Ratings.

“Further, the non-performance of UCBs as per expectations can potentially be attributed to political intervention, fraud, absence of requisite skill sets among employees and top management, capital-raising challenges along with increased competition from NBFCs and fintechs,” he said. Joy Thomas, former managing director at PMC Bank who was arrested in late 2019, was earlier this month granted bail by a sessions court in Mumbai, reports said.

Further, experts are of the view that stress in cooperative banks remains elevated with dwindling returns on assets (RoI), equity, and net interest margin metrics.

The RBI, in its Financial Stability Report in June, said it conducted stress tests on a select set of urban cooperative banks (UCBs) to assess credit risk, interest risk and liquidity risk, based on their reported financial positions as of March 2022. The results showed that a few UCBs failed on four of the five risk parameters, even under the baseline scenario.

Further, the impact of credit default risk was higher than the credit concentration risk in all three scenarios, the RBI said. The impact of shocks to the trading book and the banking book were minimal, while liquidity shock impacted the largest number of UCBs, it added.

“Despite the rich history of the cooperative movement, the market share of UCBs in the banking sector has been gradually declining, and today stands at around 3 per cent,” the RBI’s expert committee on UCBs said in a report in August last year.

Even as 94 percent of the entities in the banking sector were UCBs as on March 31, 2020, their combined share in the banking sector’s overall deposits and advances stood at 3.24 percent and 2.69 percent, respectively, the RBI said.

“The system should be transparent, whether it be YES Bank, Lakshmi Vilas Bank, or PNB. If they repay them, they should also do it for cooperative banks. They should not give UCBs banking license otherwise. In my locality, 90 percent of people have deposited their savings with PMC Bank,” Lal said.

Picture credit: Sunny Fernandes

Picture credit: Sunny Fernandes

(This is the second story in a Moneycontrol series on ‘India’s cooperative mess' that highlights the plight of retail depositors whose hard-earned savings are stuck at failed cooperative banks across the country. You can read the first part of the series here.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!