BUSINESS

Emergency funding for Jet Airways put on hold until further clarity

Bankers are concerned if the airline can maintain the current fleet to stay operational until new investors are found

BUSINESS

Banking sector weekly wrap: Jet Airways on sale; RBI's woes over stressed assets and big ticket bank mergers

For customers, the wait for lower monthly loan installments just got longer.

BUSINESS

Despite RBI rate cut, banks find it difficult to pass benefits to customers, say experts

According to experts, tight liquidity conditions are likely to keep banks' cost of funds elevated, limiting their ability to cut lending rates.

BUSINESS

Jet Airways' lenders start stake sale process; to invite EOI on April 6

The SBI-led consortium to invite Expressions of Interest on April 6, with the deadline for submissions set on April 9.

BUSINESS

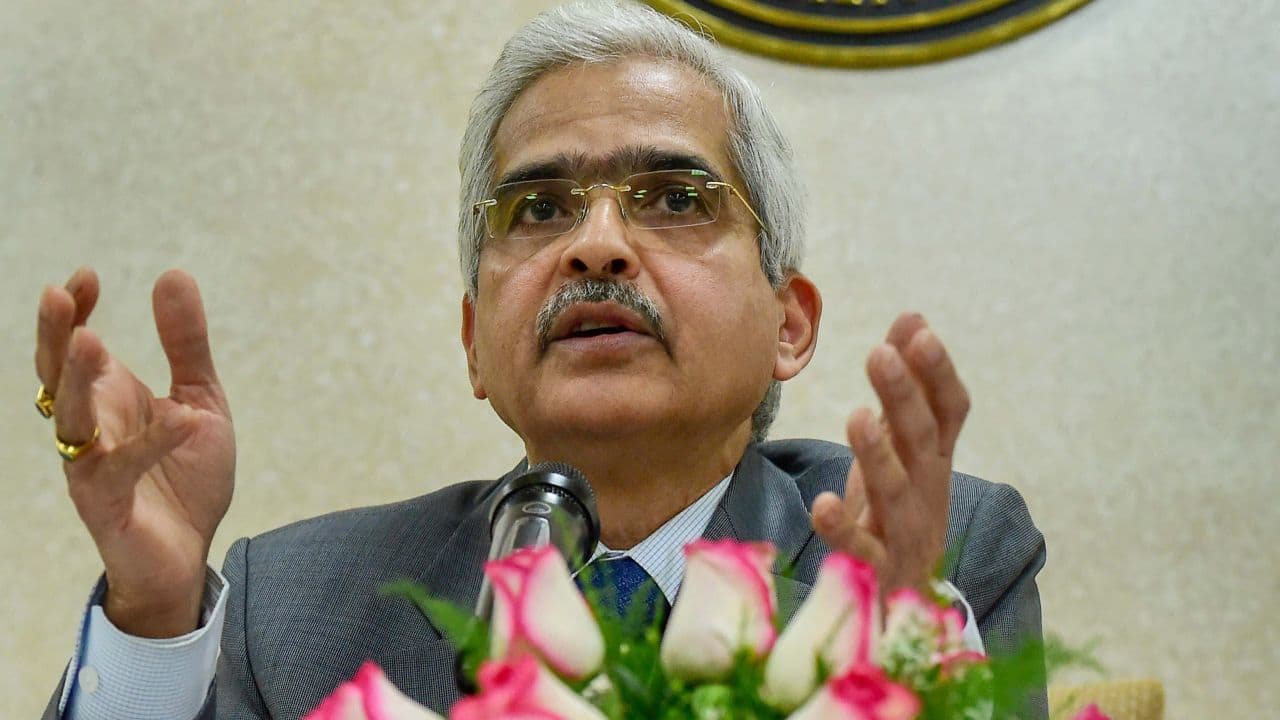

Supreme Court order has not taken away any powers from RBI: Shaktikanta Das

The central bank will issue a revised circular to ensure expeditious and effective resolution of stressed assets.

BUSINESS

RBI cuts policy rate by 25 basis points, keeps CRR unchanged

The six member Monetary Policy Committee, headed by RBI Governor Shaktikanta Das, noted that inflation remains firmly within the comfortable range and will likely persist below 4 percent throughout 2019-20.

BUSINESS

RBI Policy Preview: Repo cut likely; guidance on liquidity easing measures in focus

In absence of adequate liquidity, a policy rate cut, even at 50 basis points, may not be effective.

BUSINESS

Power companies need at least 6-12 months for sectoral reforms to take effect

Banks, as financial creditors, still have the discretion to invoke insolvency under IBC. However, now they will need to decide on case-to-case basis to initiate action, without the deadlines set by the RBI.

BUSINESS

What the Bank of Baroda mega merger means for customers

The consolidated bank, named as Bank of Baroda, has over 9500 branches, over 13,000 ATMs, 85,000 employees and 12 crore customers.

BUSINESS

RBI’s maiden dollar-rupee swap auction a hit; more such operations likely in future

Going ahead, traders expect the RBI to use the swaps along with it’s regular open market purchase of government bonds to provide liquidity to the system.

BUSINESS

SBI pushes fundraising plans to FY20 in hope for better market conditions

The country's largest lender has raised Additional Tier 1 bonds of Rs 1,251.30 crore at coupon rate of 9.45 percent.

BUSINESS

Jet Airways Rescue Plan: Lenders to take control, Goyal asked to step down

Sources say Tata Sons have been approached to rescue Jet Airways

BUSINESS

RBI's $5 billion swap: A window of opportunity for the corporate

While a similar move was undertaken in 2013, the difference is that it was a concessional window. No such incentives were offered this time.

BUSINESS

Jet Airways debt resolution: Etihad's Tony Douglas to meet SBI chief on March 18

Douglas, in an interview to IATA earlier this month, had said that Etihad doesn't want to continue with its equity alliance strategy going ahead

BUSINESS

Jet Airways resolution likely in a week: SBI official

The official also said that the lenders wish to keep the airline operational.

BUSINESS

With Pramit Jhaveri's Citibank exit, an era ends at India's largest foreign bank

Jhaveri will demit office on March 31, ending his nine-year stint as Citibank's face in India. He is serving as an interim head of India operations currently, after the Reserve Bank of India (RBI) denied him a new three-year term late last year.

BUSINESS

State Bank of India hits autopilot on interest rates

While SBI has linked only select rates to the policy, it will have implications on longer-term loan rates as well which are priced on the basis of the bank's Marginal Cost Lending Rate.

BUSINESS

SBI ups digital ante against private banks, will install over 150 Electronic Toll Collection centres

With an increase in transaction volumes in ETC lanes, the country's largest lender wants to step up the competition in the digital space. So far only two private lenders - ICICI Bank and Axis Bank have been active in this area.

BUSINESS

DBS Bank aims to triple India business via wholly-owned subsidiary

DBS Bank invested Rs 1,800 crore this year to fuel growth in the short run and Its capital base in India now stands at Rs 7,700 crore.