BUSINESS

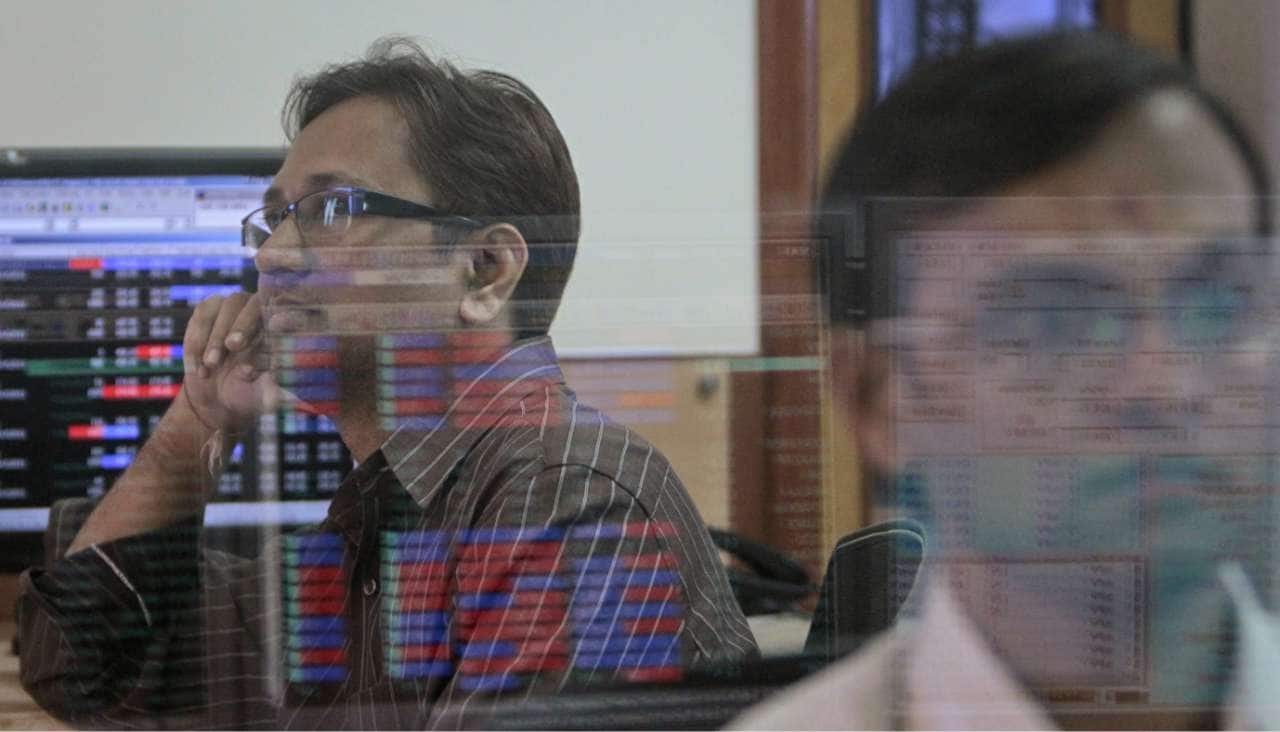

The weekly dossier: Top voices of D-Street give you cues about the market

In the coming week, market observers expect the market to consolidate before starting the next leg of the rally.

BUSINESS

Monsoon to bring relief amid COVID-19 pain; 9 stocks that could benefit

Experts point out that the rabi season ended largely on expected lines and at present, it appears the kharif crop is unlikely to be affected and may see a normal season.

BUSINESS

Deals of the day: BNP Paribas sells stake in RBL Bank; Fidelity offloads shares of SH Kelkar

Fidelity Investment Trust's Fidelity Series Emerging Markets Fund sold 8,10,800 shares of SH Kelkar at an average price of Rs 65.24 per share

BUSINESS

Shree Renuka Sugars share price hits 5% upper circuit on fund raising plans

The company's board approved the proposal for raising funds from its holding company Wilmar Sugar Holdings through external commercial borrowings (ECB) to refinance existing debts.

BUSINESS

Midcaps may take time to catch-up; 12 names to bet on amid uncertainty

While the large-cap stocks have been rising, experts believe as sectors, mid-caps and small-caps will take a longer time to pick up as bigger companies could be in a better position to grab higher market share in their respective sectors after the lockdown ends.

BUSINESS

Banks, financials pushing the market higher; should you trust the rally?

There is not much hope for the banking and financial stocks or for the market, for that matter, unless the COVID-19 comes under control and the economy opens completely.

BUSINESS

Taking Stock | Market rallies for 5th day in a row; Nifty on course to retest 10,000

Sensex closed with a gain of 522 points, or 1.57 percent, at 33,825.53 while Nifty ended 153 points, or 1.56 percent, higher at 9,979.10.

BUSINESS

Market is negating economic realities; how to play in such a market?

The GDP numbers may touch unprecedented lows during the April-June quarter as restrictions and lockdowns continue to constrain people's movement, severely hurting economic activity.

BUSINESS

Chemicals look attractive in times of uncertainty; ICICI Direct picks 5 stocks that can rise up to 20%

The size of the Indian chemical industry is estimated to be around $165 billion, representing a market share of 3.4 percent in the global chemical market.

BUSINESS

Sensex, Nifty jump 3%; 5 factors fuelling the rally

Experts said the domestic market is witnessing strong recovery led by the global tailwind of hopes of a coronavirus vaccine in the offing & easing lockdown regulations worldwide.

BUSINESS

Modi 2.0 | Year of unusual volatility as Sensex fell over 500 pts on 28 days, rose over 500 pts on 24 days

In terms of the market, the first year of the Modi 2.0 government has been marked with unusual volatility owing to factors including Budget and COVID-19.

BUSINESS

Q4 GDP numbers reveal poor health of domestic economy; will it weigh on market's mood on Monday?

GDP numbers may touch unprecedented lows during the April-June quarter as restrictions and lockdowns continue to constrain people's movement, severely hurting economic activity.

BUSINESS

The weekly dossier: Here's what top voices have to say about the market

In the coming week, the market will be focussing on the government's announcement regarding the lockdown and the geopolitical developments.

BUSINESS

FIIs pare stake in 90% Nifty companies in Q4; trend may continue in coming quarter

The trend may remain unabated in the coming quarters too if the current situation does not change even as there are some positives that are comforting, said experts.

BUSINESS

March quarter GDP growth to show drastic fall; brace for worse in Q1FY21 print

A note by ICICI Bank stated the country's March quarter GDP growth may come to 1.5 percent year-on-year (YoY).

BUSINESS

Taking Stock | Market rises for second day in a row; investors richer by nearly Rs 2 lakh cr in a day

The overall market capitalisation of BSE-listed firms jumped to Rs 125.5 lakh crore on May 28 from Rs 123.6 lakh crore on May 27, making investors richer by Rs 1.9 lakh crore in a single day.

BUSINESS

FII holdings in the Nifty500 hit a 5-year low in Q4FY20; metals, autos, private banks witness selling

In Q4FY20, FII holdings in the Nifty500 hit a 5-year low, declining 140 bps quarter-on-quarter (QoQ) and 80 bps year-on-year (YoY) to 21 percent in Q4FY20, a report from brokerage firm Motilal Oswal Financial Services said.

BUSINESS

Most banking, financial stocks gained during lockdown period; Axis, HDFC Bank among top gainers

While most sectors have experienced the heat of disruption caused by COVID-19, experts have repeatedly highlighted the acute pain inflicted on the country's financial space.

BUSINESS

Banks' risk aversion may worsen COVID-19 crisis; these 40 companies are high liquidity risk

Addressing banks' risk- aversion is a vital to unclogging credit flow, say experts.

BUSINESS

Pain likely to exacerbate for banks, financials; should you avoid the sector?

Nifty Bank index plunged 2.6 percent on May 22. As many as 9 out of a total of 12 stocks ended in the red, with Axis Bank, Federal Bank, RBL Bank, ICICI Bank and Bandhan Bank as the top losers.

BUSINESS

Brokerages see more pain for D-Mart, signal avoiding it

The company is well-positioned in terms of the business model and balance sheet, but the ongoing turmoil, caused by coronavirus, has cast a dark shadow over the near-term prospects of the company.

BUSINESS

Resumption of flight services a positive, but the sky looks hazy for airline stocks

Brokerage firm Centrum Broking believes that one-third of scheduled capacity is a reasonable starting point for the sector given that demand is likely to remain low.

BUSINESS

The weekly dossier: Words of top experts on the market, RBI policy

For the week, Sensex fell 1.4 percent while Nifty lost 1.1 percent. The BSE Smallcap index declined 1.5 percent while the BSE Midcap plunged by about 2 percent in the same period.

BUSINESS

Market stares at an uncertain tomorrow; 12 stocks that can still reap gains

Experts continue to warn that the market will keep oscillating between rise and fall and one must remain cautious while taking a call for trade.