BUSINESS

Merchant loyalty to Paytm intact despite the payments bank setback, says Datum survey

According to a large survey of 2,000 people done by Datum Intelligence, 80 percent of the merchants said that they are either staying or waiting for more information before shifting. Only 13 percent planned to shift to competitors

BUSINESS

Indian startups raised $1.2-billion venture debt in 2023: Report

This comes in contrast to Venture Capital (VC) investment in the Indian startup ecosystem, which experienced a significant funding downturn last year, a report by investment firm Stride Ventures notes.

BUSINESS

Had to sell PhonePe to Flipkart so we could compete with Paytm: Sameer Nigam hits out at foreign-owned tag

Nigam revealed that as a result of the company's merger with Flipkart, he didn't own a single share in PhonePe, apart from employee stock options (ESOPs).

BUSINESS

PhonePe’s Indus Appstore will give the right visibility to Indian apps: Amitabh Kant

Walmart-owned PhonePe on February 21 launched the much-anticipated Indus Appstore, a homegrown Android app store designed as a challenger to Google Play Store, for consumers in India, the world’s second-largest smartphone market.

BUSINESS

Exclusive: RBI said to up scrutiny of P2P lenders, asks platforms to share financial data

The regulator had sent out fresh emails to a few platforms last week as many continue to flout the legal conditions laid out in the P2P-NBFC master circular.

BUSINESS

Market not willing to bet on loss-making startups: Info Edge founder Sanjeev Bikhchandani

Bikhchandani said shortage of capital is good for discipline among startups as they become frugal and conscious of unit economics

BUSINESS

GIFT City listing may cut out domestic investors, says Sanjeev Bikhchandani

The Info Edge founder says it is easier to list on Indian exchanges and the process is less complicated

BUSINESS

New IFSCA rules: Fintech firms now need separate licence to offer payment services in Gift City

The Gift City regulator has come up with new rules for payment service providers (PSPs) to regulate cross-border money transfers, account issuance, merchant acquisition, e-money and escrow services

BUSINESS

Hurts when people don’t understand we turned profitable without cutting expenses: PB Fintech’s Yashish Dahiya

In conversation with moneycontrol, the founder says that only a few investors could see the real strength of the company, which includes his early investors like Info Edge.

BUSINESS

We have a 5 to 7 times spike in applications for online payments bank accounts since Jan 31: Anubrata Biswas, CEO Airtel Payments Bank

Payment banks can do much more in India, by leveraging the large user base and reach, particularly with the increase in the number of users from Tier 2 and 3 cities, says Biswas.

BUSINESS

PayU Finance elevates Deepak Mendiratta as CEO, former DBS bank chief is new CFO

Former chief risk officer Mendiratta replaces Prashanth Ranganathan who quit six months ago. The rejig runs parallel to leadership changes taking place across the board at PayU

BUSINESS

Paytm crisis: Users struggle to switch primary accounts linked to PPBL on Paytm Money

Paytm Payment Bank account holders claimed to have been facing issues to change their bank accounts on brokerage platforms, who are said to be aggressively educating customers about the latest update to facilitate smooth transition

BUSINESS

Cactus Venture Partners make final close of debut fund at Rs 630 crore

The Mumbai-based VC firm is looking to invest in eight to 10 startups in health tech, climate tech and B2B SaaS space, with a cheque size of $2-5 million

BUSINESS

CRED acquires Kuvera, marks entry into wealth management space

The latest deal would allow CRED to offer investment product like direct mutual funds, FDs, SIPs, and digital gold to its user base besides financial planning tools. The company has also been looking to expand its new insurance product under fintech arm DASPL.

BUSINESS

PhonePe expands board, inducts former revenue secretary Tarun Bajaj, two executives from Walmart

PhonePe has been broadening its ambitions beyond payments, with the launch of an e-commerce-focused app called Pincode and an investment app for stocks and mutual funds called Share. Market.

BUSINESS

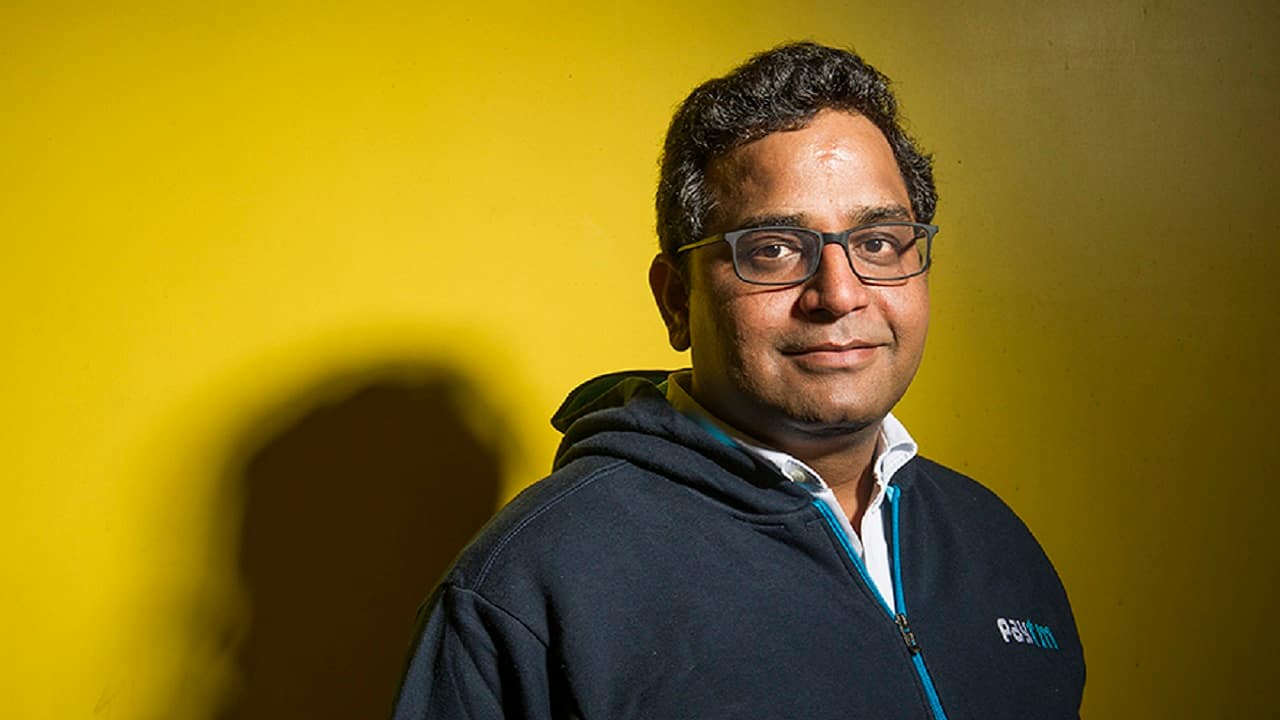

Paytm crisis: "Don't know what went wrong", Vijay Shekhar Sharma to employees on RBI circular, assures job safety

In his first direct communication with employees, Paytm founder Vijay Shekhar Sharma sought to pacify their fears around job security while "figuring out a solution to RBI's diktat soon"

BUSINESS

Govt cuts allocation for major schemes under 'Startup India' initiative in Budget

Allocation for Small Industries Development Bank of India (SIDBI)-operated Fund of Funds Scheme (FFS) was cut down to Rs 1200 crore compared to Rs 1470 it allocated for FY24 while Rs 100 crore was earmarked for Credit Guarantee Fund compared to Rs 220 crore, previously.

BUSINESS

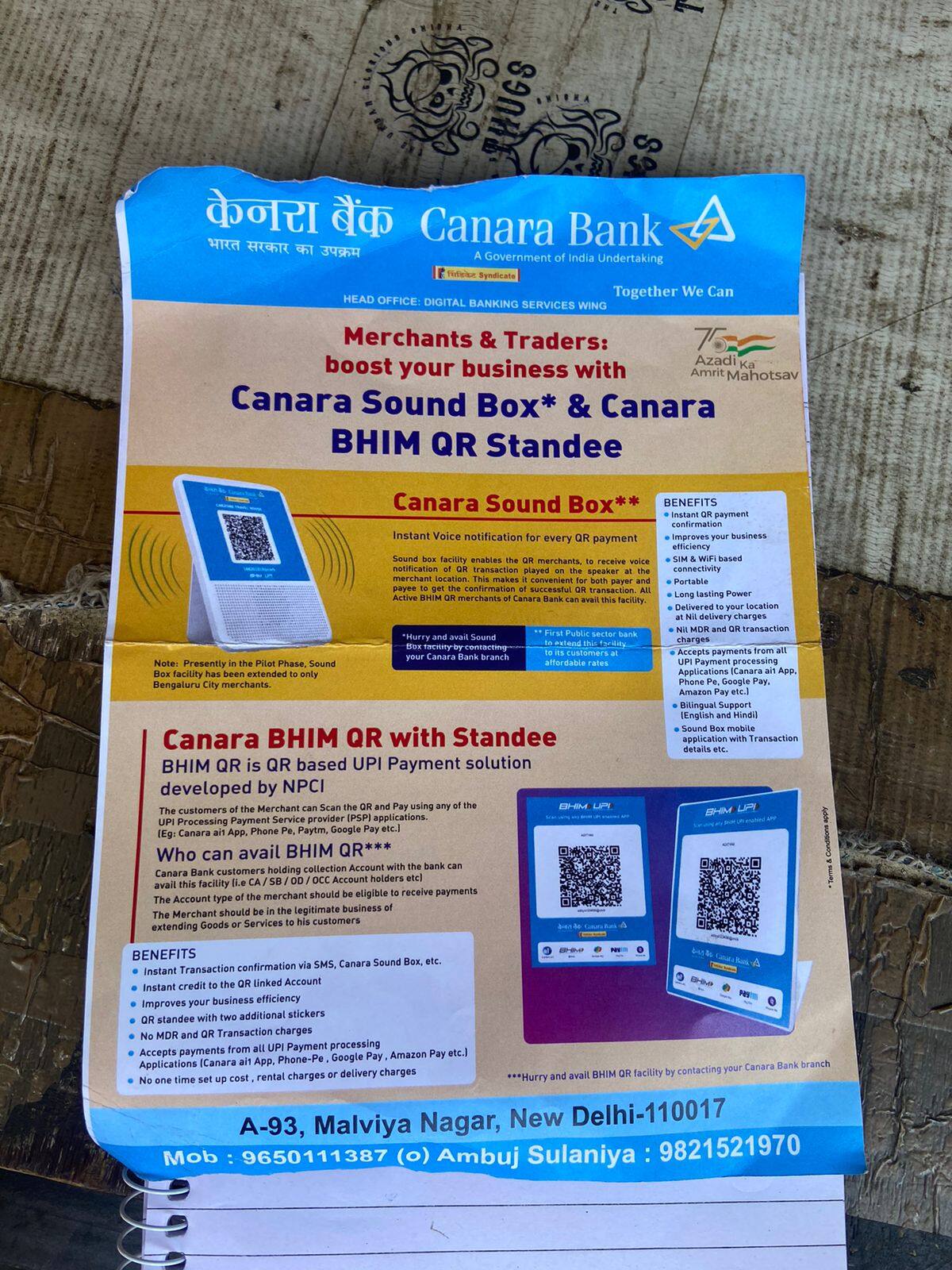

Budget 2024 slashes incentives for RuPay debit cards, low-value UPI transactions

The scheme was introduced to compensate acquiring banks and fintechs for promoting Point-of-Sale and e-commerce transactions using RuPay debit cards and low-value BHIM-UPI transactions (P2M) up to Rs 2,000, giving up on the MDR earned.

BUSINESS

Paytm crisis: Vijay Shekhar Sharma says "Indian startup dream must overcome every situation collectively"

Many founders have come out in Vijay Shekhar Sharma's support post RBI's diktat on Paytm Payment Bank barring it from offering banking services.

BUSINESS

Budget 2024: Fintechs pin hopes on continued subsidy for UPI transactions

For 2023, the government had earmarked Rs 1,500 crore (provisional) for the promotion of digital payments. The industry expects the provisional outlay to be revised to a higher amount with the momentum of UPI transactions picking up.

BUSINESS

RBI’s Paytm crackdown causes shockwaves across fintech industry

While many founders continue to hope for the issue to resolve, others said the move will have a ripple effect on the ecosystem and restrict newer players from coming into the banking business.

BUSINESS

In talks with fintechs, retail firms to integrate Bhashini platform: Amitabh Nag

Since its inception in 2022, Bhashini has been collaborating with a diverse set of stakeholders. This includes engagement with the government, academia, research groups, startups, banks, industry players, and data collection companies.

BUSINESS

From Aakash to Whitehat Jr, how Byju’s acquisitions performed in FY22

Byju's subsidiaries Whitehat Jr and OSMO were the most underperforming assets in FY22, accounting for almost 45 percent of the total losses of edtech firm.

BUSINESS

Demand for workforce may shrink as Paytm ups AI play, says CEO Sharma

The fintech has been able to bring down its people costs using AI, says president and Group CFO Madhur Deora. The company will not be adding more salesforce on ground, he has said