BUSINESS

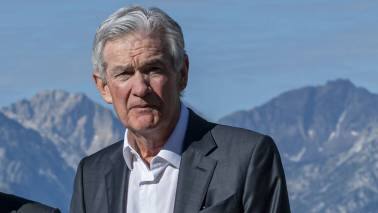

The Federal Reserve must deliver two things this week

The first is a steadier hand on the policy wheel and the second is abandoning the 'only game in town' mindset

WORLD

Labour’s growth-oriented UK policies are promising

New Chancellor of the Exchequer Rachel Reeves is offering what is needed for an economy that for too long has lagged behind the Group of Seven

BUSINESS

Five key ways the Bank of England outperformed its peers

It’s not perfect, but the central bank has been better than others in terms of honesty, humility, and willingness to learn from its mistakes

BUSINESS

US Federal Reserve’s uniformity on rates comes with risks

The high-for-long mantra recently adopted by US central bank policymakers raises threats for the economy and financial stability

BUSINESS

American exceptionalism on display in the bond market

The divergence between key fixed-income benchmarks shows the US economy is on a healthier endogenous growth path compared with Europe

BUSINESS

A Fed held hostage by data is asking for trouble

An excessive focus on the numbers tips the balance of risks toward keeping interest rates too restrictive for too long, unduly increasing the probability of output loss, higher unemployment and financial instability

BUSINESS

Fed’s ‘last mile’ of inflation fight will be no cakewalk

Myriad economic variables add layers of complexity to the central bank’s efforts to vanquish accelerating prices

BUSINESS

What US Treasury volatility means for the economy

The volatility last week differed from that of 2022 and earlier this year because it was driven not by the policy-sensitive short end of the yield curve (such as the two-year Treasury) but by the longer-dated bonds

BUSINESS

Why we should pity the Bank of England

The UK central bank faces a more acute set of challenges compared with those confronting the ECB and the Fed

BUSINESS

Persistent UK inflation should worry everyone

Bank of England has no choice but to both raise interest rates and signal more hikes to come amid growing tensions in the mortgage market. Bringing down inflation in an orderly fashion besides interest-rate hikes need more responsiveness on the supply side, enhanced productivity, and improved provision of public services and safety nets

BUSINESS

JP Morgan, First Republic Bank and the curse of the second best

The solution to regional bank’s crisis raises more questions and concerns about the US financial system

BUSINESS

Why UK took a different approach than US on Silicon Valley Bank intervention

British policymakers have a stronger aversion to the twin risks of moral hazard and co-option of monetary policy by financial markets

WORLD

Davos meetings are full of potential but rarely full of solutions

The World Economic Forum is gathering again and the list of economic problems facing the world is long and getting longer