BUSINESS

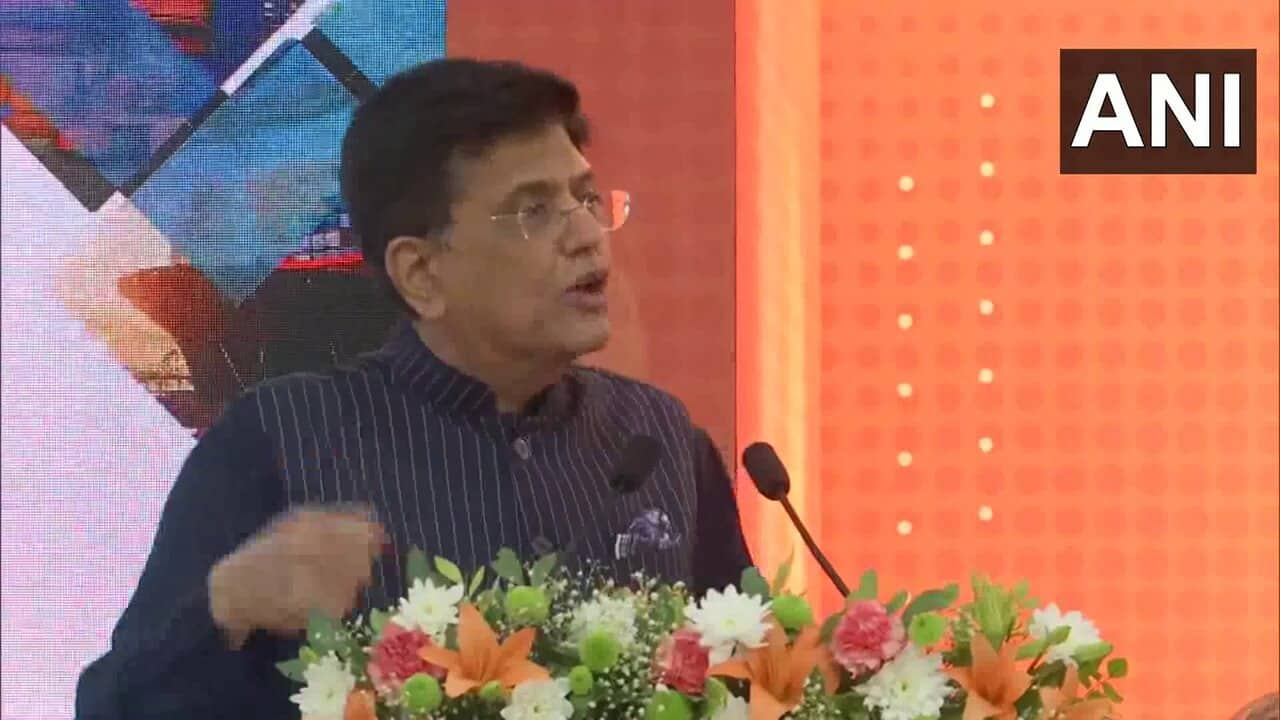

Drop in food expense in household consumption survey a good sign: Piyush Goyal

The commerce minister was speaking at an event on the theme of 'Viksit Bharat @2047' organised by industry body Ficci.

LOK-SABHA-ELECTIONS

No proposal for FM Sitharaman to contest Lok Sabha polls: Source

Union Finance Minister Sitharaman and External Affairs Minister Jaishankar are Rajya Sabha members from Karnataka and Gujarat respectively.

BUSINESS

Exclusive: Govt likely to focus on strengthening related party clause in company law

All the big investigations, including ZEEL, are likely to expose violation of related party transactions

BUSINESS

SCI divestment faces more hurdles as pension scheme and ongoing court case may delay process further: Sources

SCI is the midst of a court case for non-payment of medical dues to its employees. There is also no clear picture of how employees will be compensated after the demerger under the pension scheme of the company.

BUSINESS

Corporate affairs ministry asks to speed up inspection report on Byju’s

There is no separate Serious Fraud Investigation Office (SFIO) probe ongoing against Byju’s, the official clarified.

BUSINESS

Household Consumption Expenditure Survey 2022-23: Here are the FAQs

A total of 405 items in the consumption basket were covered in the survey, which was divided into three categories: food items, consumables and service items, and durable goods.

BUSINESS

Consumer or exchequer - who will win after GST compensation cess expiry?

The cess on the sale of goods and services is set to end on March 31, 2026. With states no longer being reimbursed for any shortfall in GST revenues, and loans taken to meet the deficit in the compensation cess fund set to be repaid early, the Centre faces a dilemma.

BUSINESS

GST Cess Explained: A Comprehensive Overview

GST cess is set to expire in two years. What happens starting April 2026 is a decision that the government has to make.

BUSINESS

MC Interview: Delta Corp planning Rs 1,100 crore investment in offline business over two years

The company has put its online gaming expansion plans on hold after the GST rate was hiked to 28 percent. It is also battling a Rs 24,000-crore GST evasion notice in the courts

BUSINESS

Sugar mills to sell potash to fertiliser cos for additional revenue: Food secy

India currently imports 100 percent of potash required as fertilisers.

BUSINESS

Views divided on India’s 8% FRP hike on cane as selling price remains lowest in the world

Industry players say that the government should increase MSP on sugar whenever the FRP on cane is hiked to avoid a cycle of high and low production.

BUSINESS

Red Sea crisis: Indian traders on edge as exports worth $64 billion at risk

A FIEO survey revealed that cotton yarn exporters are facing a 50-600 percent increase in costs for their shipments to Bangladesh, Europe, and Egypt. The full impact of the crisis is likely to be visible in India’s export figures February onwards.

BUSINESS

CBI raids former DIPP Secy Ramesh Abhishek in disproportionate assets case

The former bureaurcrat is serving as an independent director on the Paytm Payments Bank board

BUSINESS

FM Sitharaman to meet over 20 fintechs today, discuss KYC norms and compliance

Paytm will not be a part of the meeting, where the Finance MInister is expected to emphasise on the importance to adhere to KYC norms and compliances, according to a government official.

BUSINESS

Talks with Tesla to slow down until general elections 2024: Government official

Officials say that although Tesla is keen on its India foray, it does not see India as a huge market just yet. Its charging infrastructure will take a few years to develop and only then can it think of a presence here, they say.

BUSINESS

Sugar production likely to be on a downslide in 2023-24: Industry

The downslide in sugar production is expected on account of less rainfall this monsoon which has led to lesser sugarcane plantations.

BUSINESS

Exclusive: Govt mulling new PLI scheme for pharma sector

The move is aimed at reducing Indian companies’ dependence on China for key chemicals needed to manufacture active pharmaceutical ingredients.

BUSINESS

Income Tax recovers Rs 115 cr from Congress bank accounts, Rs 19 cr pending

Recoveries have been made against the total outstanding demand of Rs 135 crore for assessment year 2018-19 arising on account of non-compliance of certain sections of the Income Tax Act and late filing of returns

BUSINESS

Rs 20 lakh cr pending direct tax demands under litigation: Govt official

Of the pending demands, Rs 3,500 crore will be waived, as per the Budget announcement on Feb 1, 2024.

BUSINESS

Govt invites applications for members of GST Appellate Tribunal

Eligible candidates are required to apply online and application portal would be accessible from February 19 until 5 pm on March 31.

BUSINESS

Pharma, solar PLIs under rethink as dependence on Chinese imports continue: Govt official

With large parts of the supply chain not falling under the schemes, domestic manufacturers face vulnerabilities.

BUSINESS

CAIT seeks 1 year delay in implementation of new MSME payment rule

The trade body met Finance Minister Nirmala Sitharaman on February 14 to put forward its concerns

BUSINESS

GST Council may issue clarification on expat salary taxation amid controversy

The clarification will be presented to the GST Council for approval once the law committee reaches a consensus on the matter

BUSINESS

Exclusive | GST Council likely to discuss coinsurance, reinsurance issues at next meet

Certain industry practices have been leading to non-payment of the tax, due to which clarity needs to be brought in, a government official told Moneycontrol.