TRENDS

ABB India: Business recovery could take a pause led by second wave of virus

Fundamentals start to reflect second wave of COVID, which may only accentuate in coming months

TRENDS

Power Grid InvIT: Offering good and predictable yield

With secured cash flows, long-term nature of the assets, strong balance sheet, support of the parent and the highest credit rating, the Power Grid InvIT issue should reward its unit holders

BUSINESS

8 big ideas from the book 'The hard thing about hard things'

Author Ben Horowitz talks about why building a company is tough and shares nuggets of wisdom on dealing with these adversities from his own experience

TRENDS

Grauer & Weil (India): A high quality business available at attractive price

Despite the huge stress and crisis caused by COVID-19, Grauer & Weil has remained profitable

BUSINESS

Should you invest in Macrotech IPO?

Macrotech has now emerged as a much stronger play, leaving behind its past luggage

BUSINESS

Railway engineering sector: Back on track

We find good value in stocks like IRCON and RITES

MONEYCONTROL-RESEARCH

Indian Energy Exchange: Creating a valuable franchisee model

The company has built a strong competitive advantage and a dominant position in the power trading space. This is only growing as more and more volumes shift to exchanges.

MONEYCONTROL-RESEARCH

Defence stocks: An alpha for a defensive portfolio

Strong execution and revival in earnings backed by robust order book should augur well for defence companies in the near to medium term

BUSINESS

MTAR: Good long-term play despite strong listing

The strong listing of MTAR Technologies in the secondary market has lifted valuation to around 75 times

BUSINESS

Praj Industries: Taking the lead in a growing space

With the government fast-tracking ethanol blending, Praj Industries' bio-energy segment has received a boost

BUSINESS

NCC: On the growth runway

With robust earnings visibility and improving execution, earnings are expected to grow strongly over the next two years which would drive the NCC stock

BUSINESS

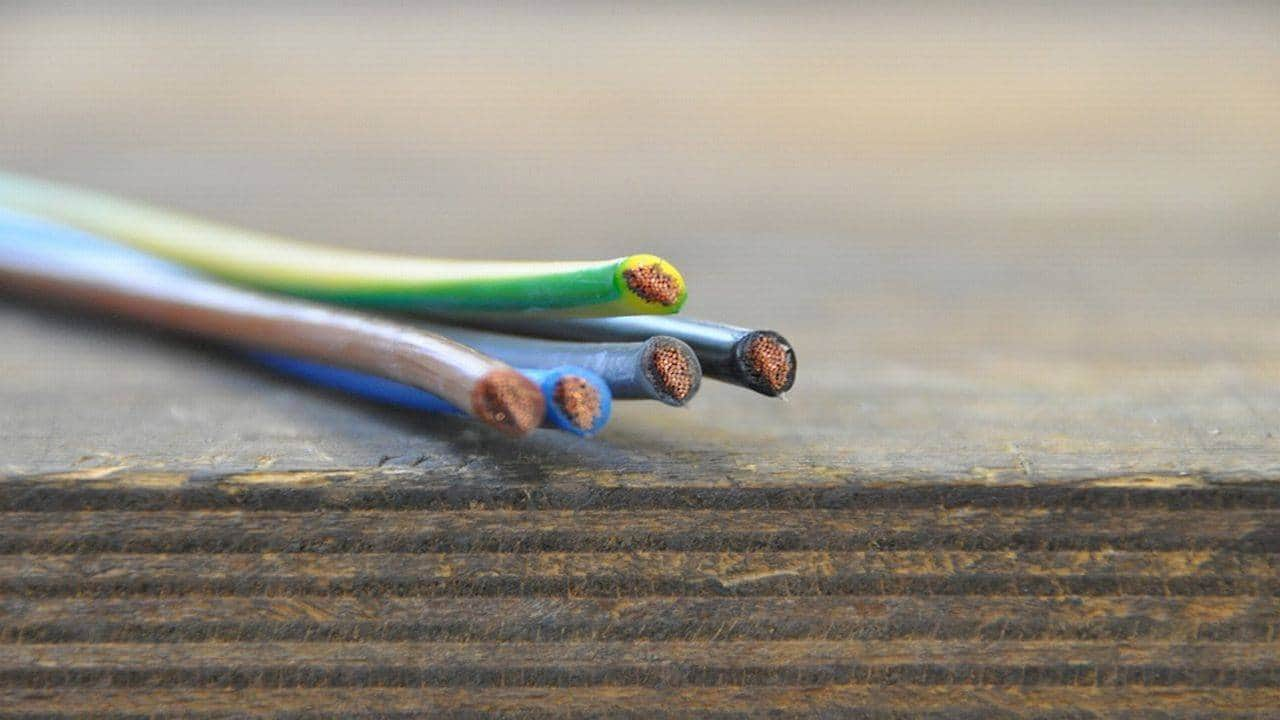

KEI Industries is back to the growth path

Business activity is returning to pre-covid levels, earnings could surprise on the higher side in the coming quarters

MONEYCONTROL-RESEARCH

MTAR Technologies IPO: The right stock to add to your portfolio

MTAR operates in niche growing areas where it enjoys strong competitive advantages

BUSINESS

Construction sector: Back on growth highway

We remain positive on our high conviction ideas -- companies with lower debt to equity and better execution capabilities -- such as KNR, PNC and HG Infra which we believe could take full advantage of the infra boom

BUSINESS

Reliance Industries: On a four-lane superhighway

The proposed reorganisation of the O2C business adds to the prospect of raising growth capital, which in turn will serve as a catalyst for the legacy growth engine of RIL

BUSINESS

Engineers India: More room for growth

Strong order book recovery in execution to support growth for EIL in coming quarters

BUSINESS

ION Exchange: What ails this company?

Drop in revenues and lower order book raise concerns over ION Exchange's near-term growth

BUSINESS

Power Grid: Focus is on earnings return

With higher capitalisation likely in the current quarter, better utilisation of assets and contribution from other ventures should translate into higher growth for Power Grid in 2020-21

BUSINESS

Va Tech Wabag: Higher execution and improving balance sheet to support growth

Led by higher execution and strong order book, Va Tech Wabag is set to deliver higher growth

MONEYCONTROL-RESEARCH

ABB India: Revival of private capex key to supporting lofty valuation

High price to earnings and lack of growth in the near term for ABB India leave very little for investors

BUSINESS

NTPC: Attractively valued despite strong earnings visibility

Earnings recovery coupled with attractive valuation to keep the NTPC stock high

BUSINESS

Adani Ports & SEZ: Strong growth trajectory likely to get better

Earnings trajectory remains strong, but investors should lower expectations given the recent spike in share prices and valuation

BUSINESS

Thermax: Recovering, but at a slower pace

High valuation and slow growth in earnings could keep Thermax stock under pressure

BUSINESS

KEC International: Reasonably valued with strong earnings visibility

Strong revenue visibility, pick-up in execution, and contribution from high growth segments augur well for KEC in the medium term