BUSINESS

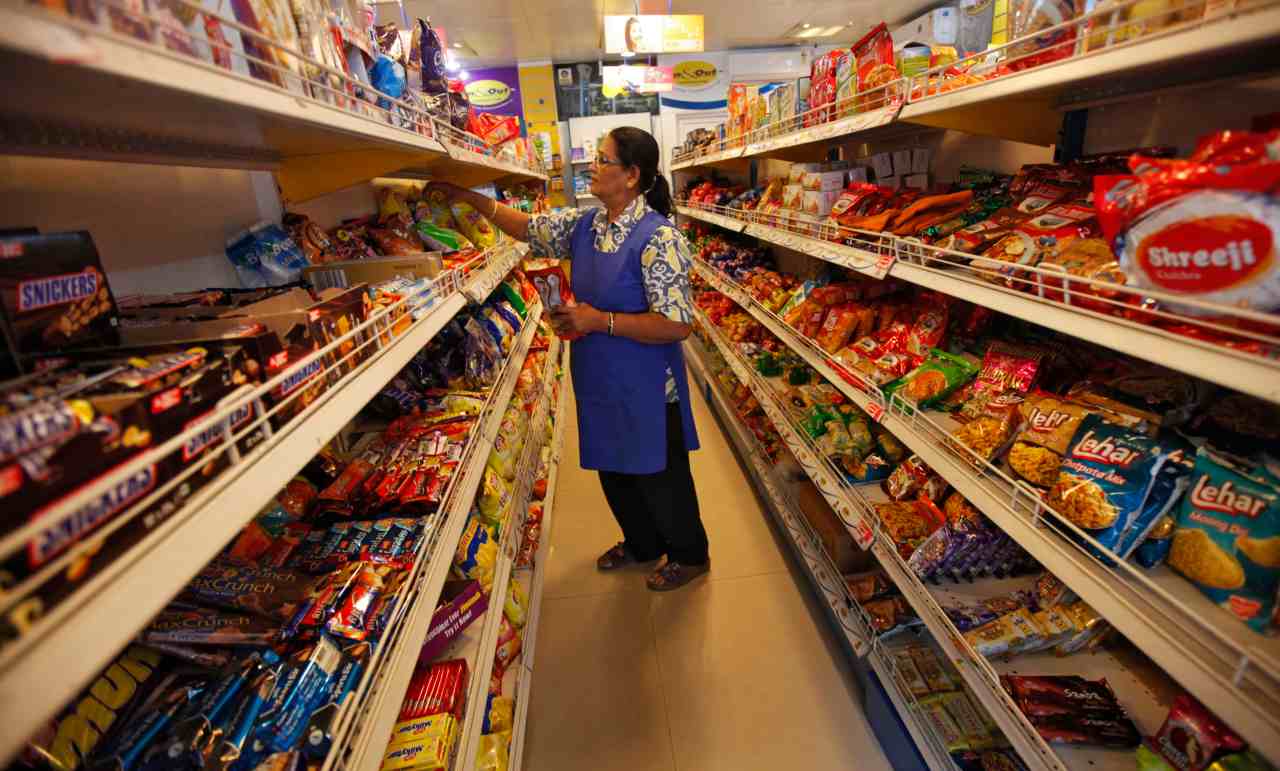

FMCG slowdown: Rural growth stable; urban decelerates

FMCG companies refused to comment on this trend, claiming silent period ahead of the quarterly result season.

BUSINESS

Franklin MF becomes first fund house to sidepocket its Vodafone Idea debt exposure

The fund house also said that side-pocketing was done only after CRISIL downgraded the telecom company’s debt securities below investment grade.

BUSINESS

Mahindra MF CIO expects FY21 corporate earnings growth at 23-25%, bets on telecom

The fund house is sitting on 4-5 percent cash in its equity portfolio across five schemes.

BUSINESS

Here's why mutual fund houses are looking at ESG funds

Axis Mutual Fund became the third fund house to launch an ESG fund. The new fund offer opened on Jan 22 and will remain open until Feb 5.

BUSINESS

Budget 2020: FMCG sector's cup of woes and its wishlist for FM Nirmala Sitharaman

High unemployment, rising inflation rates and minimal uptick in income levels are taking a toll on urban demand.

BUSINESS

Ban on upfront commission hits new IFA registrations

According to AMFI, new IFA registrations have fallen 55 percent in this financial year so far compared to FY19.

BUSINESS

Franklin Templeton MF marks down Vodafone Idea investment to zero

Franklin Templeton MF has the highest 62% exposure in Vodafone Idea, MFs held Rs 3,000 crore worth debt papers in the company

BUSINESS

Budget 2020 | AMFI hands over wishlist to Finance Ministry

"Some of the proposals are also aimed at bringing parity with comparable investment avenues, making mutual funds more retail investor friendly," said NS Venkatesh, Chief Executive Officer of AMFI.

BUSINESS

Aditya Birla Mutual Fund’s debt CIO Dangi says US-Iran tensions key emerging risk for Indian macros

High inflation, proximity to terminal repo rate, improving growth conditions and fiscal stress will move government bond yields higher in 2020

BUSINESS

MFs stake in Yes Bank down to 5% in December; lowest since March 2005

According to the data on ACE Equity, mutual funds stake in Yes Bank fell to 5.09 percent as on Dec-end 2019, from 9.26 percent stake as on Sep-end 2019.

BUSINESS

2020 a year of consolidation and transition, says Aditya Birla MF CIO Mahesh Patil

FY21E Nifty 50 earnings growth is projected to be around 23 percent

BUSINESS

Manulife Investment Global CIO Chris Conkey recommends Indian investors to diversify in global markets

Manulife Investment Management has approximately $394 billion in assets under management as of September 30, 2019. In terms of region, The company's portfolio is tilted towards the US with a 52 percent exposure, followed by 25 percent exposure to Asia, 21 percent to Canada and the balance 2 percent to Europe.

BUSINESS

Mutual funds wrap: Will AMFI’s new categorisation list lead to major rehashing of portfolios?

Currently, the mutual fund industry, which consists of 43 players, offers 26 mid-cap schemes and 21 small-cap funds with the total Assets Under Management (AUM) of Rs 133,496 crore.

BUSINESS

Liquidity in trading Bharat Bond ETF units crucial for enhancing retail investor participation

Bharat Bond ETFs were listed on exchanges on January 2. The NSE data shows between January 2 to January 9, the Bond series 2023 has had daily trading volumes between 8,600 to 40,700 ETF units. For the same period, bond series 2030 has had trading volumes of 13,000 to 50,600 units approximately.

BUSINESS

CPI inflation to stay above 4%; RBI rate cuts may be pushed to FY21: Tata MF debt head Nagarajan

Liquidity is expected to remain easy to support growth even though CPI inflation will remain elevated

BUSINESS

Tata Mutual Fund CIO Rahul Singh expects Nifty earnings growth to be between 10-12% for FY21

He also said it is the ‘right time’ to look at mid caps, and even more for looking at small cap stocks as they are expected to deliver robust returns going ahead.

BUSINESS

ICICI Pru MF's Naren expects market to stay volatile in 2020, US-Iran tensions to hurt sentiment

Naren recommended investors to put money in risky assets due to low credit growth, particularly small-cap stocks.

BUSINESS

Smallcaps to deliver robust returns in 3-5 years, says ICICI Pru MF's S Naren

Since February 2018 till December 2019, the m-cap of companies ranked from 251 to 500 have dropped 23.2 percent while that of beyond 501 companies have decreased by 56.5 percent

BUSINESS

Wrap: Cautious October-December quarter growth for mutual fund industry

The growth, however, is still a silver lining as after a year of defaults and downgrades that spelt trouble for the MF industry, it managed to maintain a growth trajectory.

BUSINESS

SEBI to revisit mutual fund categorisation, circular likely next week

In order to enable investors to make accurate comparisons of schemes, SEBI introduced categorisation and rationalisation of mutual fund schemes in October 2017.

BUSINESS

BPCL, Air India, CONCOR divestment unlikely in FY20: Source

“The roadshows have happened. The next stage is getting the financials in place," the official added

BUSINESS

International funds stood out in 2019; small cap funds laggards

Edelweiss Greater China Equity Off-shore Fund and Kotak World Gold Fund delivered 46.64 percent and 45.45 percent average returns, respectively.

BUSINESS

Retail chain 1-India Family Mart looking to open 200 stores by 2022

Speaking about the overall slowdown, the company's chief said: "The year 2019 has been a tough year in terms of the consumption but we are putting in best of the efforts in marketing, product profiling, technology and customer profiling to grab the best we can."

BUSINESS

Will SEBI’s move to make mutual funds directly responsible, create issues for MF trade platforms?

Some of the of the direct mutual platforms in India Kuvera, Goalwise, CAMS & Karvy Website/Mobile App, AMFI’s Mutual Fund Utility, PaisaBazaar, Zerodha, PayTM Money, Groww and Clearfunds.