BUSINESS

COVID-19 impact: Here's why Indian banks won't come out of abyss anytime soon

Bankers and analysts expect significant spike in non-performing assets going ahead. The pain may not be visible immediately since the RBI has extended regulatory relaxations.

BUSINESS

With CKP Bank’s failure, yet another co-operative bank bites the dust: What’s ailing these lenders?

India’s weak co-operative banks have been imploding one after the other. Almost every month, the RBI brings some or the other co-operative bank under restrictions.

BUSINESS

CKP Co-operative Bank has 97% NPAs; most to real estate developers

Over the years, CKP Bank had built its business by lending to mostly small and mid-sized real estate developers in Mumbai, who did not pay back loans leading to a huge spike in NPAs.

BUSINESS

RBI top brass takes stock of situation; bank CEOs seek extension of COVID-19 relaxations

Banks have demanded possible extension of the loan moratorium facility to borrowers announced by the RBI in the wake of Covid-19. The RBI will look into these suggestions now

BUSINESS

Franklin Templeton crisis: Here’s a closer look at the companies in which Franklin has invested in

Franklin Templeton's six schemes have total investments of Rs 7,697 crore to 26 companies (with 100% exposure to the six debt funds) of 88 top borrowers in its six debt schemes

BUSINESS

RBI determined to make banks lend to crisis-ridden mutual funds: Will lenders pay heed?

Banks fear huge bad loans going ahead from such exposure in low-rated papers where mutual funds have parked money. Someone needs to guarantee these loans, ideally the government or the central bank.

BUSINESS

Sapre says Franklin Templeton needs to repay lenders first before investors, in talks with firms for early repayment

President of Franklin Templeton India assures investors that they will get their money back, but after the company pays off borrowings and sells securities.

BUSINESS

Franklin Templeton gives moratorium to NCDs of three Future Group companies

“Future Group has requested Fixed Income schemes managed by Franklin Templeton Mutual Fund , relief under the moratorium benefit announced by the RBI," the mutual fund said.

BUSINESS

SIDBI extends loan repayment term to 1-year for NBFCs, MFIs

This is a significant development as microlenders felt the earlier repayment rules were stringent considering the present operating environment.

BUSINESS

COVID-19-hit microlenders knock on SEBI’s door seeking extension of rating period

Rating agencies typically revise ratings of microlenders after 12 months. Despite the lock down, some of the microlenders have received communication from agencies on further rating revision.

BUSINESS

All good for Axis Bank in Q4, but COVID-19 uncertainty shadows future outlook

For banking analysts, Q4 numbers aren’t that important. All eyes are on the April-June quarter when the world will emerge out of the 40-day-long lockdown. That is when the RBI relief for borrowers, in the form of moratorium and liquidity stimulus, will come to an end.

BUSINESS

Why banks are not lending to small companies despite availability of cheap funds from RBI

Their risk aversion has affected NBFCs and smaller MFIs the most.

BUSINESS

Franklin Templeton: Who is to blame for the mess?

How lazy regulators, feckless rating agencies and rash fund managers take mutual fund investors for a ride time and again.

BUSINESS

Coronavirus relief: MFIs write to Sidbi, RBI seeking relaxation in refinance scheme eligibility terms

On April 17, announcing the second round of COVID-19 relief measures, RBI Governor Shaktikanta Das had launched refinancing support to the tune of Rs 50,000 crore through all India financial institutions such as NABARD, SIDBI and NHB.

BUSINESS

Shaktikanta Das is the knight in shining armour yet again; this time for worried mutual funds

This isn’t the first time the RBI is helping mutual funds industry. In 2008, in the aftermath of the global financial crisis, the RBI had stepped in to save the sector. The central bank then opened a special window to provide banks with funds to support mutual funds.

BUSINESS

Franklin Templeton mess: A liquidity mishap or a series of wrong, aggressive bets?

The closure of Franklin Templeton’s six funds has opened room for questions.

BUSINESS

Franklin Templeton fund closure: Will RBI step in to save MFs from likely redemption pressure?

As investors look for safer assets, bank deposits — despite the lower returns they offer — may see more preference since safety will be sought-after over returns.

BUSINESS

RBI's TLTRO 2.0 fails to get good response. What does it mean for fund-starved NBFCs?

"Limited participation by banks in the TLTRO 2.0 clearly highlights the bank's reluctance to lend to mid-size and small NBFCs and MFIs in the current situation," Brickwork Ratings said.

BUSINESS

RBI's much-hyped refinance window may fail to help small MFIs and MSMEs

"Due to the repayment clause and the minimum rating required, most MFIs are not even approaching SIDBI for refinance facility," said P Satish, Executive Director of Sadhan, an industry body.

BUSINESS

RBI says 10% cap for banks to invest TLTRO funds applies only to the fourth tranche

On 16 April, Moneycontrol had reported about the confusion in the markets on whether this rule applies to all rounds of TLTRO.

BUSINESS

ICICI Bank confirms exposure to Singapore firm Hin Leong, says taking appropriate steps

On April 20, Moneycontrol reported that ICICI Bank has an exposure of $100 million (about Rs 760 crore) to Hin Leong.

BUSINESS

RBI announces more measures to nudge banks to lend to small NBFCs. Will lenders act at least now?

Smaller NBFCs and MFIs typically do not get preference since these companies are perceived to be high-risk borrowers and normally carry lower ratings.

BUSINESS

Singapore’s Caladium ups stake in Bandhan Bank to 4.49%

Of late, sovereign funds and other overseas investors are increasingly looking at Indian companies as share prices have fallen and these entities look good to global investors from an investment perspective.

BUSINESS

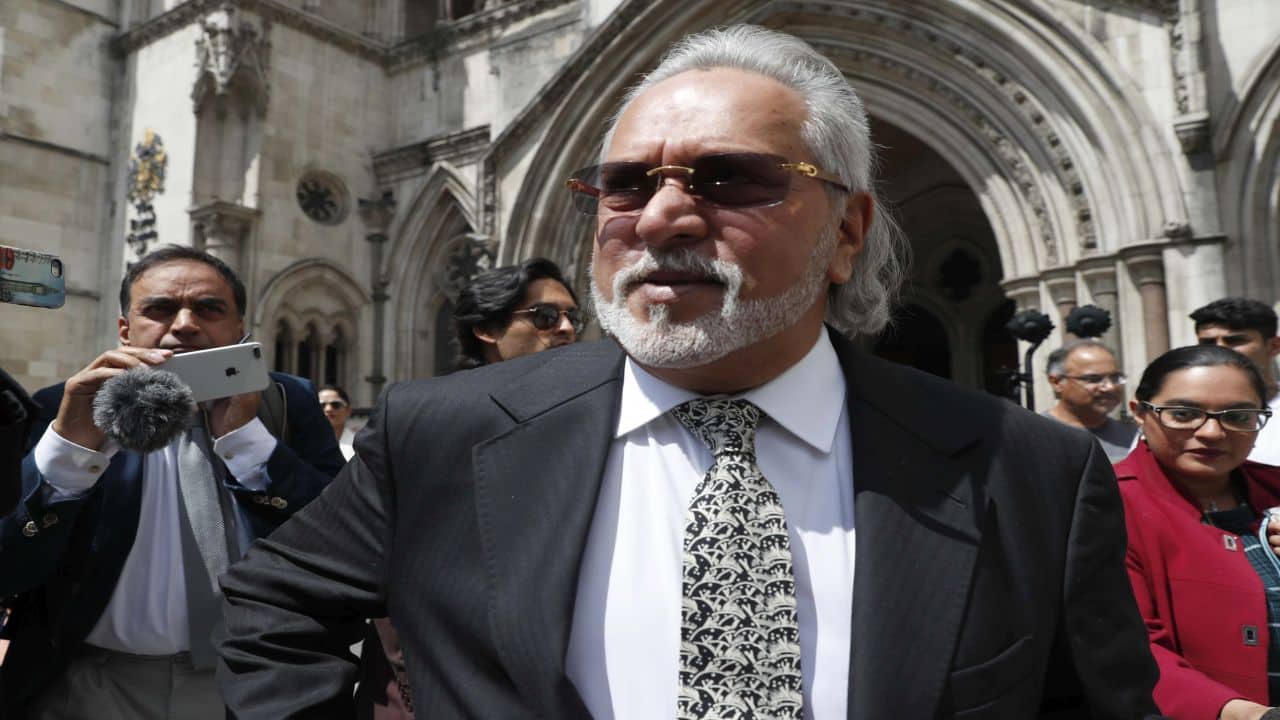

Vijay Mallya saga: Endgame for ‘the King of Good Times’ but what next for his lenders?

Mallya's holding in United Breweries is 11.04 percent which has a value Rs 2,696 crore and that of United Spirits (1.52 percent) at Rs 582 crore. In total, if banks manage to sell these share holdings on April 20, banks would get Rs 3,278 crore. But selling these shares and recovering money isn’t that easy.