BUSINESS

Kotak bank created and oversaw offshore fund that partner used to short Adani stocks, says Hindenburg

Adani-Hindenburg case: US-based Hindenburg Research received a 46-page show cause notice from SEBI regarding its Adani Report on June 27, the shortseller said.

BUSINESS

SBI gets a new chief: Can Setty make the elephant of Indian banks dance again?

Outgoing Chairman Dinesh Khara, who is set to retire on August 28 when he turns 63 (the upper age limit for the position of SBI chairman), is leaving a strong balance sheet for his successor

BUSINESS

Banking Central | Student loan burns a hole in banks’ books. But that isn't a surprise

The share of NPA in education personal loans stood at 3.6 percent in the overall personal loans bucket, compared with 1.8 percent in credit cards, 1.3 percent in auto loans, and 1.1 percent in housing loans

BUSINESS

RBI finally has private credit market on its radar, and for the right reasons

Private credit is provided by non-bank lenders to corporates. The market has grown four-fold in the past decade, emerging as a major source of corporate financing among middle-market firms that have low or negative earnings, high leverage and lack quality collaterals

BUSINESS

As bad politics threatens good economics, lenders fear a rough ride ahead

Such loan waiver promises severely impact the credit culture of a large geography, encouraging even the honest, regularly paying borrowers hope for a waiver of their liability by the government

BUSINESS

Bandhan Bank hopes director onboarding to firm up transition, says RBI flags no concern

The RBI appointed Arun Kumar Singh as an additional director on the Board of Bandhan Bank for a period of one year from June 24

BUSINESS

Why did RBI appoint A K Singh on Bandhan Bank’s Board?

The development is happening at a time when the bank is going through a leadership transition phase and a forensic NCGTC audit is underway on the microloan book linked to concerns around evergreening.

BUSINESS

In India’s rate-setting panel, there is a growing chorus for growth

While it was only Jayanth Varma till now who sought a rate cut, one more member—Ashima Goyal-- has joined the club now.

BUSINESS

Banking Central | Microlenders, it's time to take a pause and think again, lest it hits you back

The RBI removed the cap on margins in November 2022, opening the field for microlenders to decide lending rates of their choice

BUSINESS

MC Interview | As inflation falls, repo should be cut to prevent real rate from rising too high, says Jayanth Varma

Sacrificing 0.75 percent or 1 percent economic growth will last not for one year, but for two. This makes the growth-inflation tradeoff a lot worse than we expected, says the MPC member

BUSINESS

MPC minutes: Maintenance of restrictive policy for long will lead to growth sacrifice in FY26, says Jayanth Varma

Varma voted to reduce the repo rate by 25 basis points, and to change the stance to neutral in the policy while the majority decided to keep the repo rate unchanged for the eights consecutive policy review.

BUSINESS

Banking Central | Who can tackle the worsening working culture in banks?

I would bet on trade unions, more than bank managements and the regulator. Let me explain why...

BUSINESS

RBI special audit over, necessary measures taken to address regulatory concerns: IIFL Finance

The report of the special audit has been submitted to the RBI and the regulator will now take a call on reviewing the business restrictions imposed.

BUSINESS

MC View | What does US Fed’s rather hawkish rate stance mean for Indian policymakers?

The Fed plans of a rate cut this year could influence the thought process for the Monetary Policy Committee, but its actions will be driven more by crucial local factors

BUSINESS

MC Analysis | Will bank privatisation return to the agenda of Modi 3.0?

Beyond introducing enabling legislation, the government needs to exhibit strong political will and resolve to walk the talk on bank privatisation. The first Union Budget of this government next month should offer some clues

BUSINESS

Banking Central | Why the RBI monetary policies have turned so boring

But that’s how the monetary policy reviews work. No action is also a good action sometimes!

BUSINESS

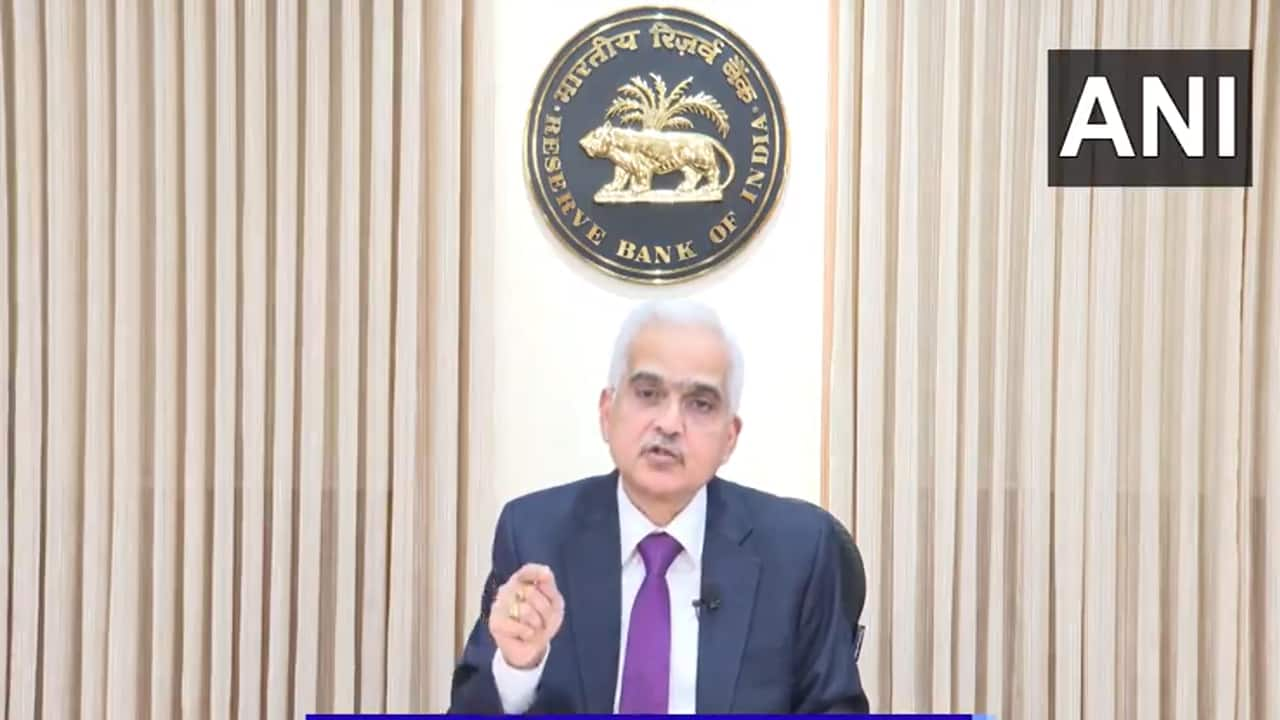

Quickview| RBI’s Das is focussed on fighting inflation and that's good news for us

The Mint Street deserves applause for retaining its sharp focus on inflation. High inflation, along with rising unemployment, remain a big worry which takes away the purchasing power of common people and denies them the fruits of growth

BUSINESS

MPC keeps rates unchanged as inflation stays beyond RBI target of 4%

Banks are struggling with a slower deposit growth far less than the credit growth, creating an asset-liability mismatch

BUSINESS

Four critical questions before the RBI in its inflation fight

The central bank wouldn’t want to hurry on a rate reversal till it sees clear signs of inflation easing to 4 per cent levels. That may be still some time away.

BUSINESS

Banking Central | What do the exit polls mean for India's banking sector?

The News18 Mega Exit Poll pegs BJP’s tally at 305-315 and that of the NDA at 350-377. While the BJP's vote share is expected to be around 40 percent, Congress' is likely to be 20 percent with 62-72 seats

BUSINESS

RBI annual report explains how Mint Street managed record Rs 2-lakh-cr surplus transfer to govt

A significant jump in interest income coupled with lower-than-expected provisions did the trick this year. Next hear could also see a substantial transfer if conditions favour

BUSINESS

Exclusive: Avendus Group plans to launch new credit fund in FY25, thrice the size of previous fund

The fund will focus on pharma and healthcare, special chemicals, manufacturing, business to business, FMCG, warehousing, logistics, financial services, and auto comp sectors, said Nilesh Dhedhi, Managing Director and CEO, Avendus Finance.

BUSINESS

View |Now, Edelweiss faces RBI’s wrath: What explains the recent spate of tough actions by central bank

The RBI's recent crackdown is a warning to the non-banking industry to follow norms in letter and spirit or be prepared to face the wrath of a watchful regulator

BUSINESS

HDFC Bank, others take over 96% haircut in Adani Goodhomes-Radius Estates deal

With the NCLAT upholding the NCLT ruling, this has become the latest case where creditors have been forced to take substantial haircut in bankruptcy cases