BUSINESS

Will the regulator have a rethink on the P2P lending industry?

The biggest problem with the P2P players is that time is not on their side for a course correction. Most of these companies are backed by equity investors who aren’t known for their patience.

BUSINESS

More bad news likely for PSBs from potential agri-loan stress

Recent announcements of farm loan waivers and the likelihood of more in the run-up to elections in the next 18 months could trigger the risk of loan waivers for state-owned banks

BUSINESS

Chart of the Day | Are banks betting too much on renewable energy sector too soon?

Bank lending to renewable energy has galloped in the last two years. There are clear upside risks to this exposure that needs to be closely watched

BUSINESS

Why are young bankers leaving the profession so soon?

Targets are given to bank employees to sell insurance products along with core banking products. Mounting pressure can create havoc as it leads to misselling or forced selling of products

BUSINESS

Banking Central | When times are good, be cautious. Hard days could be looming close

Good times are typiclly followed by tough cycles. Banks had seen a spike in bad loans following the credit boom in the early part of last decade following the global crisis when careless lending crept in.

BUSINESS

Banks are left nearly bald after IBC haircuts; what's the cure?

The recovery track record of banks in the insolvency process has been poor. Losses incurred in corporate lending imply big sacrifices made by shareholders.

BUSINESS

For India’s big banks, small is not beautiful in the NBFC lending market

Data shows banks are now very selective in funding NBFCs; only top-rated NBFCs get loans at relatively lower rates. Borrowers rated AA and below are struggling to access bank credit

BUSINESS

Banking Central | As banks speed up on credit, RBI shifts to lower gear. For a good reason, though

Recent regulatory actions could force banks moderate credit growth this fiscal year. That will help moderate the CD ratio but for banks. But this will come at a cost

BUSINESS

Are Indian MFIs pushing too much credit to the borrower?

There are signs of overheating in some pockets of the industry, signalling build-up of potential stress. It is time for the industry to recall the lessons of the 2010 crisis and do a course correction

BUSINESS

Shifting goal posts on inflation targeting will be unfair to India's poor households

For the average Indian, inflation essentially means prices of most consumed food and vegetable items.

BUSINESS

ULI can make the credit process quicker; the tricky part is recovery

Technology platforms, as envisaged by the RBI, can smoothen the credit process and cut time delays. The difficult part is recovering the small loans

BUSINESS

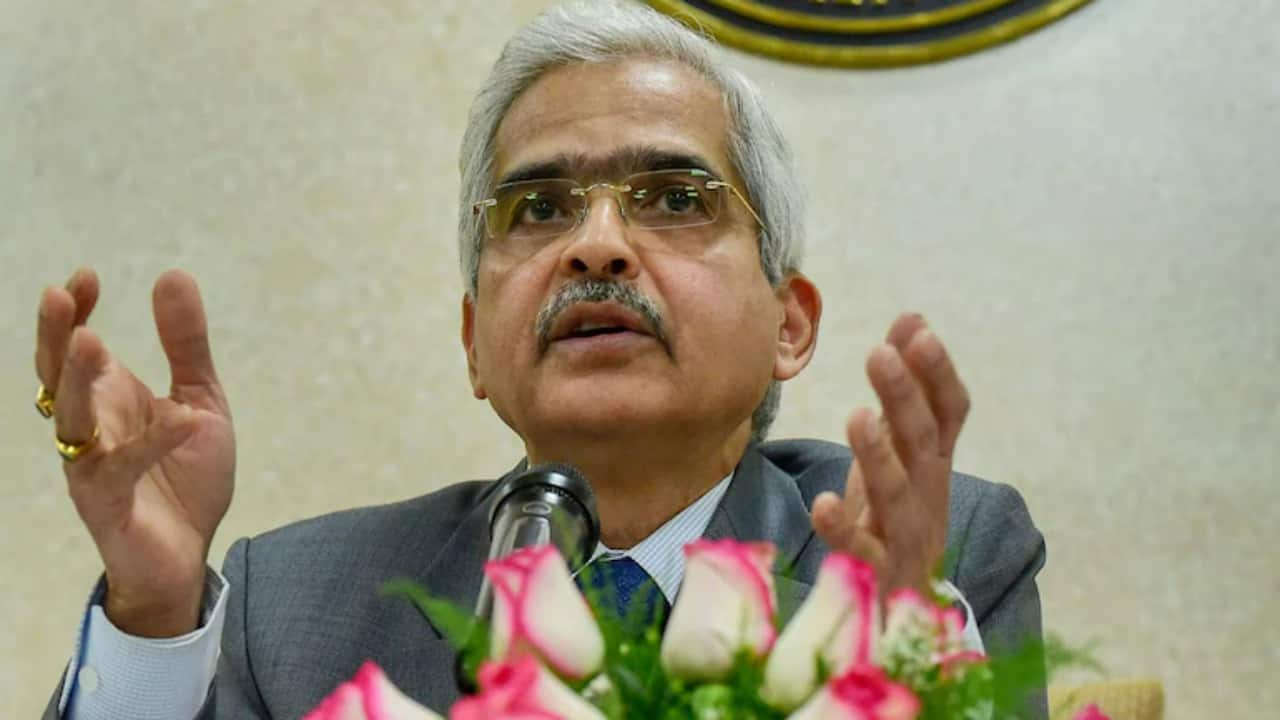

Banking Central | A tough balancing act awaits rate-setters as MPC nears a reshuffle

Although India continued to grow at the fastest rate among its peer economies, there are certain pockets of deep worry. One of the foremost is the issue of rising unemployment

BUSINESS

On real rate debate, the gloves are off in the near-expiry MPC

As both Varma and Goyal argued, holding interest rates too high for too long can hurt economic growth. But Das and Patra warn that lowering the guard on inflation too early too can be a mistake.

BUSINESS

Interview | MPC member Jayanth Varma warns high real interest rates can depress private investment, suppress demand

Varma has been cautioning that keeping interest rates too high for too long can hamper growth

BUSINESS

Moneycontrol Pro Panorama | Fed is hinting at a September rate cut; will Mint Road blink?

In Moneycontrol Pro Panorama's August 22 edition: Kolkata horror warrants a relook at women's safety in workplace, all bank depositors should get full insurance cover, decoding the core inflation pattern, will rollback of lateral entry ensure a win for social justice, and more

BUSINESS

Chart of the Day | What does the core inflation pattern tell us?

The consistent decline in core inflation in the last one and a half years amid the strong growth momentum is bit unusual and may correct going ahead.

BUSINESS

Not only senior citizens, but all bank depositors have the right to full insurance cover

Rising bank failures, especially among the coop banks, have created a trust deficit among depositors. Increasing the insurance cover can help partly address the problem

BUSINESS

Can banks hit the jackpot as private capex heads for Goldilocks zone in FY25?

An article by RBI staff published in the August bulletin projects a significant pick-up in private investments in 2024-25 backed by rising demand and cleaner books of companies, banks. Will banks benefit from this growth?

BUSINESS

Banking Central | Are banks going overboard in lending to commercial real estate?

Commercial real estate loans are attractive bets for banks but can turn risky in a downturn when vacancies soar

BUSINESS

Indian P2P players should learn from Chinese debacle, RBI has just pressed a warning button

Typically, the banking regulator issues mild warnings to the industry before actual clampdown. P2P lenders need to read the signals now

BUSINESS

Last mile of disinflation is an unfinished job for near expiry MPC

While the MPC has managed to bring inflation within the 6% upper band, comfortably landing at the 4% medium-target remains a work in progress

BUSINESS

For banks, cheaper deposits are not easy to come by

Declining CASA ratios are adding to the cost of funds for many banks, thereby forcing them to up lending rates as well to manage margins. The problem may persist going ahead as interest rate differentials persist

BUSINESS

Banking Central | Will banks follow up with deposit rate hikes?

Even though banks have been struggling to raise deposits, data suggests that the deposit accretion has improved in the recent months

BUSINESS

RBI has a case to rethink on the proposed liquidity norms on tech-enabled retail deposits

RBI wants banks to be ‘innovative’ in mobilising deposits even as it is framing a rule that’ll essentially burden banks if they use digital channels to get deposits.