BUSINESS

Moneycontrol Pro Panorama | In the New Year, some old worries persist

In the January 1 edition of Moneycontrol Pro Panorama: For the Indian economy, not all is well at this moment. On the ground there are signs of a growth slowdown. Latest numbers on consumption and loan repayment records suggest a downturn and a deepening stress

BUSINESS

Zooming gold loans, rising defaults: What does this combo tell us about the Indian economy?

If there is rising stress at the bottom of the pyramid, such as in sensitive gold loan and microloan portfolios, the RBI should be worried. It should acknowledge the problem rather than pretending all is well in the economy.

BUSINESS

The 2025 New Year resolutions that will not be made…

It’s not just you and me—there are a few others who also want to share their big resolutions for 2025

BUSINESS

Banking Central | NBFCs may have to live with slower growth in new year

As the smaller NBFCs fail to raise money from the bond market at attractive rates, they are left with only two options - either shrink their credit growth or borrow at a higher rate from banks

BUSINESS

Moneycontrol Pro Panorama | What's in store for banks and savers in 2025?

In today’s edition of Pro Panorama: An infra value bet, the evolution of CRR, the Bengal paradox, what 2025 holds for crypto, life beyond technical analysis and much more

BUSINESS

Chart of the Day | How banks' CRR liability evolved in the flexible inflation targeting era

Data shows that the FIT era freed up funds for banks enabling them to use this for productive lending purposes

BUSINESS

MPC minutes point to pro-growth lobby gaining ground

The arguments by MPC member Nagesh Kumar in favour of a rate cut were based on a pressing need to support the slowing economy with a cut in interest rates. Ram Singh too supported this view.

BUSINESS

Banking Central | Illegal loan sharks in the line of fire, can't escape the net for long

Illegal loan apps have thrived over years leading to a total chaos in the small loan market. It is time to rein in such loan sharks

BUSINESS

Moneycontrol Pro Panorama| When the Fed sneezes, the world catches a cold

December 18 edition of Moneycontrol Pro Panorama: Inflation is a beast that is an expert in the art of deception—it pretends to be tamed for a while giving false comfort, before rising back in a jiffy

BUSINESS

Chart of the Day | A puzzling dichotomy is shaping up between housing prices and bank lending

The House Price Index and home loan growth trends in banks show a divergent trend

BUSINESS

Bank lending to NBFCs has dried up this year; can CRR cut turn the tide?

NBFC funding by banks may not pick up in the foreseeable future despite the liquidity infusion

BUSINESS

Banking Central | Why doves may have a greater say than hawks in Feb MPC meet

The November retail inflation number has made a compelling case for a rate cut in the February monetary policy review

BUSINESS

Will the RBI, under Malhotra, have a rethink on crypto?

The RBI and the government will be making a mistake by ignoring the latest WazirX episode in the Indian crypto market. It signals a larger problem of safety of transactions and lack of security for investor money.

BUSINESS

Moneycontrol Pro Panorama | Trial by fire awaits new RBI governor

For December 11 edition of Moneycontrol Pro Panorama: Banks turn cautious but agriculture loans set to rise, real estate majors flock Mumbai’s redevelopment market, questions on climate finance needs reframing, how Shaktikanta Das would be remembered, and more

BUSINESS

Chart of the Day | Even as banks turn cautious, collateral-free agriculture loans set to increase

Bank lending to agriculture segment grew by just 6.5 percent between March 2024 and October 18 compared with 10.6 percent in the comparable year-ago period as banks slowed lending

BUSINESS

Why the 50 bps CRR cut may not move the needle

If banks don’t respond to the CRR cut by passing on the excess liquidity to the borrowers through cheaper loans, the ball will be back in the RBI’s court to offer a growth stimulus post the disappointing Q2 numbers.

BUSINESS

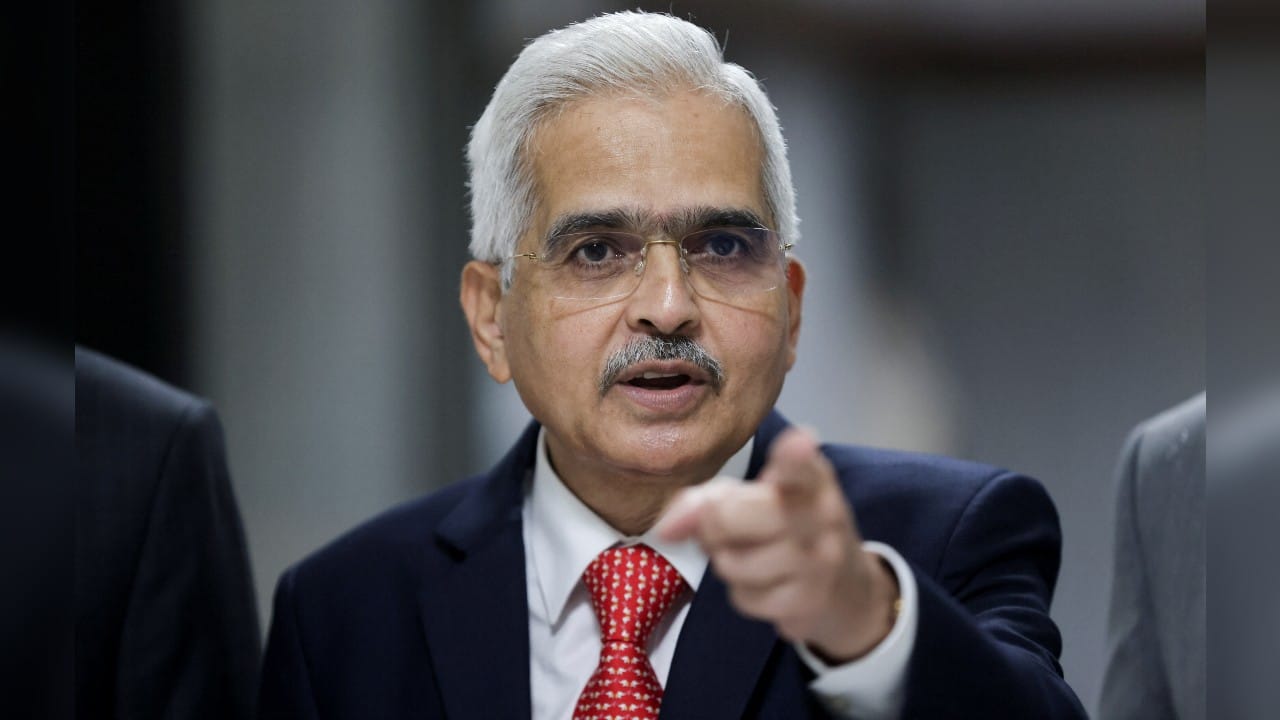

Shaktikanta Das era ends at Mint Road — RBI governor for all seasons

Das’s six years in office saw him steering monetary policy through a pandemic bringing the world down to its knees, a banking crisis roiling the world's largest economy, two major wars and raging inflation.

BUSINESS

Banking Central | If RBI survey holds a clue, MPC is in for a long battle against inflation

Compared to September 2024 round of the survey, somewhat larger share of respondents expects the year ahead price and inflation to increase, mainly due to higher pressures from food items and housing related expenses

BUSINESS

How the MPC just dodged a curve ball on a sticky wicket

A 50 bps CRR cut, and rates on hold is a safe play for the MPC, caught in a growth-inflation conundrum, at this point.

BUSINESS

Moneycontrol Pro Panorama| Rising rate cut calls & winds of reform in India’s financial sector

For December 4 edition of Moneycontrol Pro Panorama: A crucial Banking Law Amendment Bill was passed yesterday, the MPC is starting a critical policy review meeting today, and just a few days ago the insurance sector got a proposal from the government to get more foreign funds.

BUSINESS

Chart of the Day: How GDP, inflation numbers responded to RBI rate actions over years

RBI has been struggling to find the right balance in terms of rate actions. Data suggests growth has taken a hit whenever RBI held rates high for too long

BUSINESS

A CRR cut is more probable this week than a rate cut

The RBI now has a ‘growth’ problem rather than an ‘inflation problem’. It cannot ignore the growth slowdown. At the same time, the MPC needs to time the rate cut carefully

BUSINESS

Banking Central | Microlenders, grow slow, grow steady!

The microfinance industry is likely to face a tough phase in terms of growth and recoveries in 2025 but that is still better compared with a repeat of 2010 crisis triggered by bad lending practices

BUSINESS

Moneycontrol Pro Panorama | The many worries of Shaktikanta Das ahead of MPC December meet

In this November 28 edition of Moneycontrol Pro Panorama: WTO turns to AI to regains its lost glory, Chrome's dominance is unchallenged, fake note trends revealled by RBI data, Sambhal-like incidents put India's security at risk, and more