BUSINESS

SIPs in MC30 top mutual funds deliver consistent returns

Systematic investment plans (SIP) in mutual funds are used to channelise regular investments in mutual funds. A Moneycontrol study shows that equity schemes from MC30 have largely delivered better returns than the category and the benchmark returns over five-year periods.

BUSINESS

Worried about market volatility? Check out these MC30 schemes that provide stability and high growth

Aggressive hybrid funds rebalance their asset allocation based on market conditions. Apart from investing at least 65 percent of equity portion, fund managers allocate the remaining 35 percent into debt and other securities.

BUSINESS

First-time equity investor? Limit your risks with large-cap funds from MC30

Best mutual funds: First-time equity investors who haven’t yet experienced the full gamut of risks in the equity market can dip their feet by investing in a basket of large-cap stocks. These companies are well-established and well-researched companies that come with a track record.

BUSINESS

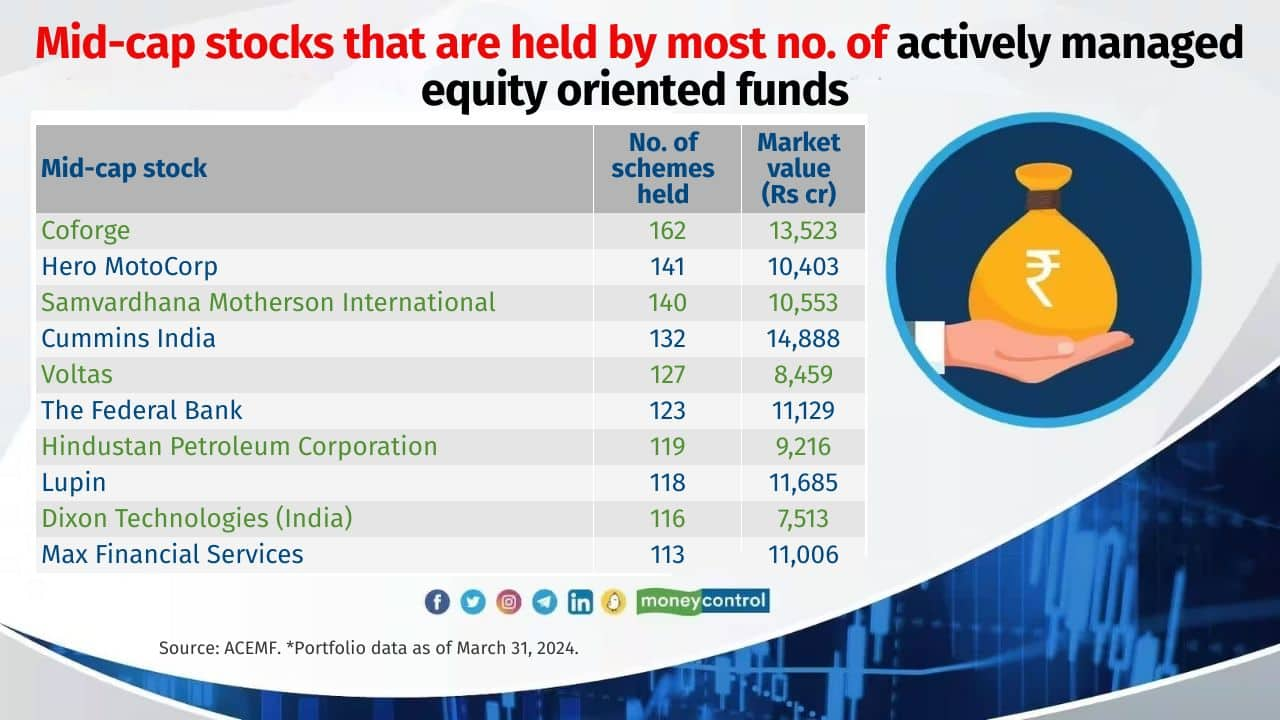

Midcap stocks that find no takers among active fund managers. Check your portfolio

Mid-cap stocks that are part of the portfolio of equity schemes have rewarded the investors. However, companies that lack business sustainability, are buried in debt, do not execute business strategies efficiently, and come with an unattractive valuation, rarely find a place in the portfolio of the actively managed mutual fund schemes.

BUSINESS

The schemes that moved out of MC30 2024 and why

MC 30: Consistently underperforming schemes move out MC30 but that's not the only reason. Sometimes, better and more compelling alternatives prevail.

BUSINESS

Top mutual funds: 3 new schemes that enter Moneycontrol’s sparkling list of investment-worthy funds; MC30

Two equity schemes that are part of a turnaround we’re seeing at one of India’s largest mutual fund houses and a hybrid fund that comes with a strong, long-term pedigree, make it to MC30

BUSINESS

Best mutual funds: 86% of actively-managed schemes outperformed benchmarks in MC30’s 2023 run

Best mutual fund schemes to invest in: MC30- Moneycontrol’s curated list of 30 investment-worthy mutual funds is back. Three new schemes enter MC30 and three among existing ones, exit

BUSINESS

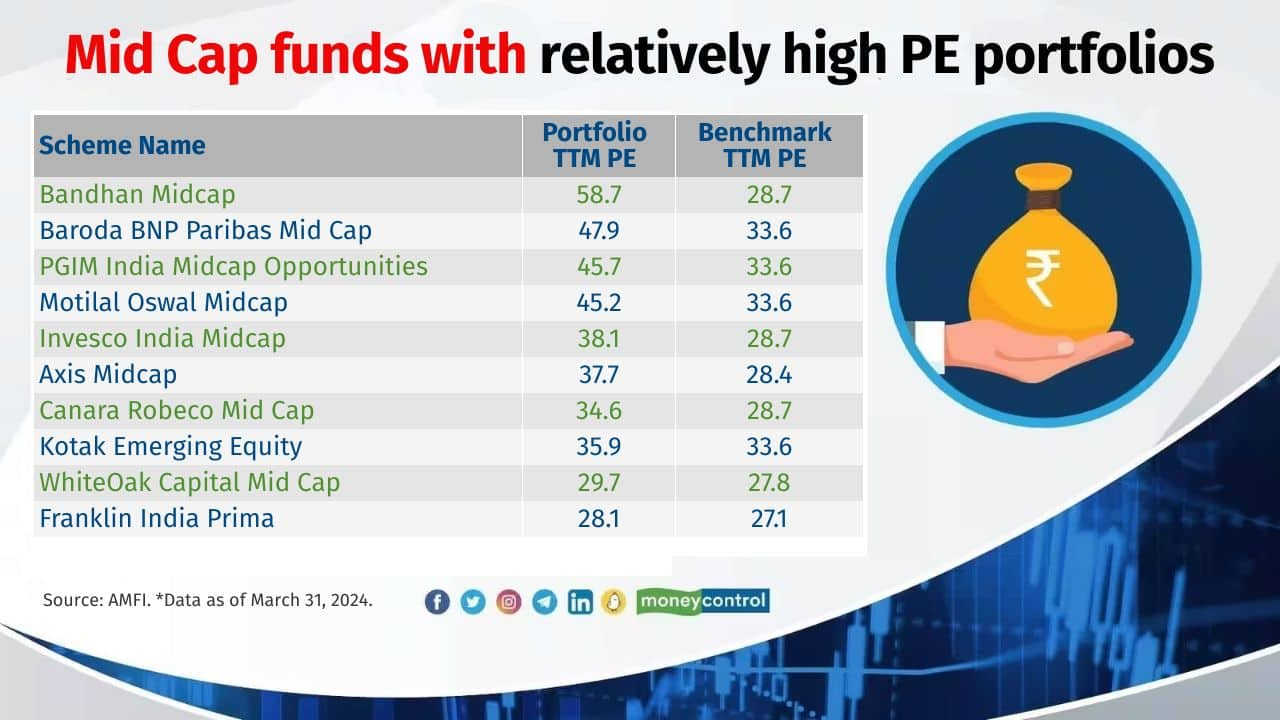

These 15 high-PE stocks make your midcap funds expensive

Companies that have a high growth potential and return on equity command a higher Price-Earning ratio. That isn’t a bad thing, though. High PE might just indicate good future prospects

BUSINESS

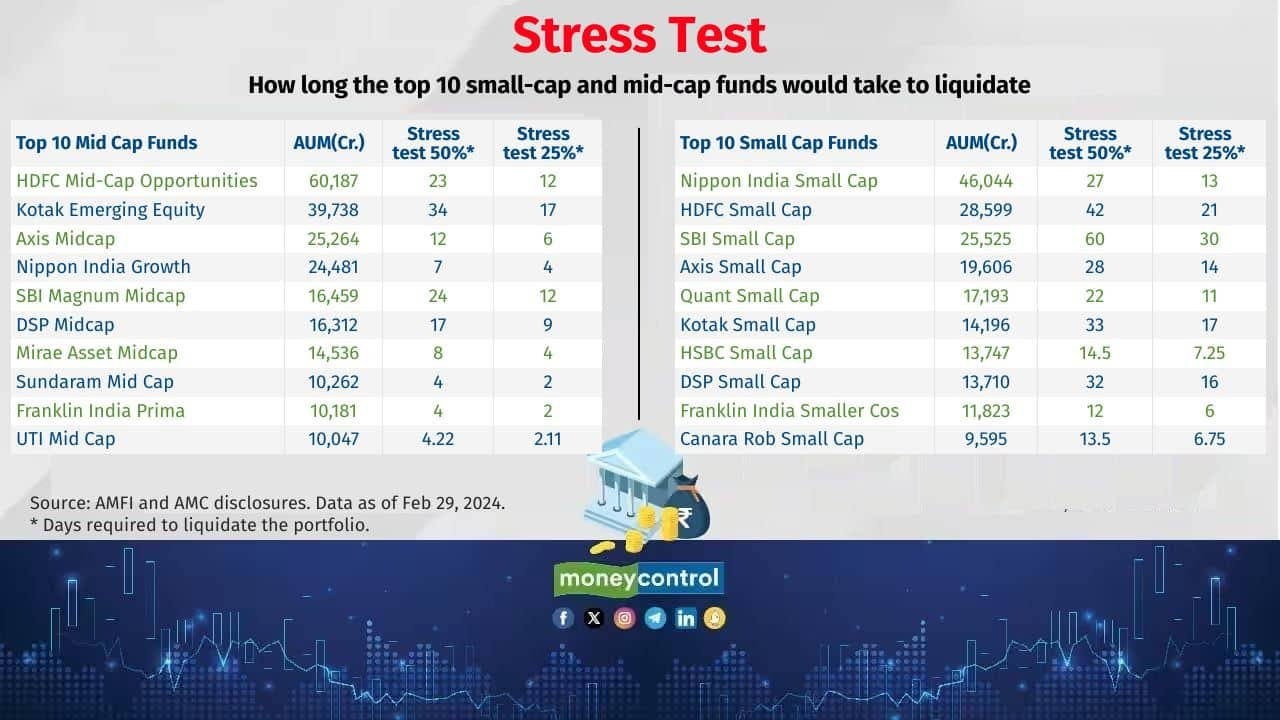

MF stress test impact: Stocks that larger-sized smallcap funds increased exposure in March

The liquidity disclosure requirement is unlikely to impact the portfolio construction of the midcap and smallcap funds. Provided, there's a chance that fund managers may increase their holdings in stocks with higher liquidity to be in a better position to compete within the category

BUSINESS

MF Stress Test Round 2: Have top small-cap funds improved their liquidity positions?

The second round results revealed that small-cap funds would need 13.7 days on an average, to liquidate 50 percent of their portfolios, almost similar to the category average of 14 days that was disclosed a month ago

BUSINESS

MF stress test, round 2: How did the 10 largest midcap funds do?

As per the second-round results, mid-cap funds would need 6.5 days on an average, to liquidate 50 percent of their portfolios, almost similar the category average of 6.6 days that was disclosed a month ago

BUSINESS

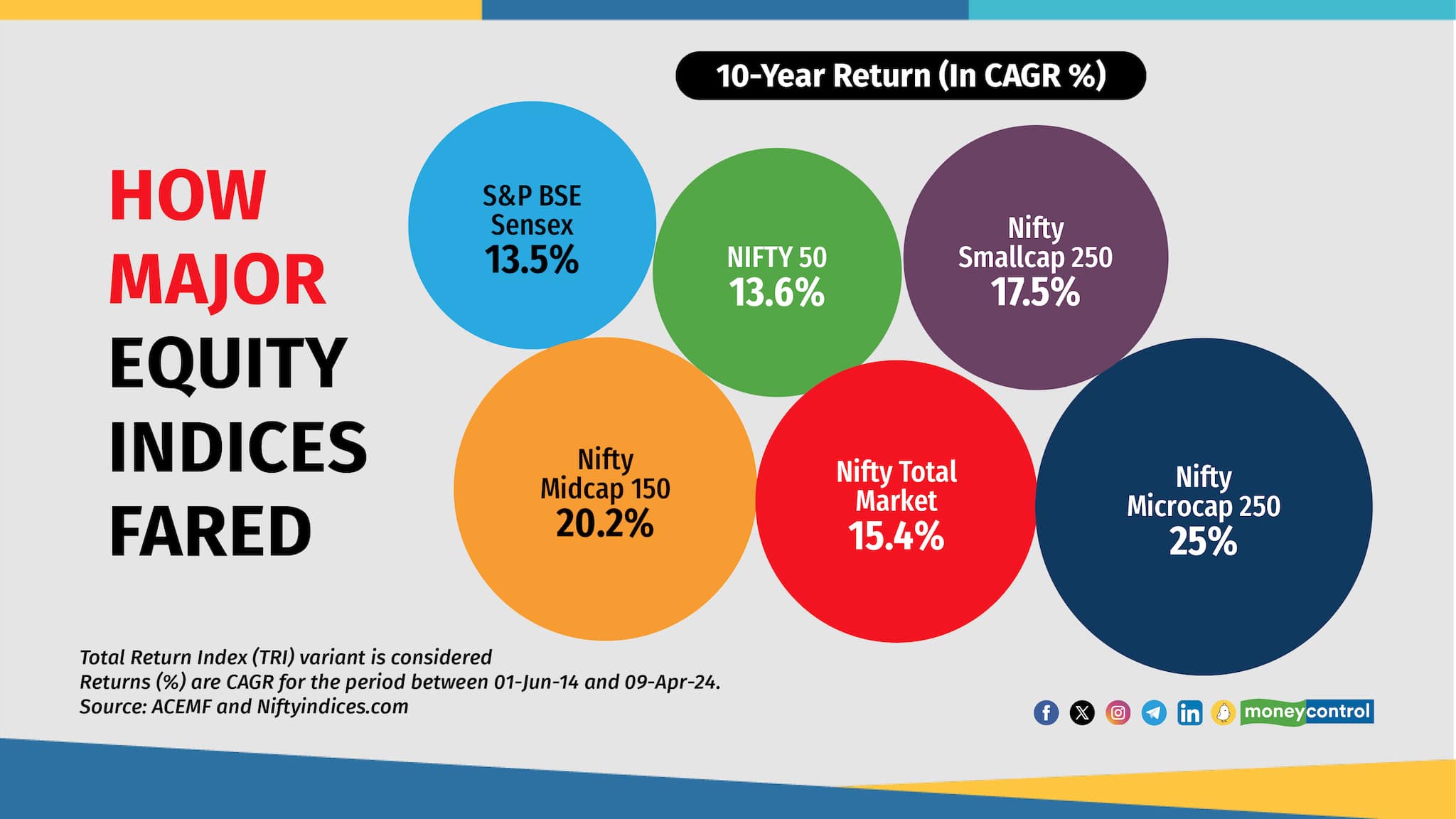

10 years of Modi regime: How mutual funds turned into a must-have investment

The equity market has grown by nearly 14 percent on a 10-year basis, commemorating Narendra Modi-led NDA government. That brought retail investors into mutual funds by the drove as equity funds benefitted

BUSINESS

Sectors that PMS expect big returns from in 2024

From financial services to healthcare and chemicals, here are top sectors that PMS fund managers believe have promising prospects

BUSINESS

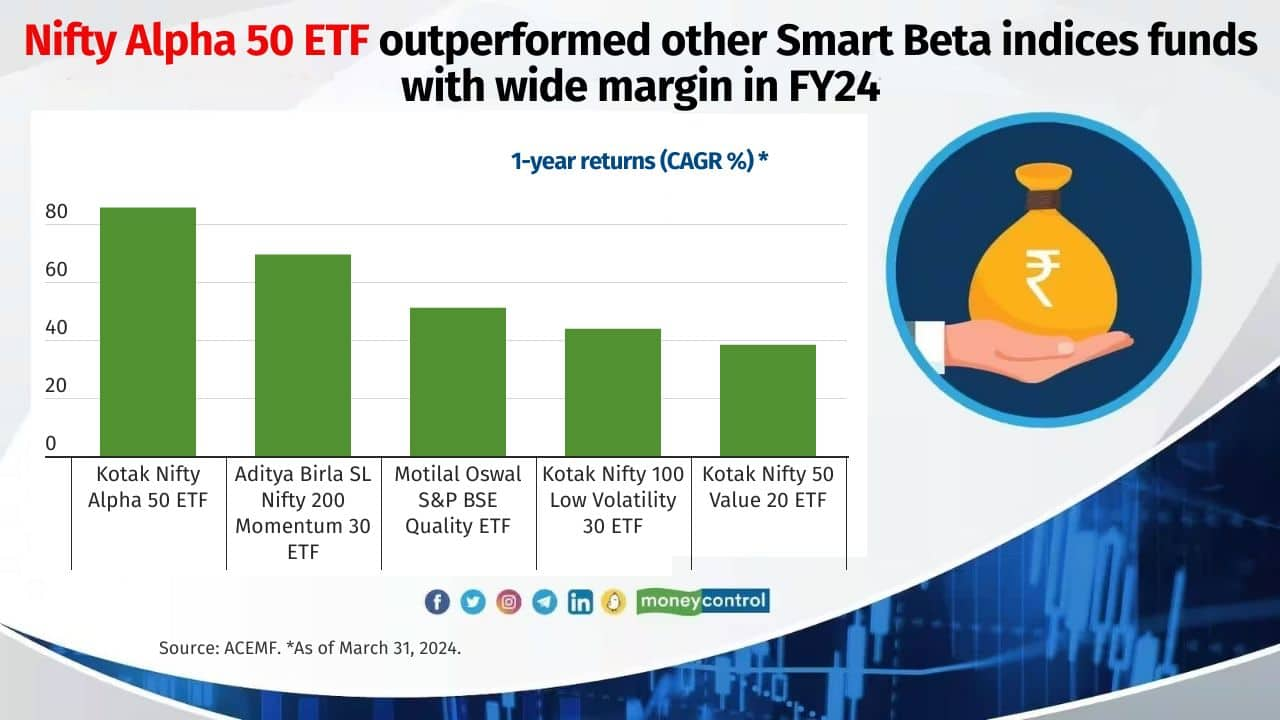

This high alpha strategy fund topped charts in FY24: Here are the Top 10 stocks

Kotak Nifty Alpha 50 ETF tracks ‘Nifty Alpha 50 index’, which measures the performance of the top 50 stocks in terms of higher alpha chosen from the universe of 300 companies

BUSINESS

Gold rewards investors. But don’t go overboard, it’s just an asset allocator

One need not go overboard on gold for getting superlative returns. Gold is used as a hedge against volatility in stock markets and uncertainty across the world.

BUSINESS

The winners’ club: Here’s the list of the top performing equity mutual funds across categories in 2023-24

Equity mutual fund schemes that had relatively higher exposures to select PSU, finance, power, construction, defence, and automobiles stocks delivered better returns in FY24

BUSINESS

10 mid-cap gems that children-oriented MFs love to hold for the long term

Children-oriented funds are open-ended schemes with a lock-in period of at least five years or till the time the child attains the age of maturity, whichever is earlier. The compulsory lock-in provides fund managers a leeway to buy quality mid-cap stocks and hold for the long term

BUSINESS

These large-cap multibaggers rewarded MF investors up to 400% in last one year

Large-cap stocks tend to generate relatively lower returns compared to mid-cap and small-cap counterparts over long run, but many can be multibaggers if you pick them after due diligence.

BUSINESS

Mutual funds call for easing RBI's limit on overseas investments amid growing opportunities

As capital market regulator, SEBI asks mutual funds to suspend inflows into overseas ETFs, top industry leaders say with forex reserves at a comfortable level, it is time for RBI to ease the investment limits.

BUSINESS

MF stress test: Check whether your smallcap fund has these illiquid stocks

SEBI asks fund houses to ignore the least 20% illiquid stocks while assessing liquidity. The idea is to let microcaps- the tiniest of the smallcaps- to grow unfettered as they could turn into tomorrow’s multibaggers. In the first such attempt, Moneycontrol identifies these 20% stocks.

BUSINESS

Silver lining from marooned markets: Midcap stocks that turned the latest MF favourites

Frothy market valuation on midcap and smallcap segments has been a concern for the regulator and experts. However, market heightened valuation and volatility have not been a constraint parameter for active fund managers in adding quality midcap stocks to their portfolio

BUSINESS

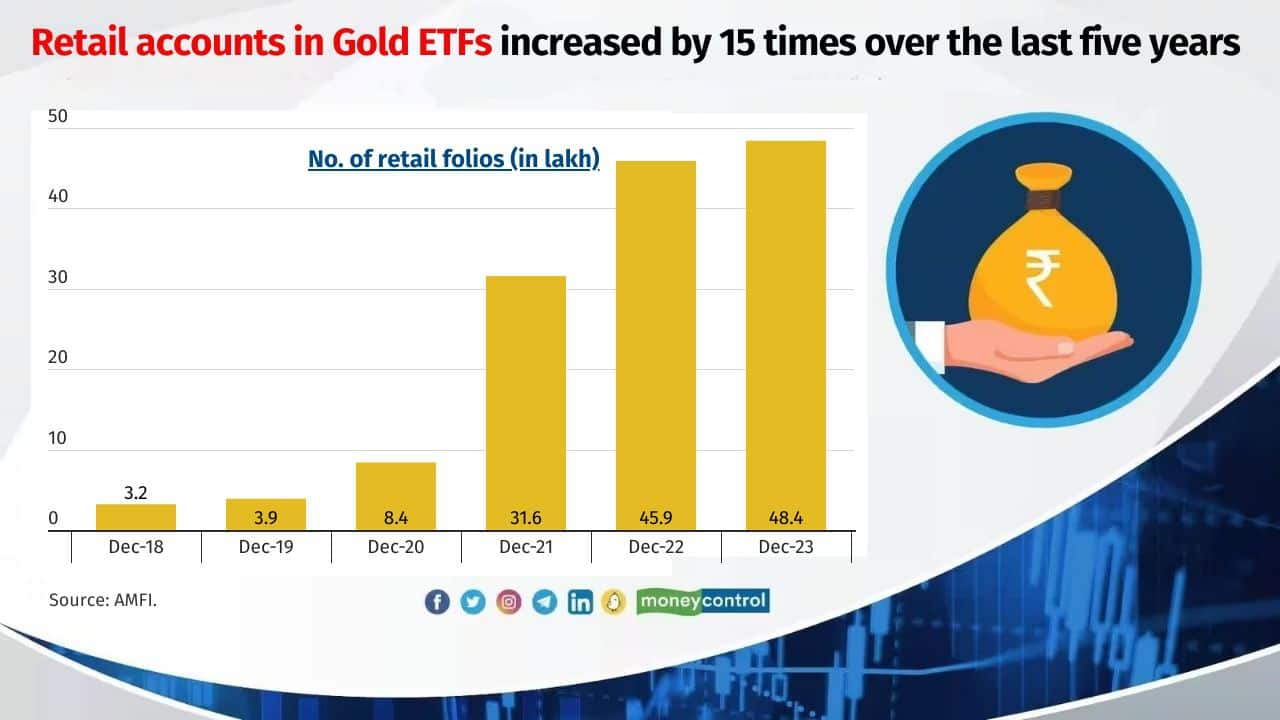

Explained in charts: The spectacular rise of Gold ETFs and what lies ahead

Gold prices crossed a remarkable milestone by hitting a lifetime high on March 4. Analysts will be keenly watching gold, which is already riding high on the back of geopolitical tensions, in the months ahead as the US looks to cut interest rates.

BUSINESS

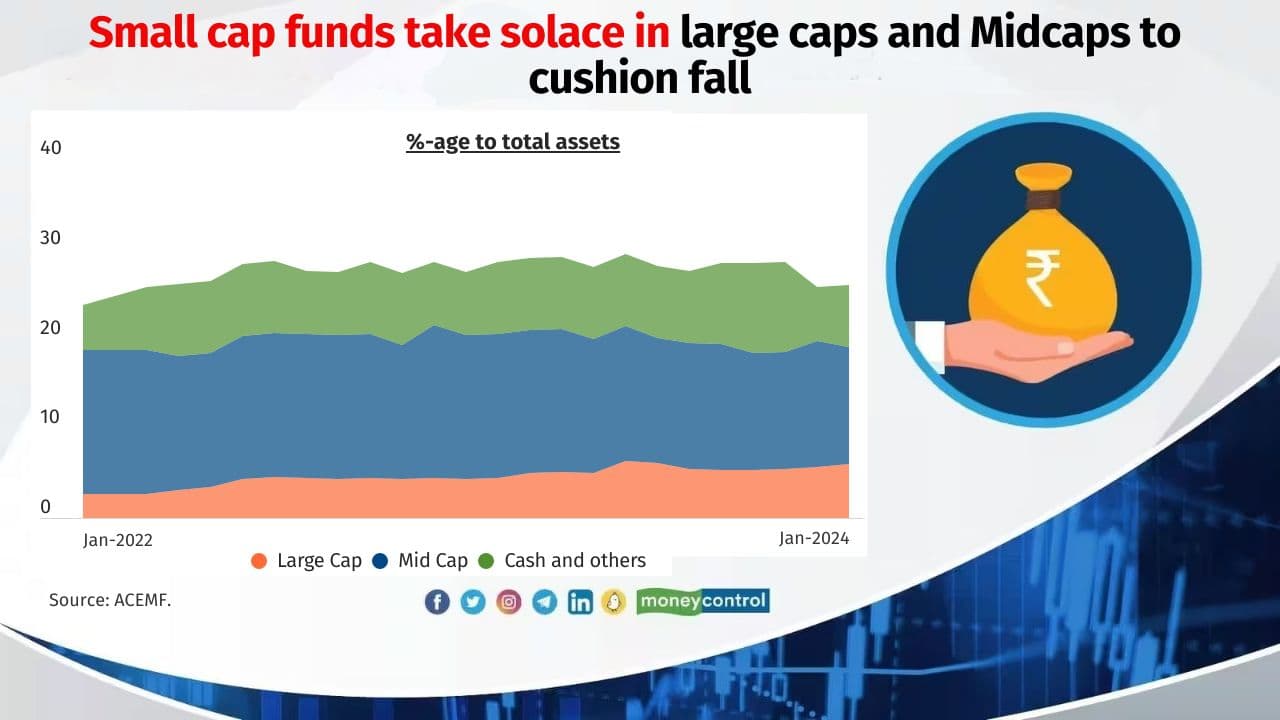

Smallcap funds bet on these largecaps to manage liquidity risk

Small-cap funds have been under the spotlight due to rising market valuations. SEBI has asked fund houses to take measures to de-risk their portfolios. One such method that fund houses use is to add large-cap stocks. Data shows that allocation to largecap stocks by smallcap funds has more than doubled over the last two years

BUSINESS

Microcap multibagger pharma stocks that MFs added lately

Active fund managers are preferably adding mid-, small- and micro- cap segment of pharmaceutical and healthcare businesses