BUSINESS

Crypto selloff resumes as post-Fed mood sours

Ether, down as much as 8.3% on Thursday to trade around $1,080, is facing a tougher road than most

BUSINESS

Edtech unicorn Upgrad doubles valuation to $2.25 billion

India’s UpGrad Education Pvt, founded by Ronnie Screwvala, increased its valuation to $2.25 billion in the round that included billionaire James Murdoch’s Lupa Systems LLC and US testing and assessment provider Educational Testing Service, according to a person familiar with the deal.

BUSINESS

Morgan Stanley’s Asia CEO Gokul Laroia joins most senior global committee

Gokul Laroia’s seat at the table of the firm’s most senior management group is a reflection of his strengths as a banker and leader, CEO James Gorman said in a memo that was seen by Bloomberg News and confirmed by a Hong Kong-based spokesman.

BUSINESS

Amazon pulled the plug on cricket, still believes in India

Securing digital streaming rights to the cricket tournament would be a huge coup, potentially luring hundreds of millions of viewers to Amazon.

BUSINESS

Airbus A350 jet deal on horizon for Tata-owned Air India

The airline may introduce the A350 by the first quarter of 2023, according to a letter sent to senior cockpit crew and seen by Bloomberg News. Pilots must respond to the offer by June 20, and those who accept will be ineligible for training on another aircraft type for two years, the letter said.

BUSINESS

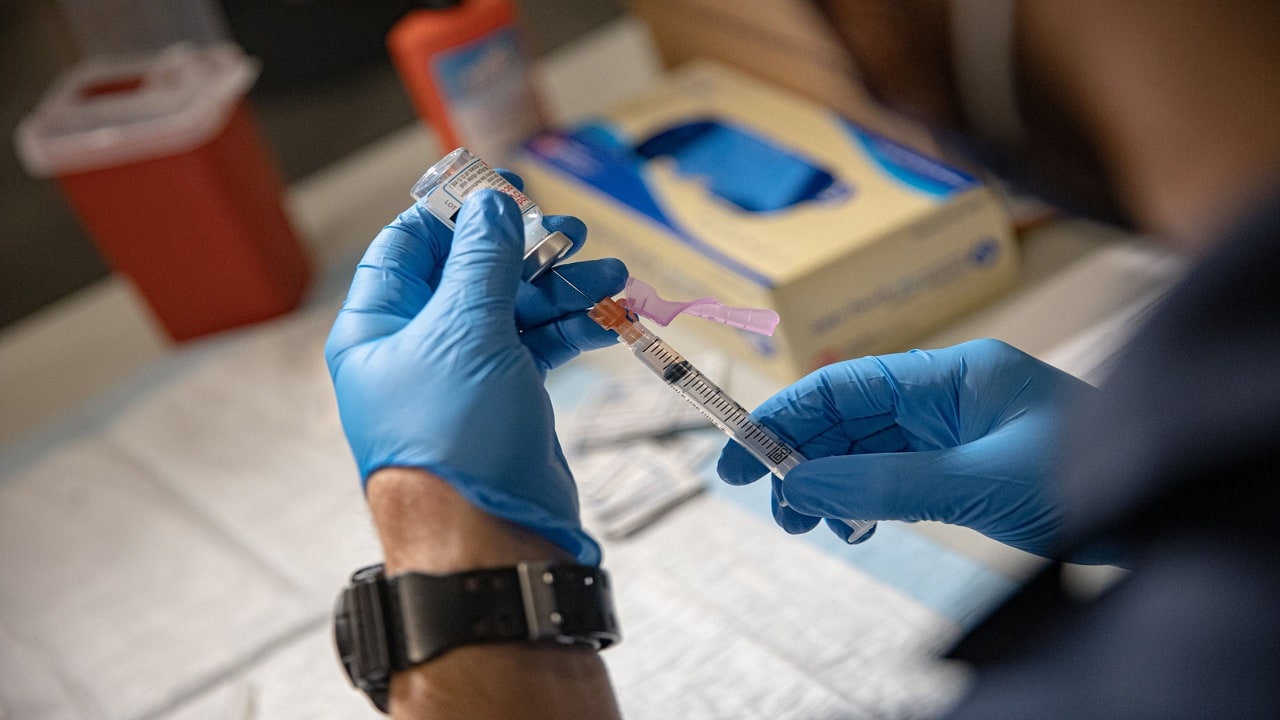

FDA advisers back Covid shots for kids under 5

The 21-member committee advising the Food and Drug Administration voted unanimously in favor of clearance for Pfizer’s three-dose vaccine for youngsters ages six months through 4 years.

BUSINESS

Recession call gets louder after Fed rate hike

The Fed hiked its policy rate by 75 basis points Wednesday to a range of 1.5% to 1.75%, as officials intensified their battle against inflation that’s remained stubbornly high.

BUSINESS

Fed hikes 75 basis points; Jerome Powell says 75 or 50 likely in July

Slammed by critics for not anticipating the fastest price gains in four decades and then for being too slow to respond, Powell and colleagues on Wednesday intensified their effort to cool prices by lifting the target range for the federal funds rate to 1.5% to 1.75%.

CRYPTOCURRENCY

Bitcoin veterans keeping their eyes on $19,511

Cryptocurrencies have tumbled this year, with prices of some digital assets falling as much as 90% as the Federal Reserve raises interest rates to combat rampant inflation.

BUSINESS

Apple’s $2 Trillion market valuation on shaky ground

Apple Inc.’s run as a $3 trillion stock proved fleeting. Now its grip on a $2 trillion market value is looking wobbly, too.

WORLD

Sweden’s faux neutrality couldn’t survive Putin’s Ukraine war

Life can be pretty sweet for a non-aligned state as long as a superpower like the US guarantees its survival.

BUSINESS

Bill Gates blasts crypto, NFTs as based on ‘greater-fool’ theory

“Obviously, expensive digital images of monkeys are going to improve the world immensely,” Gates said sarcastically while speaking at an event in Berkeley, California hosted by TechCrunch. He said he’s neither long nor short the asset class.

BUSINESS

Oracle jumps most in six months as cloud sales show momentum

Investors sent the stock up more than 10% to $70.72 at the close Tuesday in New York, the biggest single-day increase since December. The move came just a day after the shares hit a 16-month low.

BUSINESS

Joe Biden to unveil plan for next pandemic

A senior administration official, speaking under the condition of anonymity as the strategy has not yet been released, said that the government has paid close attention to research that suggests there’s a 50/50 chance of another Covid-like pandemic — or one that is more deadly — over the next 25 years.

BUSINESS

Pre-FOMC volatility at decade high, rush to exit on Wall Street

Particularly among managers who premise strategies on quantitative signals, exposure to stocks and other risky assets has been cut to the bone. Weeks of selling has pushed systemic positioning as measured by Deutsche Bank AG two standard deviations below average levels in data starting in 2010, among other examples.

BUSINESS

Fed mulls ‘game changer’ to jolt inflation: Decision day guide

The Federal Open Market Committee is expected to raise rates 75 basis points by Wall Street firms including Goldman Sachs Group Inc., JPMorgan Chase & Co. and Barclays Plc, who cite rising inflation expectations among Americans in looking for the largest increase in nearly three decades.

BUSINESS

Stagflation fears surge and ‘sentiment is dire’ in BofA survey

Global profit expectations also dropped to 2008 levels, with BofA strategists noting that prior troughs in earnings expectations occurred during other major Wall Street crises, such as the Lehman Brothers bankruptcy and the bursting of the dotcom bubble.

WORLD

World’s richest have lost $1.4 trillion in 2022 after rapid gains

It's a stark contrast to last year, when soaring markets boosted the world’s population of high-net-worth individuals by about 8%, including 13% in North America, according to a Capgemini World Wealth report released Tuesday.

BUSINESS

Drawdown fuels panic, S&P 500 could slip further

The S&P 500 has fallen nearly 9% in three days, a bruising stretch that has left virtually nothing unscathed, including energy shares, the year’s best-performing group.

BUSINESS

‘Bear-Market Blues’ test mettle of most devout Bitcoin holders

Bitcoin, down about 20% this week, fell to as low as $21,932 on Tuesday, putting it squarely below the average investor cost base of $23,500, according to UBS. That means prices have declined enough to test even long-term holders, who up until now in the 2022 drawdown were largely in the green with their investments.

BUSINESS

JPMorgan’s Marko Kolanovic says US will avoid recession

“Friday’s strong CPI print that led to a surge in yields, along with the sell-off in crypto over the weekend, are weighing on investor sentiment and driving the market lower,” Kolanovic and his team wrote in a note to clients on Monday.

BUSINESS

Musk warns of Tesla’s ‘very tough quarter’ in employee message

Tesla Inc. has had a “very tough quarter” as it struggles with supply-chain snags, Chief Executive Officer Elon Musk warned in an internal memo, imploring workers to help get the electric-vehicle maker back on track.

BUSINESS

Goldman and Morgan Stanley say stocks don’t fully reflect risks

Goldman Sachs Group Inc. strategists led by David J. Kostin said that US earnings estimates are still too high and expect them to be revised downwards even further.

BUSINESS

At $17 Billion Loss, LIC IPO Among Top Asia Wealth Losers

The drop puts it just behind South Korea’s LG Energy Solution Ltd., which saw a more than 30% peak-to-trough decline in its share price after an initial spike on debut.