BUSINESS

Should the MPC give one more rate hike for the road before resting?

The MPC faces a tough choice between staying the course and pausing a bit to take stock and then making the next move

BUSINESS

Fusion Micro Finance expects consistent margin expansion, says MD Sachdev

Fusion Micro Finance has made more than adequate provisioning for stress, says Devesh Sachdev

BUSINESS

Life insurers get wiggle room on spends, but don’t expect commissions to surge

The new EoM rules, and the bunch of relaxations on capital and distribution tie-ups that IRDA has announced, should explain the surge in the shares of listed life insurers.

BUSINESS

India’s small insurers get the wings to grow as IRDA eases rules

IRDA’s relaxations could see competition heating up in the insurance space in the coming years

BUSINESS

UTI AMC stake sale key for PNB’s growth, but bank needs more capital

At November 25 market price, PNB’s 15 percent stake in the AMC will be worth about Rs 1,376 crore. Analysts point out that PNB has fallen short of peers when it comes to improvement in asset quality. For the July-September quarter of FY23, the bank reported a net profit of Rs 410 crore, which was lower than Street estimates.

EARNINGS

Sensex@all-time high: Buffett smell test shows Indian equities fairly valued amid frothy global markets

However, the situation could sour if exports drop or there is a flight of capital due to a narrowing rate gap between the US and India, or global oil prices gallop.

BUSINESS

Budget 2023: Wishlist of markets has a tax-heavy logic

Market participants said there was a need to harmonise tax rules on different financial products.

BUSINESS

LIC: Can the insurance whale put up a dolphin show?

LIC is serious about getting its growth mojo back and the 2.8-percentage-point market share gain during the quarter is a good start. But the big question is whether this is enough for investors who picked up its stock at the IPO to finally get any bang for their buck

BUSINESS

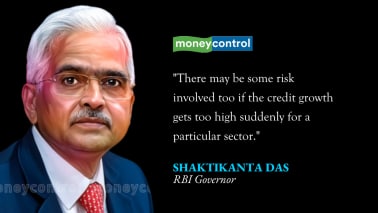

Riding the credit boom won’t be easy for PSU banks

Public sector bank shares are in demand, rising by 28 percent in a month. Investors are betting they will ride the anticipated credit boom

BUSINESS

SBI: Is the elephant dancing on a tin can?

Growth in lending means the bank will need capital, which analysts say is the next stage that is critical for a rerating of the stock.

BUSINESS

Best asset quality of banks hides some risks; the Street should notice

Mere headline numbers do not tell the complete story. What is interesting is how banks have brought down their dud loans. Read on

BUSINESS

Five key trends from Q2 earnings of banks

Most banks saw faster loan growth, a reduction in stressed assets and a rise in profits. Though public sector lenders reported the biggest fall in bad loan stock on a YoY basis, most still have bad loans in excess of 5 percent of their loan book

BUSINESS

RBI-EU standoff will hit markets, regulators must talk to each other

If the stand-off continues, European banks operating in India would be forced to halt transactions in the domestic markets

BUSINESS

LIC Housing Finance must fix margins as earnings cuts loom

Analysts believe that a 10-15 percent erosion in earnings can be seen for the current year. Morgan Stanley noted that most metrics were way below its expectations and has kept an underweight rating on the stock.

BUSINESS

As forex trading volume zooms, these currencies make their presence felt

The US dollar continues to reign supreme but some currencies have defied gravity when it comes to forex trading volume in the past three months. On the flipside, currencies such as Russian rouble, Turkish lira and Argentinian peso have fallen off a cliff.

BUSINESS

Doves, hawks and the Catch 22 in monetary policy

While the RBI members of the Monetary Policy Committee are all for further tightening, two outside members---Ashima Goyal and JR Varma—believe it’s time to ease up on tightening policy

MARKETS

The world is selling US treasuries and that is bad for the RBI

The RBI is exposed to the double whammy of valuation risk due to the dollar's rise, as well as interest rate risk from the rise in bond yields

BUSINESS

NBFC Q2 Preview: Loan growth a bright spot, margins may bother

NBFCs may report double-digit loan growth with housing finance companies and consumer finance firms such as Bajaj Finance showing more than 20 percent growth. Net profit growth may decelerate owing to a high base for most finance firms.

BUSINESS

Banking Q2 Preview | All-round profit growth likely; deposits to be the differentiator

As credit growth surges, banks that have a larger portion of low-cost current and savings accounts would be clear winners amid tightening liquidity.

BUSINESS

RBI takes its first steps on digital currency, but is it really a giant leap for finance?

The RBI has addressed most of the misgivings about the Central bank Digital Currency (CBDC) in its concept note, but it doesn’t make a compelling case why it’s needed

BUSINESS

SEBI’s axe on Brickwork should keep rating companies in line

The regulator’s unprecedented action of shutting down Brickwork suggests sharper oversight and may help the debt market trust rating companies a little more than before.

BUSINESS

As bank stocks steal the show, NBFCs must offer more

Cost of borrowing and asset quality have been the checks on the NBFC rally fuelled by growth prospects of the lenders. The second quarter performance will determine whether the rally in NBFCs has more legs to it.

BUSINESS

India’s bonds will have to wait longer for global index inclusion

Both JP Morgan and FTSE Russell have retained Indian bonds under their watchlist for potential index inclusion.

BUSINESS

Does IndusInd Bank deserve its valuation boost? Yes, but conditions apply

While loan growth may have been impressive, investors should also look at asset quality when the bank details its quarterly performance this month.