BUSINESS

Declining asset turnover dragging down India Inc’s RoE: DSP Netra report

DSP Netra’s latest report suggests the weakness stems from declining asset turnover. In the 2003–07 cycle, for instance, the report notes that companies generated nearly Rs 150 in sales for every Rs 100 of assets. Today, that figure has slipped to Rs 120–130.

BUSINESS

GST Windfall: Where fund managers are buying, where they’re bailing

Tax cuts likely to spur demand in cars, cement and durables, but stretched valuations keep fund managers selective

BUSINESS

India’s share in global market capitalisation weighed down by tariffs, valuations and outflows

India continues to rank among the top ten contributors to global equity wealth, with these leading economies collectively accounting for 82.8 percent of worldwide market capitalization.

BUSINESS

Silver FoFs emerge top performers, outpace equity, hybrid, debt-oriented FoFs

FoFs invest in other mutual funds or ETFs rather than directly in stocks or bonds. Silver FoFs, for example, invest in silver ETFs, which hold physical silver. This structure provides diversification and convenience, with only a small additional cost.

BUSINESS

Gold, silver ETFs surge on hopes of Fed rate cut; momentum likely to continue amid festival season

Among gold ETFs, Nippon India Gold BeES rose 1.49 percent to Rs 86.61, while HDFC Gold ETF advanced 1.59 percent to Rs 89.43. SBI Gold ETF and ICICI Prudential Gold ETF gained 1.67 percent and 1.77 percent, respectively.

BUSINESS

Union Mutual Fund launches All Cap FoF, says first SIF product coming in November

Nair explained that the Equity All Cap Active FOF is a product designed to simplify equity investing by dynamically allocating across large-cap, mid-cap, and small-cap Union MF equity schemes.

MARKETS

MF distributor growth in FY25: NJ Indiainvest tops with Rs 2,608 cr in gross commissions, SBI boasts of largest AUM

The mutual fund industry saw continued growth in FY25. As of July 31, total AUM reached Rs 75.36 lakh crore, up 21.6 percent from Rs 61.98 lakh crore in July 2024

BUSINESS

Real estate stocks show steady performance, yet mutual funds remain wary

Companies such as Sobha, Raymond, and Prestige Estates are trading significantly above their 10-year historical averages, suggesting either overvaluation or growth expectations already priced in

BUSINESS

Amidst rally, US tech stocks continue to find favour in Indian MF portfolios

In July, the value of Indian mutual funds’ foreign equity holdings rose on average by roughly 6.4 percent to Rs 51,705.99 crore.

BUSINESS

What to watch for in Reliance Industries’ 48th AGM?

With nearly 44 lakh shareholders, the AGM is expected to see announcements that could set the tone for RIL’s next phase of growth across digital, retail, and energy businesses.

BUSINESS

Under-30 investor share slips marginally, but continue to drive fresh market participation

Data from the latest NSE Market Pulse report shows the under-30 group saw a decline from 39.5 percent in March. This marks the first dip after several years of steady growth, during which the segment rose from 22.6 percent in March 2019 to nearly 40 percent by March 2024.

BUSINESS

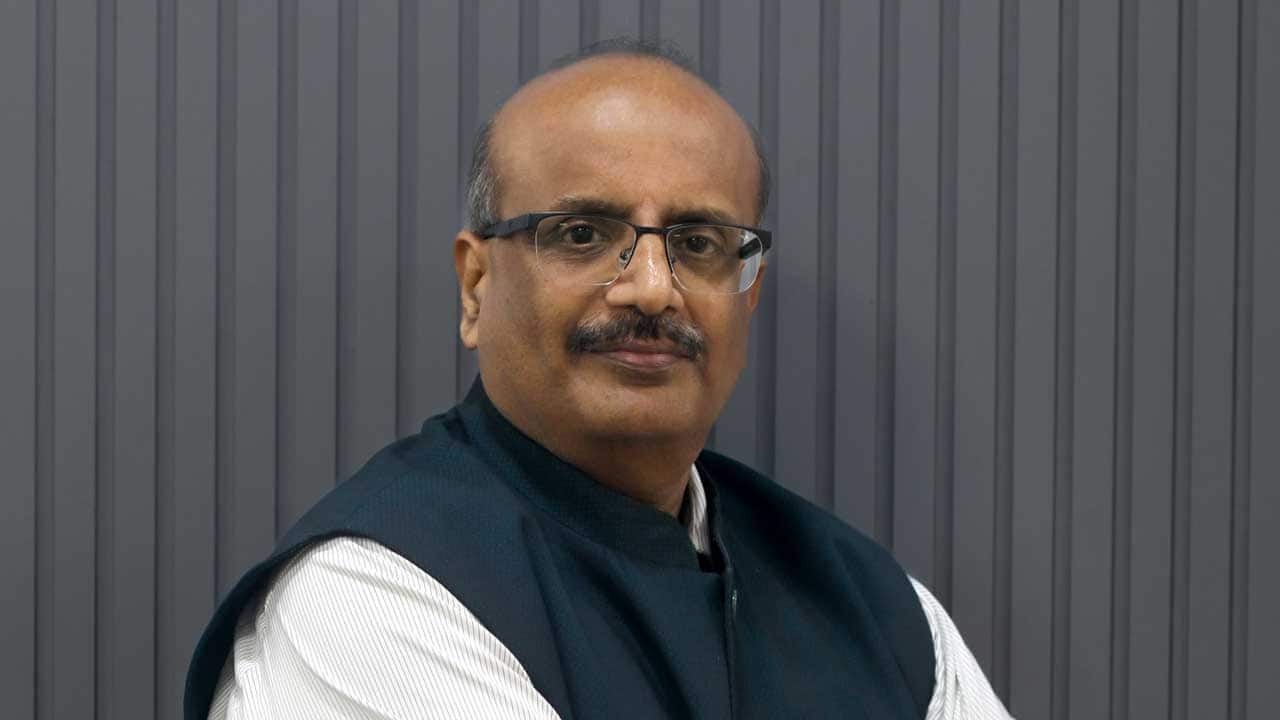

True benchmark for funds is not AUM alone, but trust and management: Sebi Chairman at AMFI event

To drive inclusivity, Sebi is working on incentives for distributors to bring first-time investors from B30 cities and additional incentives to encourage women investors. “Financial inclusion will remain incomplete unless women are equally represented,” Tuhin Kanta said.

BUSINESS

Mutual funds boost money market bet through TREPS allocations to protect returns from volatility

The use of TREPS is becoming increasingly widespread as a means to hold cash positions. As per PrimeMFDatabase, 89.71 percent of equity schemes had exposure to cash equivalents like TREPS, CBLO (Collateralized Borrowing and Lending Obligation), or reverse repos in July. In just two months, 18 additional equity schemes have begun using these instruments to manage cash positions.

BUSINESS

We need to go deeper, district by district as financial penetration remains shallow, says AMFI chief Venkat Chalasani

According to AMFI data, only 18% of total mutual fund AUM comes from B-30 locations, and even among individual investors, just 27.4% of assets originate outside the top 30 cities.

BUSINESS

PSU majors drive Q1FY26 defence earnings in a soft quarter but analysts continue to flag high valuations

BUSINESS

Power posted a mixed quarter after early monsoon cut demand, but here’s why hopes of a recovery ride high

Margins in coal and regulated businesses slipped on lower incentives while renewable margins improved on better PLF and cost control.

BUSINESS

Indian mutual funds continue global big tech buying spree in July

According to Prime MF Database, the combined value of the top foreign stocks bought by funds rose by over Rs 2,900 crore, with most of the gains concentrated in mega-cap US tech names. HDFC Top 100 Fund led the way, adding 10,500 shares of Alphabet (worth Rs 300 crore), 4,200 shares of Microsoft (Rs 150 crore), and 3,800 shares of Amazon (Rs 120 crore). ICICI Prudential US Bluechip Equity Fund added 8,990 shares of Alphabet (Rs 280 crore) and 5,000 shares of Nvidia (Rs 90 crore).

BUSINESS

Not soliciting sales in US amid tariffs: Vikram Solar MD

The comment comes as the revenue share from US exports drastically reduced to 0.96 per cent of the total revenue in fiscal 2025, as compared to 61.1 per cent in fiscal 2024.

BUSINESS

With support from govt, increased sales, we see potential for PAT to multiply in FY26: Vikram Solar CMD

The public issue for the solar manufacturer will open next week on August 19, with the public subscription open till August 21.

BUSINESS

Thematic funds surge on NFO wave but can the momentum last? Experts advise caution

According to experts, the spike was primarily driven by a rush of new fund offers (NFOs) promising exposure to niche sectors, innovation themes and factor-based strategies.

BUSINESS

Key highlights of MF flows in July: Record equity inflows, Rs 9,000 cr in NFOs, SIPs on record-breaking spree

Systematic investment plan (SIP) activity reached fresh records, with monthly contributions at Rs 28,464 crore, up 4.3 percent over June’s Rs 27,276 crore and 22 percent higher than Rs 23,332 crore in July 2024.

BUSINESS

AMFI July data: SIP flows increase to all-time high of Rs 28,464 crore; SIP stoppage ratio at 63%

The number of SIP accounts at the end of July stood at 9.45 crore, up from 9.19 crore in June, with 68.69 lakh new SIP registrations in the month, while 43.04 lakh accounts were closed or matured.

BUSINESS

Nearly 750 stocks crash over 50% from 52-week highs; small caps bear maximum brunt, financials, infra lead losses

Of the 743 companies, more than 82 percent or 614 entities are small caps. Mid-caps account for 95 companies, while 34 large-cap stocks, typically considered safer bets, have also shed more than half their value.

BUSINESS

DSP MF launches India’s first passive Flexi Cap fund: Here's what differentiates it from active fund

The fund is based on the Nifty500 Flexicap Quality 30 Index, developed in partnership with NSE. The index combines quality stock selection with flexible allocation across market caps.