BUSINESS

A for artificial intelligence, B for base effect: The A-Z of Q3 earnings season

While some analysts and investors are still digesting the data and reading between the lines, here is a handy summary of the key trends which shaped India Inc’s Q3 show.

BUSINESS

Q3 review: Banks cash in on robust loan demand but margin woes weigh

While private banks’ domestic loan growth was faster than their public-sector peers, PSU lenders drove the asset quality improvement with a declining slippage ratio

EARNINGS

Q3 earnings: Cyclicals drive show amid margin boost; consumer staples in hot water

A key trend in Q3 was the K-shaped recovery in the economy – robust demand in urban markets but continuing sluggishness in rural India.

EARNINGS

Analyst call tracker: HUL, Asian Paints among struggling giants in consumption space

One is India’s biggest FMCG company, the other is the country’s largest paints firm. Both wallow in the list of companies with the most downgrades by analysts over the past year.

EARNINGS

Q3 earnings review: Energy, infra firms lead profit surge; IT, FMCG face headwinds

Among major corporates that have announced their December quarter earnings, so far, Indian Oil Corporation has clocked the biggest year-on-year jump in net profit at a whopping 1,071 percent

BUSINESS

What the markets liked and did not in Interim Budget

The Modi government did not succumb to the temptation of announcing populist measures in the interim budget though the Lok Sabha elections have to be held by May

BUSINESS

MC Graphixstory: Mutual funds’ AUM bigger than GDP of Sweden, Norway; 9-times Swiss gold reserves

The AUM of the Indian MF industry has grown from Rs 8.26 lakh crore as on Dec 31, 2013 to Rs 50.78 lakh crore as on Dec 31, 2023, a more than 6 fold increase in a span of 10 years.

MARKETS

Kings of consistency: Nifty stocks which have regularly outdone the benchmark

A Moneycontrol analysis shows that eight Nifty stocks have outperformed the index five times, the highest, since 2016. These are L&T, Ultratech Cement, Titan, Bharti Airtel, Adani Ports, Tata Steel, Bajaj Finance and RIL

BUSINESS

Analyst Call Tracker: Banks, infra dominate Dec ‘buy’ lists; Bajaj Finance in top bets of 2023

IT and pharma stocks wallowed in the pessimism list amid global and domestic headwinds, as per Moneycontrol’s Analyst Call Tracker for December.

BUSINESS

Market goes Atmanirbhar as DIIs beat foreign peers in buying Indian equites, 3 years on

Analysts foresee further rise in Indian markets in the first half of 2024 on the back of likely rate cuts by global central banks as well as the RBI. Another surge is expected ahead of the general elections

MARKETS

Sectoral Scorecard: A look at the winners and losers of 2023’s bull run

In the broader market, while the mid- and small-cap indices outperformed the benchmarks by a wide margin, there was no contest as to which sector 2023 belonged to

MARKETS

Year in Review: Dalal Street waltzes to lifetime highs as domestic tunes drown out global tumult

The benchmarks have gained around 18 percent this year, but the smallcap and midcap indices have vaulted over 40 percent.

BUSINESS

IPO rally stays the course with Rs 60,000-cr share sales lined up for new year

In 2023, some 57 Indian companies raised around Rs 49,000 crore through mainboard IPOs. And, 27 companies have already obtained the green light from the market regulator to float their public issues to raise around Rs 29,000 crore

BUSINESS

Darlings of Dalal Street: The stocks most owned by mutual funds

The most owned consumption stock is Titan followed by ITC and Hindustan Unilever (HUL) in the FMCG segment.

BUSINESS

Odd ones out: Only 2 Nifty indices haven't touched lifetime highs this year

While the benchmark Nifty and all sectoral indices have been on a record-smashing spree, two segments failed to join the party. Read on to find out which are the two and why

BUSINESS

Wage Hike: How will it impact PSU banks?

State-run lenders’ robust credit growth and improving profitability allow them to absorb the wage hike impact without breaking much sweat, analysts said.

INDIA

Of polls and punters: Decoding the D-St dynamics in a year of elections

Since the elections of 1999, when the BJP-led NDA swept into power, the Nifty has returned an average of 21.2 percent during the six-month period before the results.

BUSINESS

Analyst Call Tracker: Banking, infra stocks rule the roost; no respite for IT pack

Banking, finance and select infrastructure stocks featured prominently on analysts’ wish lists in November, while IT companies continued to be at the receiving end of brokerages’ sell calls.

BUSINESS

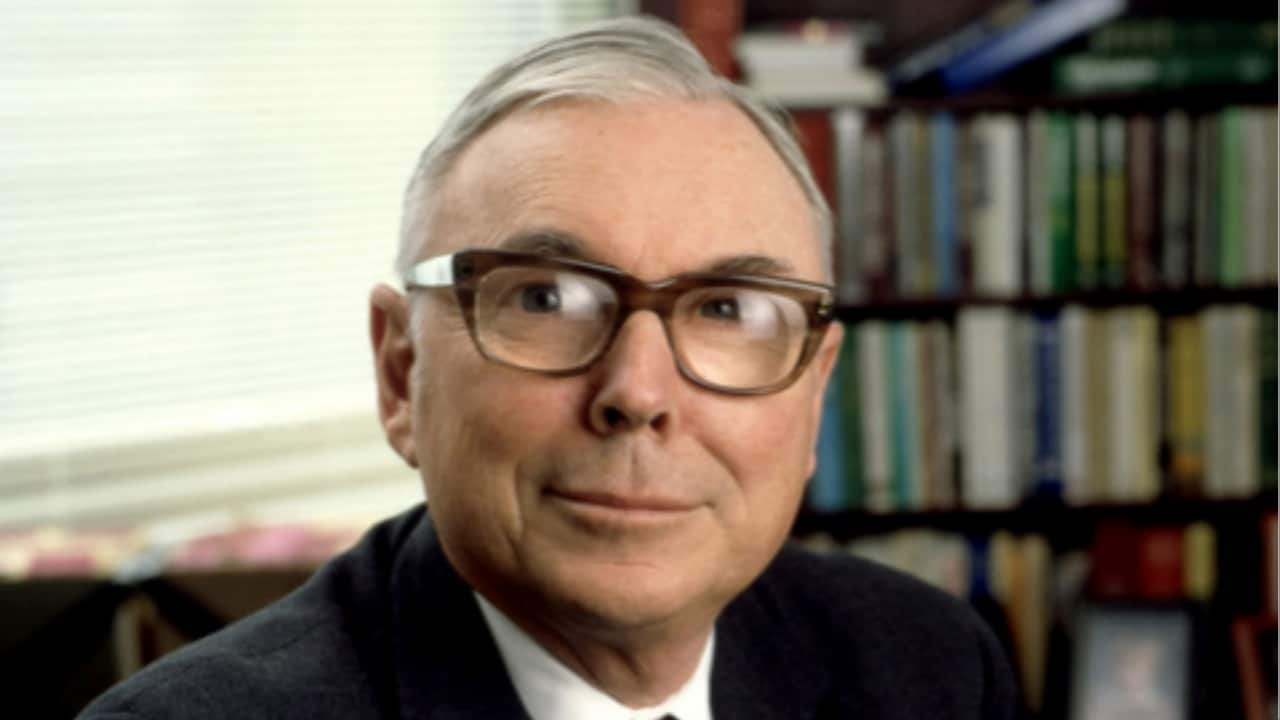

Charlie Munger's common sense approach to investing

It was Munger who persuaded Buffett to focus on acquiring great businesses at acceptable prices rather than hunt for seedy bargains

BUSINESS

Heavy Metal: Sovereign Gold Bond outshines nearly 1 in 3 Nifty stocks

If you had invested in the first tranche of Sovereign Gold Bonds in November 2015, you would have comfortably beaten Nifty constituents like Coal India, Tata Motors, ONGC and Hero Moto.

BUSINESS

40-40-20: How one of India’s top money managers invests his own money

You have to manage the risk, not run away from risk, says Rahul Singh, Chief Investment Officer (Equities) of Tata Mutual Fund.

INDIA

Howzzat! Nifty sticks to script after India’s World Cup heartbreak

There’s a remarkable correlation between the Indian cricket team’s performance in ICC tournaments and the market reaction the next day. Correlation, of course, doesn’t imply causation.

BUSINESS

World Street: WeWork founder’s payday, Black Swan fund boss’s warning, US realty loans, JP Morgan warns on Bitcoin rally

World Street is a curated list of key developments and trends in the global financial world, from the marbled corridors of Wall Street to the dusty mines of Latin America. Get a bird’s eye view of the global equity markets, bonds, commodities and consumer trends shaping our lives.

BUSINESS

World Street: EV wars, water crisis in Suez canal, Arm flounders, US steel prices rise, pricey iron ore

Presenting World Street, a specially curated list of all the major developments in the global financial world, from the marbled corridors of Wall Street to the dusty mines of Latin America. Get a bird’s eye view of the global equity markets, bonds, commodities and consumer trends shaping our lives.