BUSINESS

International MF schemes: Why some funds are still taking money, and others have stopped

Most overseas funds as of now are open for investments while some are allowing only fresh SIPs. However, this can change at any point depending on the headroom available to the fund houses for overseas investments.

BUSINESS

Cash levels of smallcap funds steady even as some limit inflows in rising markets

Funds having a high cash allocation may suggest a sense of caution towards the stock market. Generally, when funds hold a significant cash position, it implies that the market is overvalued or an anticipation of favourable investment opportunities in the future.

BUSINESS

Kotak Mahindra MF limits lumpsum investments in its smallcap fund

Kotak Mahindra Mutual Fund isn’t the first one to put restriction on its smallcap fund. SBI MF, Nippon India MF and Tata MF had earlier put restrictions on investments into their smallcap funds

BUSINESS

Should you invest in Sachin Bansal’s Navi Finserv NCD issue offering up to 11.19%?

Navi Finserv’s rating of ‘A’ is the fifth highest behind ‘AAA’, ‘AA+’, ‘AA-’ and ‘AA’, meaning the issue comes with a high degree of risk. While retail investors should look to avoid low-rated NCD issues, HNIs or high-risk investors should note that even AAA-rated NCDs have defaulted in the past

BUSINESS

How Indian investors are gaining as Nvidia sees record rally

Nvidia has grabbed the limelight among global investors as the company recently reached a market capitalisation of $2 trillion, after more than doubling its stock price in the last one year.

BUSINESS

Multi-asset allocation mutual funds have stormed the Street. But should you touch them?

These funds are a good place to start one’s investment journey. However, do note that multi-asset funds entail a higher level of risk compared to traditional high quality debt products

BUSINESS

Fixed income portfolio: Using bonds to complete asset allocation | Simply Save

Vishal Goenka, Co-founder of IndiaBonds.com talks about how fixed-income markets are placed after the Interim Budget and RBI’s monetary policy review. He also shares tips on how to invest in fixed-income market given the current market condition.

BUSINESS

Sensex @73k: Do not stop your SIPs, but go slow on lumpsum investments, advise experts

Reaching a particular index level alone may not be a sufficient reason to change your mutual fund investment strategy. It's essential to consider your overall financial situation, goals, risk tolerance, and the need for diversification, say experts

BUSINESS

PPFAS MF's Dynamic Asset Allocation Fund goes on stream. Should you invest?

Unless there is a completely new investment strategy or new geography, a retail investor should go with an existing fund with a proven track record rather than choose a new fund

BUSINESS

Canara Robeco launches new fund on manufacturing theme

Manufacturing is a relatively new category for mutual funds. There are only five active schemes with this theme

BUSINESS

Edelweiss MF new tech fund invests in US, Indian companies: A Moneycontrol review

Edelweiss Technology Fund, a domestic fund offering allocation to US tech companies, is a unique proposition. Invest only if you know how to time your entry and exit in this sectoral fund

BUSINESS

Mutual fund investor grievances continue to remain minuscule: AMFI

The number of complaints has gone down to 485 against last year when the total number of complaints received during the first half of the financial year 2022-23 were 619

BUSINESS

Samco MF again restricts investments in active momentum fund

The asset management company had on January 31 lifted restrictions on fresh investments in Samco Active Momentum Fund

BUSINESS

Small states, Union territories jump on the mutual fund bandwagon

The smaller states have shown a high growth in AUM originating from the region, partly due to a lower base effect but mostly due to greater interest in mutual funds. Dig deeper, and you see a starker picture — the number of branches in many such places is negligible.

BUSINESS

Sachin Bansal-backed Navi Finserv aims to raise up to Rs 600 crore via NCDs

The secured NCDs have been assigned 'A' rating with a 'Stable' outlook by Crisil Ratings. The issue will come with tenors of 18, 27, and 36 months and offer effective yields of 10.47-11.19% per annum.

BUSINESS

Sovereign Gold Bond Scheme 2023-24 Series IV opens; should you invest?

Gold surprised markets in 2023 despite high interest rates. From a returns perspective, gold prospects look challenging in the short run. Use gold as a hedge, instead. An investment of 5-10 percent of your corpus is ideal.

BUSINESS

New crypto exchange Pi42 avoids flat 30% tax -- but is it safe?

The newly-launched crypto futures exchange offers a chance to speculate in crypto without investing in them.

BUSINESS

Sovereign Gold Bond 2016-I matures; gives 13.6% return and outperforms gold funds

The biggest gold fund, Nippon India ETF Gold BeES, has delivered a compounded annual growth rate of 9.31 percent during February 8, 2016 to February 8, 2024, underperforming Sovereign Gold Bond 2016-I issue.

BUSINESS

Equity fund inflows jump 28% to Rs 21,781 crore in January, SIP book hits fresh record high

Investments via systematic investment plans hit a fresh record high of Rs 18,838 crore against Rs 17,610 crore in December. Total SIP assets under management (AUM) also rose above the Rs 10 trillion mark to Rs 10.27 trillion in January.

BUSINESS

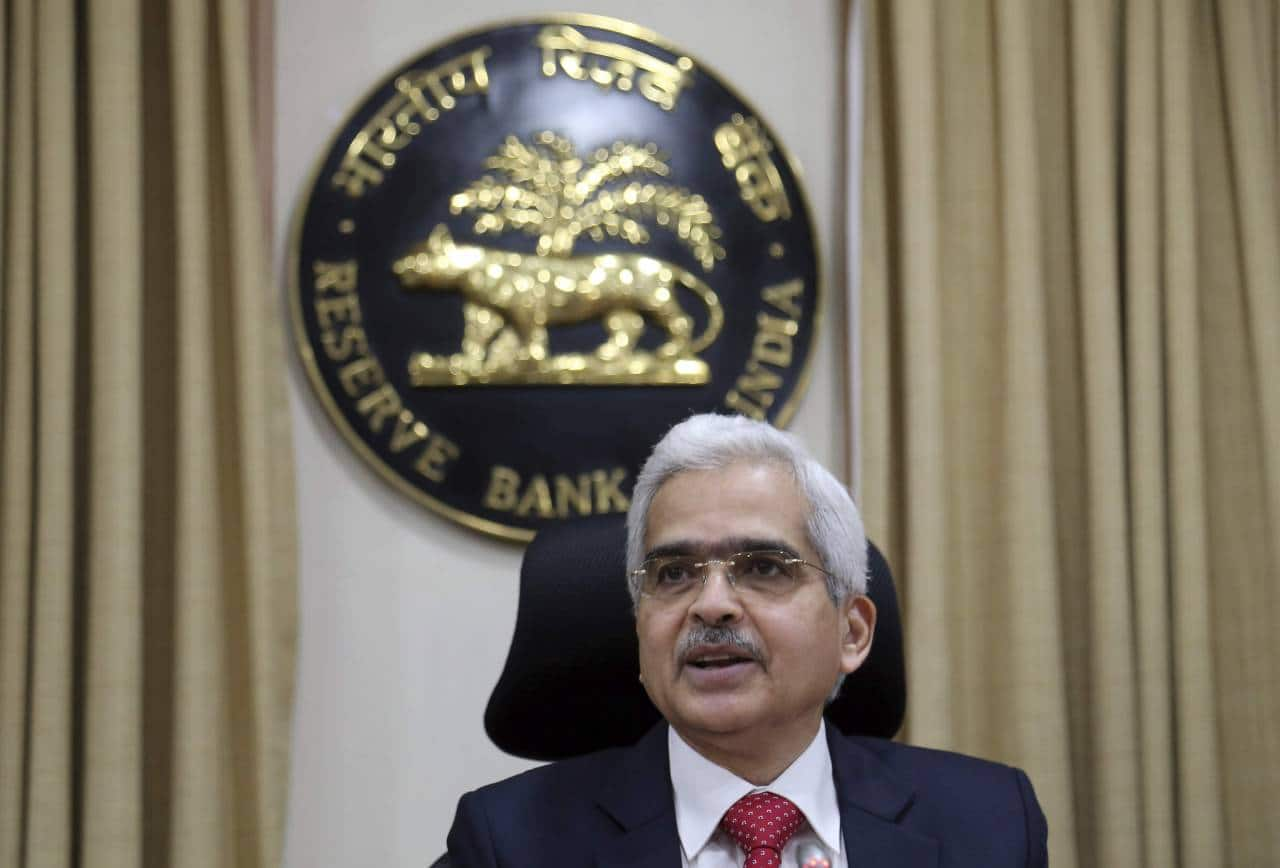

RBI maintains status quo on rates. What should be your debt-fund strategy?

With the government’s focus on fiscal prudence and the RBI maintaining status quo, experts said this is a good time to go for long-duration bond funds.

BUSINESS

Moneycontrol review | Bajaj Finserv MF’s just-launched large and midcap fund

The fund seeks to invest in companies that enjoy a distinct competitive advantage over their peers, in what is known as a Moat Investing strategy. Bajaj Finserv MF started operations in 2023.

BUSINESS

As debt funds look more attractive, here is what fund managers suggest

Though the interim budget is out of the way, there are factors, like the interest-rate scenario, which can still affect bond markets. While there is a debate over when and by how much the Fed and the RBI will cut rates, experts believe this is a good time to invest in the bond markets.

BUSINESS

Three sector funds in spotlight after interim Budget 2024

Infrastructure, tourism, defence, consumption and railways are among the key sectors that stand to benefit from the announcements made on February 1, fund honchos say.

BUSINESS

Budget impact on debt funds: Fixed income managers may look to add duration to their funds

Debt fund managers feel that through the Interim Budget 2024, the government has given positive signals for both long duration bond funds such as government securities (GSecs) as also for equity funds in general.