BUSINESS

US-focused IT mutual funds lead Indian sectoral peers, but investors have few options

Consider investing in a sectoral fund only if you have reliable access to quality advice. Given the prolonged weakness in IT companies, timing the entry could be tough.

BUSINESS

Mutual fund holdings hit another high: These are the top stocks in AMC portfolios

HDFC Bank, ICICI Bank and Reliance Industries were among the biggest stock holdings of the top mutual funds. Overall, mutual funds had exposure to the tune of Rs 2.20 lakh crore in HDFC Bank, followed by ICICI Bank at Rs 1.84 lakh crore and Reliance Industries at Rs 1.47 lakh crore.

BUSINESS

Will a new scheme that bets on non-cyclical consumer sectors pay off? A Moneycontrol review

Groww Nifty Non-Cyclical Consumer Index Fund review: Investors aiming to tap into consumer funds would find it more sensible to opt for an established scheme with a proven track record. Further, whether excluding cyclical consumption themes would enhance performance and minimise volatility remains uncertain.

BUSINESS

SEBI releases framework for supervision of research analysts, investment advisers

SEBI on April 26 notified that a recognised stock exchange may undertake the activities of administration and supervision over specified intermediaries. Accordingly, stock exchanges can now be recognised as administrative and supervisory bodies of RAs and IAs.

BUSINESS

Personal Finance: Can arbitrage funds continue their bull run?

One risk that investors run is in having a very short timeframe for their arbitrage fund invesments. As long as they have a six-month horizon or more, they will be decently protected, say wealth advisors

BUSINESS

Mutual fund KYC puzzle: How to solve it | Simply Save

Amol Joshi, Founder of PlanRupee Investment Services talks about the hardships that mutual investors are facing because of re-KYC mandate, what are the different KYC registration statuses, how to validate KYC and the issues specific to NRI investors.

BUSINESS

This new fund captures the upside in equity markets and protects the downside. Will it work?

Edelweiss MF launches the Nifty Alpha Low Volatility 30 Index Fund. Smart-beta funds like this may not perfectly align with an investor's individual preference or risk tolerance. Nuanced investors who understand how smart-beta funds work can go for this scheme.

BUSINESS

‘Special situations’ theme funds make a beeline for investors’ money

Special situation or special opportunities funds invest based on triggers such as corporate restructuring, government policies, regulatory changes or technology-led disruptions. The strategy is agnostic of market mood or valuations, which may make it ideal for current markets.

BUSINESS

Need regular income? Try systematic withdrawal plan of mutual funds. Here’s how it works | Simply Save

Systematic Withdrawal Plans allow investors to withdraw fixed sum every month. Akhil Chaturvedi, Chief Business Officer, Motilal Oswal Mutual Fund, talks about how to start a SWP, how much should you withdraw and the pitfalls that come with it.

BUSINESS

Motilal Oswal Financial Services offers up to 9.70% yield in maiden NCD issue; should you invest?

MOFSL is offering eight series of NCDs carrying fixed coupons with a tenure of 24 months, 36 months, 60 months, and 120 months with annual, monthly and at-maturity interest payment options. Effective annual yield for NCDs ranges from 8.85 percent to 9.70 percent per annum.

BUSINESS

India should see $3 trn capital flows in the next 10-15 years if it gets policies, politics right: Arvind Chari of Q India (UK)

Arvind Chari, Chief Investment Officer of Q India (UK) Ltd, guides global institutional investors on their India asset allocation. In an interview with Moneycontrol, he talks about how global investors are viewing India, key risks for Indian markets and sectors he is betting on.

BUSINESS

Mutual fund stress test: Which funds showed biggest improvement, which ones slipped

While the overall liquidity stance of small-cap schemes is largely in line with the previous results, there are some notable changes at the scheme level.

BUSINESS

2nd stress test results: Quant Small Cap Fund's liquidity position improves

During March, when smallcap funds saw net outflows for the first time in 30 months, Quant Small Cap Fund had the highest net inflows at Rs 156 crore

BUSINESS

All eyes are on mutual fund stress test No. 2; here's what to expect

The mutual fund stress-test results are being watched closely as small-cap funds saw outflows for the first time in 30 months in March, after the capital markets regulator highlighted its concerns over “froth” in the smaller-cap segments.

BUSINESS

Equity inflows slump 16% in March as smallcap funds see first outflows in 30 months

Inflows into equity funds have remained in the positive zone for a 37th straight month, AMFI data shows

BUSINESS

Inflows surge 6 times in 8 years: How mutual fund SIPs have grown in Modi regime

A surge in stock market rallies and heightened involvement from retail investors has facilitated increased investments in the mutual fund industry through the systematic investment route.

BUSINESS

Silver shines: Should investors keep riding this rally?

Experts say the silver prices outlook is bullish in the long term but for mutual fund investors, taking precious metal exposure via gold may be a better bet.

BUSINESS

Tata Mutual Fund launches 6 index funds; 3 are industry first

Tata Nifty MidSmall Healthcare Index Fund, Tata Nifty500 Multicap India Manufacturing 50:30:20 Index Fund and Tata Nifty500 Multicap Infrastructure 50:30:20 Index Fund are the industry first.

BUSINESS

Capitalmind, Cosmea Financial apply for mutual fund licences

The Indian MF industry is one of the most competitive with 43 players and more looking to enter the space which manages Rs 54.45 trillion worth of assets

BUSINESS

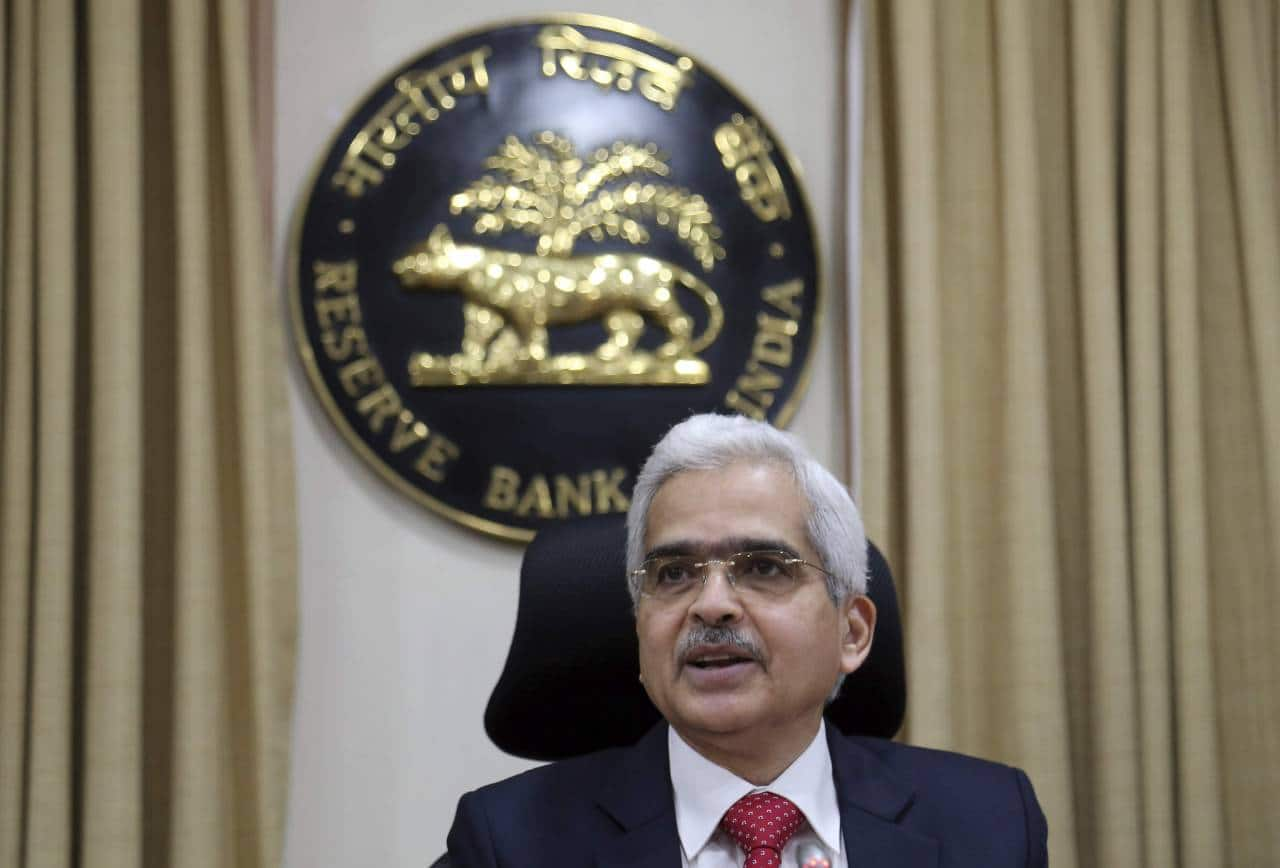

RBI holds rates. Here’s what debt mutual fund investors should do

After RBI's status quo, investors may continue to enhance duration across debt schemes with a view of softer rates and stable liquidity conditions going ahead

BUSINESS

Gold rewards investors. But don’t go overboard, it’s just an asset allocator

One need not go overboard on gold for getting superlative returns. Gold is used as a hedge against volatility in stock markets and uncertainty across the world.

BUSINESS

This mutual fund facility gives you regular income. Here’s how

Systematic withdrawal plans can be a useful tool for generating regular income from investments but investors should carefully consider their individual financial goals, risk tolerance, and investment strategy before implementing an SWP

BUSINESS

HDFC Nifty Realty Index Fund stops lumpsum investments, restricts SIPs days after launch

As per industry sources, given the steep valuations and recent rally in the real estate stocks, HDFC MF has taken a fair call to restrict inflows into its Nifty Realty Index Fund

BUSINESS

PSU, auto, infra fund categories shine in FY24; private banks disappoint

Funds based on the public sector unit (PSU) theme surprised experts as it emerged as the top-performing fund category during the financial year while IT despite gaining 35 percent was among the least performing.