For Shakti Pumps, FY16 was a weak year. The company, which manufacturers pumps used in agriculture, industrial and commercial activities, had suffered because of a poor monsoon and subdued demand from the industrial segment. Also, the geopolitical crisis at the time and decline in crude oil prices had hit its export markets, particularly the Gulf countries which account for 30-35 percent of its sales.

During FY16, when the downturn had hit both the domestic and exports market, Shakti Pumps was operating at 45 percent capacity utilisation.

While the turnaround is clearly visible in recent quarters, there is a lot more headroom in terms of growth and benefits of operating leverage. For instance, in FY12, the company was clocking a sales turnover of close to Rs 200 crore on a fixed assets base of Rs 52 crore. By the end of FY16, it was still doing a sales turnover of Rs 270 crore despite three times increase in fixed assets to Rs 164 crore.

However, this is now changing. In Q4FY17, the company's sales grew by 124 percent from the year-ago period to Rs 164 crore and profits saw a huge spurt from Rs 0.22 crore in the period under question to Rs 10.94 crore.

The company is witnessing a demand recovery both in agriculture and industrial segments coupled with higher export volume, which accounts for about 41 percent of its total revenues.

Demand driversBack home, the Indian government is already stepping up its efforts to encourage upgradation of existing pumps (used in agriculture) with more energy-saving pumps. Besides, a few states are giving pumps free of cost to replace the old ones. Moreover, a lot of money is now being spent on solar-based pumps, an area in which the company is already present.

Industry estimates suggest that close to 2.6 crore pumps need to be replaced to conserve both electricity and diesel which will lead to lowered costs. This is huge compared to the current capacity of players like Shakti which has an annual production capacity of 5 lakh pumps.

While replacements would be an incentive, implementation of GST could be another trigger worth noting. “The proposed introduction of the Goods and Services Tax in July this year could remove inter-state tax variations, reduce the competitiveness of unorganised pump manufacturers and enhance the proportion of organized manufacturers from 15 percent of all new pump off-takes to a projected 50 percent over the foreseeable future," said Dinesh Patidar, Chairman, Shakti Pumps in a shareholder address in its last Annual Report.

To capitalise on the demand, the company has already started building its brand by roping in Bollywood superstar Amitabh Bachhan as its brand ambassador. The company is also developing a distribution network and extending its reach to tap higher demand.

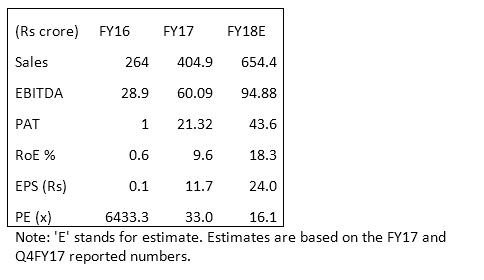

ValuationOperating leverage could further boost company's financials, while improving profitability will have a positive rub-off effect on valuations.

While the stock had a stellar run up in the last one year – by close to 140 percent -- it still remains reasonably valued. Based on Q4FY17 net profit of Rs 10.9 crore the company might deliver profits in excess of Rs 40 crore in FY18. At current market capitalisation of Rs 710 crore, the price-to-earnings works out to 16 times, which is reasonable, considering the growth and quality of the business.

It is noteworthy that except for FY16 when the ROE had dropped to 0.56 percent, the company had been generating RoE of about 15-20 percent. At the current pace of profitability (Q4FY17 profit at Rs 10.9 crore), it will again reach to near 18-20 percent return on equity in the coming years.

Valuation also looks to be in a healthy zone given the fact that Shakti Pumps has a reasonably strong balance sheet, having negligible debt in the books (debt to equity 0.4 times in FY17 and interest coverage of close to 5 times in Q4FY17) and it is expected to generate large free cash flows in the absence of immediate capex requirement.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.