The year 2018 started on a muted note but markets were quick to pick up momentum towards the close of the first week of January supported by robust global cues. However, higher crude oil prices played a spoilsport.

History suggests market witness’s volatility in the beginning of the year amid low trade due to Christmas and New Year holiday.

In the year 2017, the market managed to hit a fresh record high amid volatility and ended the passing year with 29 percent gains.

We might not be able to see a repeat of 2017 amid high volatility this year (2018) due to major events such as Union Budget, 8 state elections, and corporate earnings, but still, 10-15 percent return cannot be ruled out.

One major reason for the optimism around Indian markets is the fact that major announcements are likely from Modi government ahead of general elections 2019. Hence, investors will be better off betting on individuals stocks rather than the index.

"For CY 2018 investors need to tone down their expectations but having said that I would not be surprised if we do end CY 2018 with a NIFTY level of 11,500," S Ranganathan, Head of Research at LKP Securities told Moneycontrol.

According to him, select individual stocks could fare significantly better due to themes like GST, financial inclusion & capex recovery.

"Given the many assembly elections coming up ahead of the General Elections in 2019 we could see some kind of populism in the ensuing budget as there could be a rural tilt but that by itself does not mean that the reform process has taken a back seat," he said.

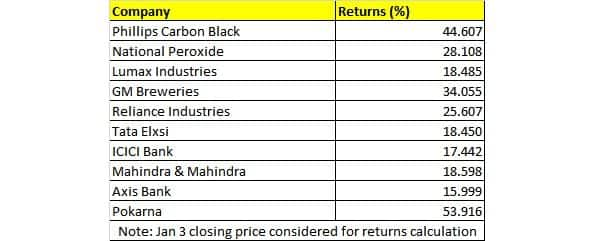

GM Breweries (GM), incorporated in December 1981, operates in the highly unorganised Indian made Indian liquor (IMIL, country liquor) segment. GM is the single largest manufacturer of country liquor with an installed capacity of 13.76 million bulk litre (around 50,000 cases) in Thane district, Maharashtra.

The leadership remains cognisant of the net revenue, EBITDA and PAT growth rates, outperforming the industry with a CAGR of 7 percent, 29 percent and 33 percent to Rs 373 crore, Rs 72.5 crore and Rs 44 crore, respectively.

It remains virtually self-funded in terms of working capital. In addition to debt free balance sheet, GM’s cash & cash equivalents (including investments) were at Rs 170 crore (12 percent of market capitalisation).

The brokerage firm believes that GM’s financials will grow at a faster pace realising the dual benefits of higher revenues (recent price hikes) and lower raw material prices.

Phillips Carbon Black (PCBL) is the largest manufacturer of carbon black (market share around 40 percent), which is used as a reinforcement material in manufacturing tyres (constitutes around 23 percent by volume).

The brokerage firm expects PCBL to report PAT of Rs 241 crore in FY18 compared to Rs 73 crore in FY17. Going forward, PAT is expected at Rs 291 crore in FY19 and Rs 335 crore in FY20.

Pokarna | Rating - Buy | Target - Rs 340

Incorporated in 1991, Pokarna is one of the largest manufacturers of quartz and granite in India. It exports to more than 60 countries including the US, Australia, UK and derives around 86 percent of its overall revenues from exports.

The brokerage firm likes Pokarna, given its shift from a pure granite player to a high margin quartz manufacturer, strong raw material security with its owned quarries and exclusive access to superior BretonStone technology.

ICICIdirect believes that the new quartz facility would bring in the next leg of growth for the company, going forward. It has a Buy rating on the stock and values it at 12-13x FY20 rough cut EPS of Rs 26.3 per share. Hence, we arrive at a target price of Rs 315-340 per share.

Brokerage: Motilal OswalICICI Bank | Rating - Buy | Target - Rs 370Credit demand from corporates for ICICI Bank remains muted and the management is not seeing any signs of capex revival. Resolution of National Company Law Tribunal referred cases would give more clarity on capex pickup and asset quality outlook.

ICICI Bank is open to evaluating opportunities to unlock value in its subsidiaries. It has recently filed DRHP towards the public issue of its securities business.

While credit cost is likely to stay elevated in the near term (NPL ageing + requirement toward the second list), Motilal Oswal expects it to moderate from FY19, enabling ICICI Bank to deliver around 12 percent RoE by FY20 (around 8 percent currently).

Brokerage: EdelweissReliance Industries | Rating - Buy | Target - Rs 1,151Reliance Industries' (RIL) USD 20 billion core capex is nearing fruition, which, unlike the uncertainties associated with Reliance Jio (RJIO), will quickly bolster earnings.

The company has now commissioned one of its most profitable core projects, a USD 4.5 billion off-gas cracker (ROGC), which is estimated to generate EBITDA or USD 1.2 billion (8 percent of FY19 EBITDA) and healthy project RoCE of 21 percent.

Similarly, its other oil-leveraged mega project, ethane imports from the US, is already generating high returns and petcoke gasification (USD 5 billion) project should commence operations shortly.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Brokerage: Reliance SecuritiesTata Elxsi | Rating - Buy | Target - Rs 1,180Tata Elxsi (TEL) is a niche IT firm that offers design and technology services for product engineering to a range of industries including automotive, broadcast and communications.

The company provides services like IT consulting, product design, development, and testing. TEL has also invested in emerging services and solutions including IoT, analytics, big data, mobility, cloud and AI.

Over the past 4 years, TEL’s EBITDA margin has risen substantially to 23.8 percent in FY17 (42 percent CAGR over FY13-FY17), led by healthy revenue growth (16.6 percent CAGR over FY13-FY17), operating leverage and increasing proportion of the high-margin SDS business to revenue.

Brokerage: Prabhudas LilladherMahindra & Mahindra | Rating - Buy | Target - Rs 895M&M’s volumes continue to be driven by strong demand for tractors and a cyclical recovery in the light commercial vehicle (LCV) segment. The utility vehicle (UV) business continues to be a drag with M&M losing around 14 percent market share over the last three years.

However, given the extremely low base, upcoming model launches (MPV/Mahindra branded Tivoli) and refreshes (KUV1oo/TUV3oo) should boost volume growth for M&M over FY19. Increased government focus on the rural economy could further accelerate growth for both, farm and auto segment.

Tractors have seen a sharp recovery over FY17-FY18 and we expect this growth momentum to continue on the back of a second consecutive year of good monsoon, healthy farm produce, and rising MSPs.

The stock has underperformed Nifty by around 5 percent over the last 12 months and currently trades at 15x FY19 core Auto PE. We upgrade rating from Accumulate to Buy with a target price of Rs 895 (earlier Rs 790).

Brokerage: EquirusLumax Industries | Rating - Long | Target - Rs 2,486Equirus has initiated coverage with the Long rating on the stock and set a target price at Rs 2,486 per share as it is set to be a key beneficiary of the shift to LEDs in 2/4-wheeler.

It is a market leader in automotive lighting market in India with 35 percent market share. It is focussing on increasing market share in commercial vehicles, tractors, and 2-wheeler.

Its return matrix is expected to improve led by growth and margin expansion. We expect revenue/EBITDA/net profit to grow at a CAGR of 15/24/27 percent over FY18-20.

Brokerage: IIFLAxis Bank | Rating - Buy | Target - Rs 650IIFL has upgraded to Buy from Add and also raised target price to Rs 650 from Rs 520 per share. Increase in share capital is expected to boost bank's capital position by over 200 bps and the share capital boost to enhance the ability to absorb large write-downs.

We expect earnings growth to rebound strongly by FY20 and expect a sharp decline in loan loss provisions. Profitability could normalise by FY19 under IND-AS, according to the research house.

Brokerage: HDFCNational Peroxide | Rating - Buy | Target - Rs 2,860National Peroxide (NPL) is a manufacturer of hydrogen peroxide, sodium perborate, compressed hydrogen gas and peracetic acid. The company manufactures hydrogen peroxide with a current installed capacity of 95,000 metric tons per annum (MTPA) on 50 percent weight per weight (w-o-w) basis.

NPL enjoys around 42 percent market share in the hydrogen peroxide market in India and is one of the pioneers in producing Peroxygen chemicals. It is raising its current capacity of 95,000 tonne to 1,50,000 tonne that will give a lift to both of its topline and bottom line figures in the coming years.

Disclaimer: The views and investment tips expressed by the investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.