Indian markets started the year 2018 on a bullish note with benchmark indices hitting fresh record highs in the second week of January as well.

The rally comes despite crude oil prices which are hovering near two-and-half-year high, but hopes of a recovery in corporate earnings, government meeting FY18 fiscal deficit target and further progress in PSU banks recapitalization are keeping the momentum going on D-Street.

Global cues also played a key role in India's 30 percent rally reported since 2017. The market hit a fresh record high in the second week of 2018 also - the 30-share BSE Sensex rallied 204.36 points to 34,358.21 and the 50-share NSE Nifty jumped 60 points to 10,618.90.

Domestic liquidity is likely to drive the Nifty higher by 10-15 percent in the current year, but overall 2018 is expected to be a volatile year for market due to likely tightening of interest rates by global central banks that may pull out some money from emerging markets like India to the US, experts suggest.

In India, Union Budget 2018 and eight state elections may cause volatility in the market, but a likely reforms related announcement from the government ahead of general elections 2019 may keep positive momentum in 2018.

Vikas Khemani, President, and CEO of Edelweiss sees 2018 will be a year of micro improvement and a few macro challenges but we see corporate earnings recovery as we progressed in the year, capex beginning up, numbers improvement across the board.

“We will have to worry about global factors like whether interest rates going up, liquidity constraints are given fiscal challenges. He still believes the market will deliver good returns in 2018, but not like 2017,” he said.

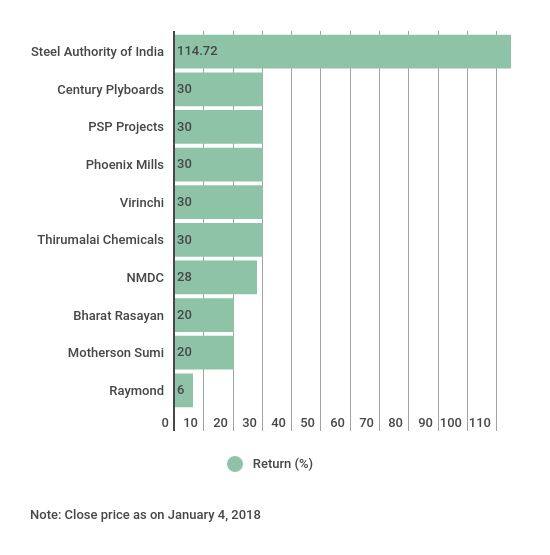

Here is a list of top 10 stocks that already rallied up to 200% since 2017 still have potential to surge up to 115%:

Brokerage: Aditya Birla Capital

PSP Projects: Rating - Buy | Upside Return - 30%

PSP Projects is a Gujarat based construction company offering a wide range of construction and allied services since past over 10 years (more than 80 percent revenue from Gujarat).

Because of its exceptional execution capability, it recently bagged marquee project of Surat Diamond Bourse of Rs 1,575 crore, its largest contract so far. Its total order book stands at around Rs 2,700 crore in December 2017 & around Rs 300 crore orders in the pipeline.

PSP Projects' revenue has grown at a CAGR of 21% over FY12-FY17, while its operating profit and PAT has grown at a CAGR of 34% and 38% over the same period. It operates under the asset-light model and enjoys a debt-free status. This has led to high ROE of over 43 percent over past five years.

Century Plyboards: Rating - Buy | Return - 25-30%

Century Plyboards is an innovation-led diversified plywood player present across plywood, MDF, particleboard, laminates, veneers, etc. Its revenue has grown at a CAGR of 12 percent over FY14-17 and its profit has grown at a CAGR of 40 percent over the same period.

The company also has the highest ROE in the sector of around 36 percent for the previous three years. The drive to formalize the economy and to bring the unorganised channels under tax regime which has taken the pace post demonetisation and GST will lead to a reduction in the price gap between the organised players and unorganised players.

Considering the prospects of the industry and the leadership position of Century Plyboard, it is well poised to en-cash on the large opportunity in organized space. The brokerage firm expects the stock to deliver 25-30 percent returns over the next 12-months.

Phoenix Mills: Rating - Buy | Return 30%

Phoenix is a name of repute and a strong brand across its diversified portfolio. It has a portfolio of 8 malls, 5 office spaces, and 2 hotels.

Increase in overall retail consumption along with a shift towards organized retail has created a huge demand for quality space in the retail industry. Phoenix is quality player in the space.

The brokerage firm is of the view that PML is one of the best proxy to participate in the growing retail consumption in India, benign interest rates & increasing disposable income.

PML's rental business has grown at a CAGR of 16 percent over FY13-17. Given its strong position in the industry & proven capabilities and interest rates trending lower, we believe PML should deliver 30 percent returns over 12-months.

Brokerage: Hem Securities

Virinchi: Rating - Buy | Target - Rs 172| Return 30%

Headquartered in Hyderabad, Virinchi Limited is a global consulting and technology services company specializing in industry-specific e-business solutions and strategic outsourcing.

The Company has grown at CAGR of more than 33 percent in the topline as well as the bottom line during FY’12 to FY’17. It posted strong return as well as margin ratio with ROE & ROCE of the company standing at nearly 14 percent while net profit margin & operating profit margin of the company standing at 8 percent and 23 percent respectively in FY17.

Looking at strong management & financials with decent valuation, we recommend Buy on the stock with price target of Rs 172 (appreciation of almost 30 percent) for long-term investment horizon.

Bharat Rasayan: Rating - Buy | Target - Rs 5,025| Return 20%

Bharat Rasayan, part of the Bharat Group of companies, is engaged in manufacturing technical grade pesticides, pesticides formulations, and intermediates. Its products are exported to 50 countries in Asia, South America, Africa and the European continent.

Currently, the company has two manufacturing plants equipped with state-of-art process systems located in the states of Haryana and Gujarat.

The Company has grown at CAGR of more than 34 percent in topline while the bottom line of the company has grown at CAGR of 40 percent during FY’12 to FY’17.

The Company has posted strong return as well as margin ratio with ROE & ROCE of the company standing at more than 30 percent while net profit margin & operating profit margin of the company standing at 8 percent and 16 percent respectively in FY17.

Looking at consistent financial performance & strong sectoral outlook, we recommend 'Buy' on the stock with price target of Rs 5,025 (appreciation of almost 20%) for long-term investment horizon.

Thirumalai Chemicals: Rating - Buy | Target - Rs 2,970| Return 30%

TCL ranks among the largest producers in the world of phthalic anhydride, malic acid, maleic anhydride and fumaric acid. TCL has a presence in more than 34 countries.

The Company has posted strong numbers in Q2FY18 with the rise of 13 percent in the top line as compared to Q2FY17 while bottom line of the company has witnessed a stellar jump of more than 100% on the YoY basis in Q2FY18.

With the strong growth in the chemical sector, the company is standing firmly with decent fundamentals, strong capex plans, healthy financial performance coupled with minimal debt to cater the opportunities present in the sector.

Looking after strong fundamentals and decent valuations, the brokerage firm recommends a Buy on the stock with price target of Rs 2970 (appreciation of almost 30%) for medium to long-term investment horizon.

Brokerage: IIFL

Motherson Sumi Systems: Rating - Buy | Target Rs450| Return 20%

IIFL has maintained its Buy rating on the stock with an increased price target at Rs 450 from Rs 300 per share earlier. Motherson is a global giant built on sound operating and financial principles.

History of value creation through acquisitions offers sizeable upside risk, the research house said. It feels the pickup in autos will drive acceleration in Motherson’s growth. Increase in content per vehicle is a key growth driver, it said.

Brokerage: Share India Securities

Steel Authority of India: Rating - Buy | Target - Rs 210| Return 115%

SAIL over FY14-17 has been a laggard and faced execution delays with low capacity expansion in comparison to domestic peers share.

The brokerage house believes that FY18 would mark a turnaround for the company has earning are expected to bottom out and come in black FY19 onwards.

SAIL has highest operating leverage among its business peers and would be a big beneficiary of industry uptick, infrastructure push by GOI, rural housing growth and industrial production growth.

It expects SAIL to report higher cash turnaround and increase its EBITDA over FY20 to higher than 15% over sales of around Rs 70,000 crore. Share India values the company at 6.5x EV/EBITDA over FY20E and assign a long-term value of Rs 210. Recommend Buy.

Brokerage: Edelweiss

NMDC: Rating - Buy | Target - Rs 195| Return 28%

We upgrade NMDC to Buy with a revised target price of Rs 195 as we expect: 1) favourable tailwinds to lend impetus to volume growth; 2) the recent price hike of 19-22% to largely sustain, and 3) the pellet and steel plants to further augment revenues.

Edelweiss raised their FY18/19 EBITDA by 9%/31% and introduce FY20 estimates. Our target price of Rs 195 implies an exit multiple of 12x on FY20 EPS and 7x on FY20 EBITDA - which is at a discount with peers, and 28% upside from current levels.

Brokerage: Stewart & Mackertich

Raymond: Rating - Accumulate | Target - Rs 1,161| Return 6%

Stewart & Mackertich initiates coverage on Raymond with Accumulate rating. Bright growth prospects in branded apparel segment, strategic plant set-up in Ethiopia and unlocking value in the non-core segments are likely to help the company to rebuild itself.

However, valuations have run up sharply and are close to our target price leaving little upside. Due to restructuring exercises and various initiatives taken by the company, we strongly believe it is on a high growth path.

The brokerage firm assumes the topline & bottom line to grow at double-digit CAGR by going on an asset-light expansion model. The ROE is also expected to improve going forward. We value the company on the SOTP basis and arrive at a target price of Rs 1,161 per share.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!