If you have read financial management books then the component ‘debt’ plays a very important role in the growth of the company. A highly levered firm does pose a risk but if the business model is robust and there is no scarcity of demand then it will give a decent return.

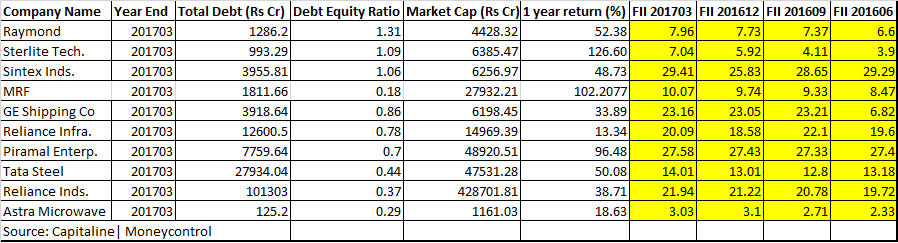

But, not every levered firm can be termed risky. In the S&P BSE 500 index, we have picked 10 firms which have given a return of 13-126 percent in the last one year.

The foreign institutional investors (FIIs) who usually shy away from risk plays have added to their stake in the last 4 quarters, Capitaline data showed.

Off late we have seen many mid and largecap stocks with high debt on balance sheet have come under pressure on muted demand environment as well as Reserve Bank of India’s new non-performing asset (NPA) ordinance.

This would give greater flexibility to banks to restructure the debt of companies. There is almost Rs 10 lakh crore bad loans in the system, said a report.

Companies which have high debt on the books but have done reasonably well include names like Raymond, Sterlite Technologies, Sintex Industries, Apollo Tyres, GE Shipping, Reliance Infrastructure, Piramal Enterprises, Tata Steel, Reliance Industries, and Astra Microwave.

These 10 stocks hold special important because FIIs have raised their shareholding in the last 4 quarters which makes them ‘jewels in the leveraged space’.

For example, FIIs raised stake in MRF which has more than doubled investors’ wealth in the last one year. According to Capitaline data, the shareholding data as on June 2016 was 8.47 percent which was then raised to 10.07 in the March quarter.

However, not every company did well where FIIs raised stake, Hence, due diligence should be done before putting money into any of these stocks.

“Plenty of growth stories, which are built on debt, die rapidly. Companies who have been very diligent on reducing debt or being prudent with using debt create long-term success stories. Therefore, the given stocks might have provided significant returns to shareholders,” Tushar Pendharkar, Head of Research, Right Horizons Investment Advisory Services told Moneycontrol.

“Few sectors such as road construction, power, heavy engineering, telecom, etc. operate on huge debt burden, because they don’t have a choice and it is the nature of their business. So, these are exceptions,” he said

He further added that there are few other exceptions such as Motherson Sumi Systems, Apollo Tyres, etc. who raised debt on balance sheet; however, that was foreign debt and thus interest burden on P&L statement was very low

Leverage is the use of borrowed funds to increase the potential return of an investment. Debt is the total amount of borrowed funds it owes and the equity is the value of shares issued by the company.

Debt equity ratio is calculated by dividing company’s total liabilities by shareholder’s equity. It is used to measure company’s leverage. It indicates home much debt the company is using to finance the assets.

The optimum debt-to-equity ratio is under 0.5 while for capital intensive industries this ration may go up to 2. But, for comparison, D/E should not be the only measure to compare the companies.

Experts suggest that D/E around 0.75x is manageable. More than 1.00x D/E reduces interest coverage ratio which impacts the bottom-line. It leaves a very limited cushion to bottom-line in the case of fluctuation in operating margins.

“Debt for expansion in business is good, which Motherson Sumi Systems, Tata Motors, Apollo Tyres etc. did in past; however, that should not come at the cost of the very limited margin of safety,” said Pendharkar.

Here’s what brokerage have to say on these 6 stocks:Astra MicrowaveDefence product related companies with net debt to equity position of less than 1x in our view are in a comfortable zone. In this context, Astra Microwave balance sheet seems not leveraged as FY17 DE stands at 0.28x which is quite reasonable as the net Debt/EBITDA also stands at 0.19x.

“Going forward, Astra to remain in this comfortable zone to service debt as it has over 1x bill-to-book ratio with stable margins negating any surprise to its earnings in the next two years,” De Arul Kaarthick of Karvy Stock Broking Limited told Moneycontrol.

Sintex Plastic TechnologyAs per Composite Scheme of Arrangement and subsequent to the approval received, Sintex Plastics Technologies Limited which will be carrying Custom Moulding and Infrastructure business has been demerged on 12th May 2017. The other entity namely Sintex Industries Limited will be carrying the business of textiles comprising of yarn and fabrics.

“As regards existing debt allocation between these two entities, the clarity is still awaited. The management has been reiterating that Sintex Plastics Technologies Limited will be debt free from day one of demerger; as a business it covers is high capacity, low utilization and have high margin,” Kiran Shankar Prasad of Karvy Stock Broking Limited told Moneycontrol.

“The total debt figure is somewhere around Rs. 7000 million that putting together both entities owes. The fact is that Textile division has been at the centre of debt. Nonetheless, the way business is being ramped up for both entities, time is not far away when debt may not be bothering point for the investors to invest in the company,” he said.

GE Shipping CompanyGE Shipping Company is largest private sector shipping company and has a history of delivering a great result. It has two main business segments including Shipping and offshore.

However, of late, its performance has been marred by a slowdown in global economies in general and Chinese economy in particular. The management is positive on offshore business on the back of pick up in crude oil price.

Besides, crude and product tankers demand is likely to catch up in view of steadiness in crude price and likely pick up in refinery production. “GESCO, being a major global player in the shipping industry, with more than six decades of industry experience is well placed to capitalize on emerging opportunities,” said Prasad of Karvy.

“The company initiatives of selling existing assets and buying new ones with the objective of benefiting from fluctuations in asset prices and staying young to meet its customers demand in the face of tough competition and utilizing its assets in spot market instead of letting them idle in face of low demand reflects to intelligence of the management,” he said.

RaymondRaymond has been at the receiving end of Q3 as it saw demand contraction across business channels in its branded textile business coupled with curtailed wedding expenses due to DeMo.

"We expect a recovery in Q4 in all its 4 Power Brands=Raymond, Parx, Park Avenue and Colorplus is driven by EBO and LFS channels, store refurbishing and focus on young consumers. Cost Optimisation, Rationalisation of Product Mix and Operational Efficiencies shall begin to yield positive traction," LKP Securities said in a note.

"Focus on Exports, Business Transformation of non-core business, Real Estate Monetisation and Strategic Initiatives to bring down net debt to equity from present levels of 1:1 shall be key monitorable going forward," it said.

Sterlite TechnologiesSterlite Technologies is poised to benefit from its leadership in the optical fiber/cable while its presence in the service segment would enable it to exploit opportunities in the NFS/Smart Cities space.

"The current capacity expansion announcement brings in additional revenue opportunity of Rs1000 crore at full capacity (from FY21 onwards). This would, in turn, be margin accretive," ICICI Securities said in a note.

"Given the robust growth potential (topline, earnings CAGR of 25.7%, 25.3%, respectively, in FY17-19E), we ascribe a target price of Rs175/share, based on EV/EBITDA multiple of 10x on FY19E EBITDA," it said.

Tata SteelTata Steel’s Q4FY17 EBITDA at Rs 70 billion (highest since Q2FY09) surpassed consensus owing to strong EBITDA at domestic operations (Rs13,586/t) and turnaround in European operations.

“We are upbeat on the likely improvement in quarterly EBITDA run rate and key concerns on UK pensions & deleveraging being allayed to a significant extent. The stock is trading at 5.4x FY19E EBITDA,” Edelweiss said in a report.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol are their own, and not that of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.