Madhuchanda DeyMoneycontrol Research

For TCS shareholders, the 3.5 percent volume growth would be the only overt positive in the June quarter numbers. The management had sounded positive while announcing the numbers for March, but that is not showing in the June earnings.

The giant is undergoing “transformation pangs” forced by a rapidly changing technology landscape. So investors need to temper their expectations till the new businesses are able to offset the pressure in the traditional services.

The quarter at a glance

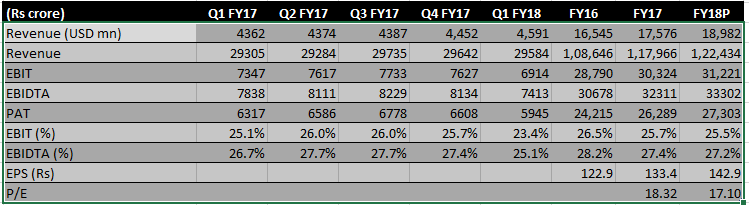

At USD 4591 mn, dollar revenues grew 3.1 percent sequentially. Constant currency revenue growth was 2 percent while the underlying volume growth was 3.5 percent. The 150 basis points gap could be explained by price erosion. Rupee revenue growth was flat at Rs 29,584 crore because of the strong rupee.

Operating margin was a bigger disappointment, falling 240 basis points sequentially to 23.4 percent. The company attributed 150 basis points decline to wage revision and 80 basis points to rupee depreciation. Remember, two months back the management was confident of maintaining 26-28 percent margin after the figure had slipped a bit to 25.7 percent during the March quarter.

The other area which deserves attention is the anaemic growth reported in the BFSI (Banking Financial Service & Insurance) Retail and CPG domains that constitute nearly 45 percent of the revenue. While these two areas have been disappointing for a while, the management is yet to turn hopeful on their future. The management mentioned that although a rebound has been witnessed in BFSI this quarter, some more deals need to fructify before turning constructive.

A new domain called “Regional markets & Others” has appeared in the reporting format that will capture the volatile revenue (especially coming out of new geographies/smaller markets) of the company.

After the robust hiring of previous quarter, the same slowed down considerably in the quarter under review.

Deal wins

The undertone was positive in terms of deal wins with the company reporting eleven deal wins - seven from North America, two in Europe and one each in Asia Pacific and UK.

The transformation – traditional services to digital

The big takeaway for long-term investors is the growing relevance of digital in the business. TCS has discontinued the reporting by service verticals (like Application development/infrastructure etc.) from this quarter as it is increasingly positioning the company to capture the opportunities in the digital space.

A new group called the Business & Technology Service Group (BTS) has been created, headed by a high-performer from the company. The three verticals under this group would be – Digital Transformation services, Cognitive Business Operations and Consulting & System Integration. TCS would commence reporting of the businesses under the new redefined verticals few quarters down the line.

The share of digital revenue that stood at 17.9 percent has improved further to 18.9 percent. Digital appears to be improving its share by close to 100 basis points every quarter (close to 400 basis points annually). While the size of the digital deals are increasing compared to the past, they are still not large enough to compensate the loss of profitability on account of the traditional services.

What to do with the stock?

Despite the disappointment and earnings slowdown (that is unlikely to exceed single digit in the next couple of years), we feel TCS is on the right track in this technological transformation journey. Given its size, for the digital high margin piece to be an important contributor to revenue will nevertheless take time.

Given the growth outlook, the valuation at 17.1X FY18 projected earnings is unlikely to excite even the long term investors. Wait for deep discount to turn constructive.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!