On June 26, country's largest private sector lender HDFC Bank in an email to its credit card customers said that rent payments made using credit cards through fintech apps will attract a 1 percent fee up to Rs 3,000 per transaction. Until now, credit card issuers were mostly stopping rewards for rent payments.

The decision to add charges to such transactions by the country’s largest credit card issuer will probably induce others to follow suit.

“If you use services like (but not limited to) CRED, PayTM, Cheq, MobiKwik, Freecharge, and others to pay rent, a 1 percent fee will be charged on the transaction amount and capped at Rs 3,000 per transaction,” the email said.

In March and April, ICICI Bank and SBI Cards, the next two biggest credit card issuers had stopped reward points for rent payments.

The turn of events has been precipitated by the huge rise in rent payments using credit cards. While RBI has not officially asked banks to stop rent payments, the regulator's concern regarding cards being used for peer-to-peer payments remains. While banks play the waiting game, fintechs that enable these payments face regulatory pressure.

Over the last few months, multiple fintechs have stopped rent payments through credit cards after nudges from banks issuing credit cards as well as unofficial directives from the Reserve Bank of India to card-issuing banks.

Since March, fintechs such as PhonePe, Paytm, Mobikwik, Freecharge and Amazon Pay have stopped accepting rent payments through credit cards.

A few other fintechs such as Cred, RedGiraffe, OneCard, NoBroker and Epayrent have started asking for more details from consumers and multiple customer complaints on rent payments failing on these platforms.

These actions followed concern at several regulatory quarters after what multiple bankers described as the alarming rise of rent payments using credit cards in the country over the last two to three years.

“Rent payments contribute to almost 10 per cent of the overall monthly credit card spending in the country. People are using it as a credit line product, for which there is an overdraft facility and sometimes these transactions mimic cashouts at merchant outlets, which is similar to taking a personal loan, ” says a senior banker, who works closely with the regulator.

Only merchants can receive credit card payments

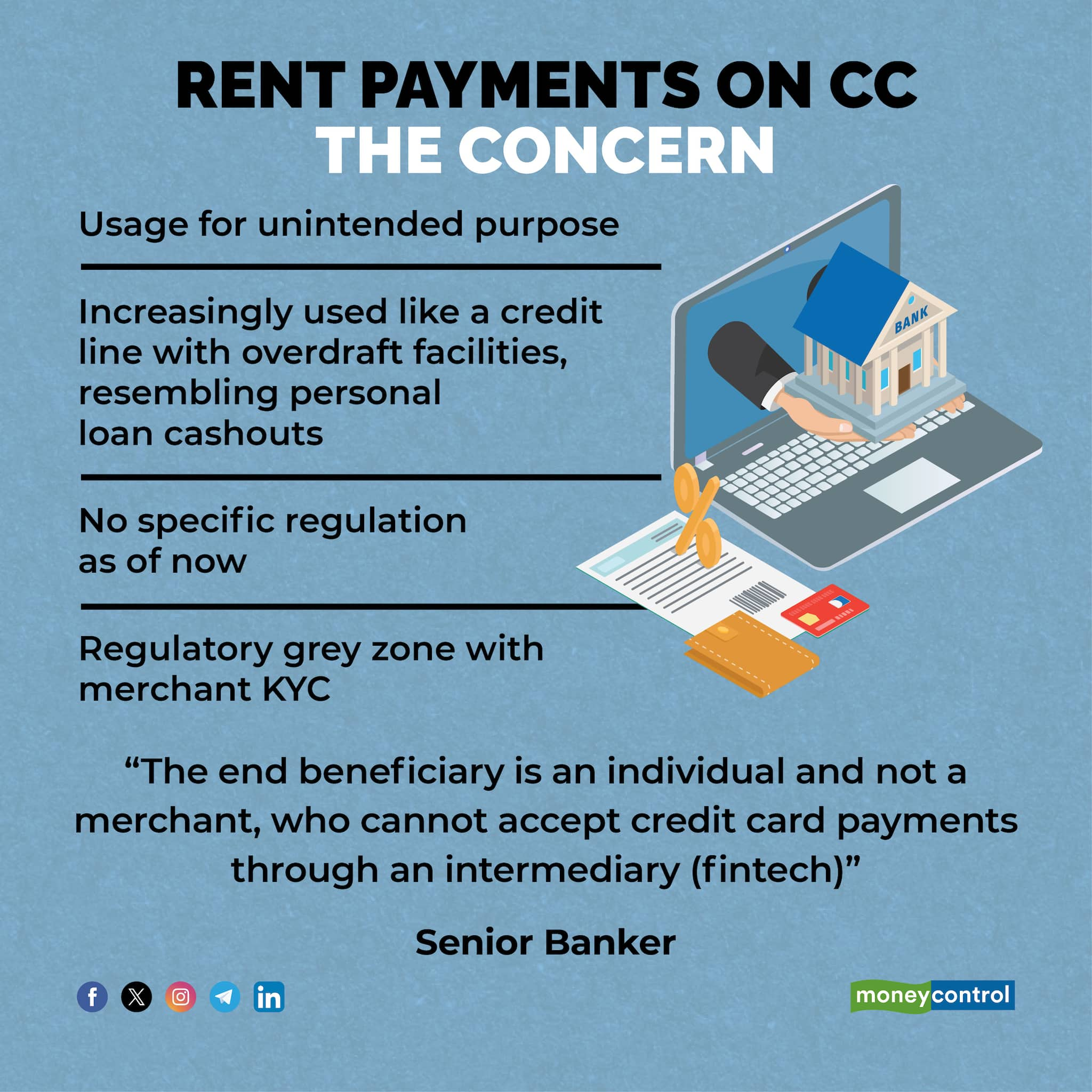

Only merchants can receive credit card paymentsWhile there is no specific regulation that says rent payments are illegal, the volumes and the usage for unintended purposes is an issue for RBI. The central bank’s official position has always been that the type of usage determines the kind of regulation that covers a certain product or programme.

Technically, only merchants can receive credit card payments. To be a merchant, they need to do merchant know your customer (KYC) and need card terminals to accept such payments. Landlords are individuals who have not done merchant KYC.

So how do they accept money from credit cards? Fintechs that onboard landlords provide their card terminals, for which they have done the merchant KYC. These landlords are treated as vendors by the card terminal.

“The fintechs are becoming a super merchant or a merchant aggregating thousands of vendors on their platform. While not illegal, they are playing in a regulatory grey zone. Banks are becoming wary because of the recent RBI action on similar practices by fintechs doing the same for corporate credit cards,” says a senior fintech executive, who has worked with card networks such as Visa and Mastercard in the past.

Early this year, RBI asked Visa to stop its business payment solution provider (BPSP) in commercial and business payments through corporate credit cards. BPSP started around 2017 as a solution to let small businesses accept card payments without having a card terminal in their account.

Before BPSP, these payments were often made by the corporates through their RTGS and NEFT account transfers, which are debit transactions. BPSP allowed them to make credit payments.

According to the regulator, under this arrangement, the intermediary accepts card payments from corporates for their commercial payments and then remits the funds via IMPS/RTGS/NEFT to non-card accepting recipients. This arrangement was without specific legal sanction from RBI.

Not surprisingly, rent payments also follow the same route.

“While RBI had money laundering concerns with respect to the relatively large value of transactions for the vendor payments, the rent payments here are mostly less than Rs 1,00,000 per month and hence RBI has not stopped this explicitly,” said the head of credit cards at a private sector bank.

Why credit cards

Why credit cardsOne of the key reasons why customers love using credit cards for rent payments is that the product carries a 45-50 days interest-free period unlike an overdraft, personal loan or even cashouts at ATMs using a credit card.

For banks, this puts them in a strange situation because most customers who use credit cards for rent payments usually settle the entire due amount at the end of the credit-free period and are not highly remunerative.

In the US, Wells Fargo Bank has suffered huge losses on its rewards programme for rent payments. This is one of the reasons why banks have started imposing fees for such payments. Banks make most of the money when customers revolve the credit (not paying the full due amount at the end of the credit cycle) and pay high interest rates for the due amount.

Fintech startup RedGiraffe, the oldest startup in the credit-card based rent payments business, submitted a white paper to RBI in March.

“The paper details a comprehensive model prevalent globally, our own current processes ensuring regular settlement of high-value transactions across all instruments with no risk of P2P transactions,” the company said in an email statement to Moneycontrol, adding that the escrow account is managed by a regulated payment aggregator.

However, RBI is not concerned about the global practice or whether the vendors are verified, says the banker who was quoted earlier. “The end beneficiary is an individual and not a merchant, who cannot accept credit card payments through an intermediary (fintech)”.

For banks that issue credit cards, the payments are deposited to a merchant account and hence cannot stop the payment.

“As long as the credit card customer has a credit balance, we have to approve the payment. Also, unless the RBI explicitly say so, stopping payments to a genuine merchant account is not good business,” says a senior executive with a private sector bank’s cards division.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.