Treasury Secretary Janet Yellen said that “unacceptably high” prices are likely to stick with consumers through 2022 and that she expects the US economy to slow down.

“We’ve had high inflation so far this year, and that locks in higher inflation for the rest of the year,” she said Sunday on ABC’s “This Week.”

“I expect the economy to slow,” she said, adding: “But I don’t think a recession at all inevitable.”

US inflation accelerated to 8.6% in May, a fresh 40-year high that signals price pressures are becoming entrenched in the economy. Those figures dashed any hope that inflation was starting to ebb, prompting the Federal Reserve to unleash its biggest interest-rate increase since 1994.

The reasons behind stubborn inflation are “global, not local,” according to Yellen, who pointed to disruption in energy supply from the war in Ukraine and goods coming in from China where Covid-related lockdowns continue.

“These factors are unlikely to diminish immediately,” she said.

Federal Reserve Bank of Cleveland President Loretta Mester echoed Yellen’s view that growth will slow down, saying that threat of a US recession is increasing.

“The recession risks are going up partly because monetary policy could have pivoted a little bit earlier than it did,” she said on Sunday on CBS’s “Face the Nation,” referring to criticism that the Fed failed to raise rates at the first signs of runaway inflation late last year.

Mester sees it taking several years for the year-on-year headline inflation rate to return close to the Fed’s 2% goal.

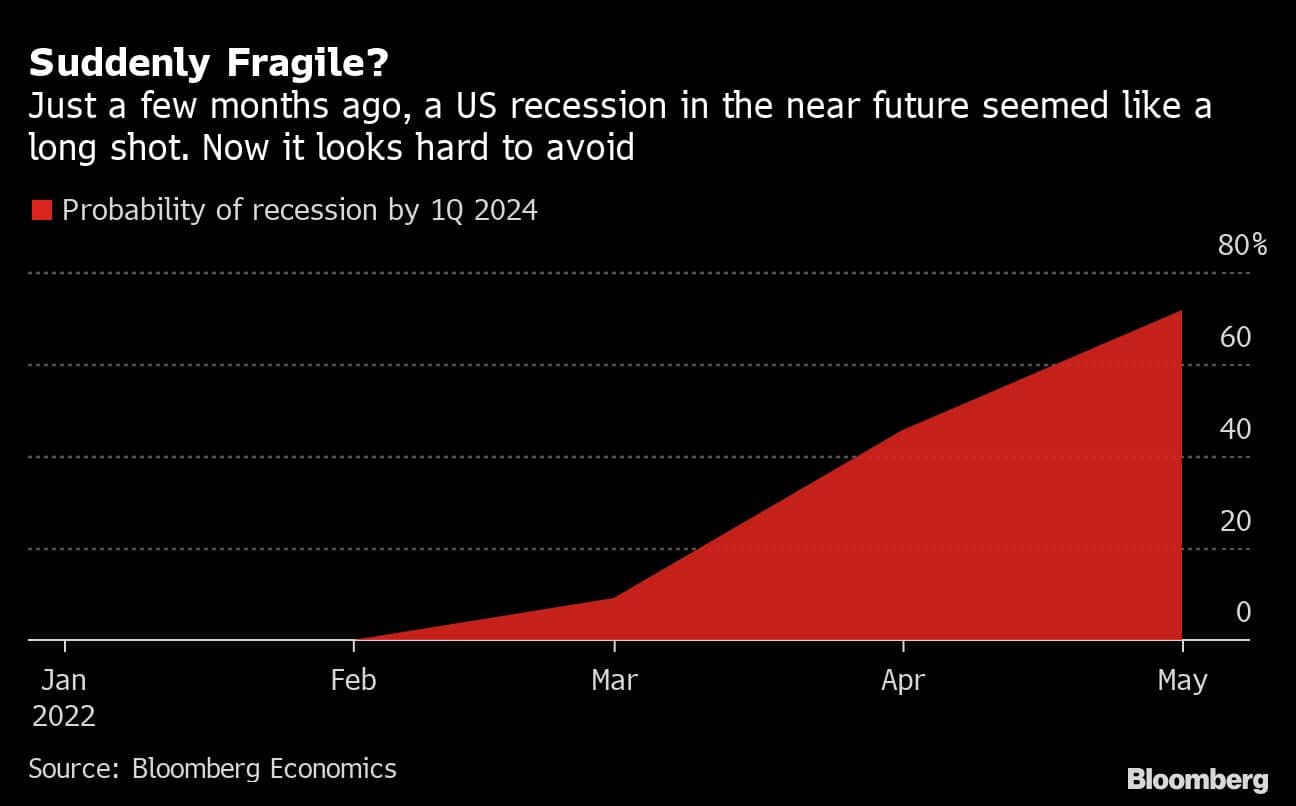

Soaring prices are hurting Americans and an economic downturn by the start of 2024, barely even on the radar just a few months ago, is now close to a three-in-four probability, according to the latest estimates by Bloomberg Economics.

Brian Deese, director of Biden’s National Economic Council, painted a rosier picture of the economy than Yellen and what Fed officials are saying. Deese referred to “independent forecasters” who “see inflation beginning to moderate over the course of this year.”

He also expressed hope that congressional passage of a bill that would lower the cost of prescription drugs, offer tax incentives for energy and other measures will take the pressure off of household finances. Yellen said a gasoline tax holiday is “worth considering” if it could help consumers weather inflation.

“We have real strengths in this economy,” Deese said on CBS, citing high household savings and a jobless rate of 3.6%. He says the administration seeks to bring down inflation in a way “where we don’t have to give up all of those economic gains.”

Still, the Fed on Wednesday forecast that a key price index would only increase in coming months, leading to the distinct possibility of another jumbo three-quarter percentage point increase in July.

Higher interest rates are seen driving unemployment to 4.5%, according to one Fed official.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.