With an industrywide boom in semiconductor sales running out of steam, the sector is dividing into two camps.

Chip companies that cater to automakers, data centers and industrial firms are still trying to keep up with demand, while those exposed to consumer electronics are stuck with inventory as sales slow.

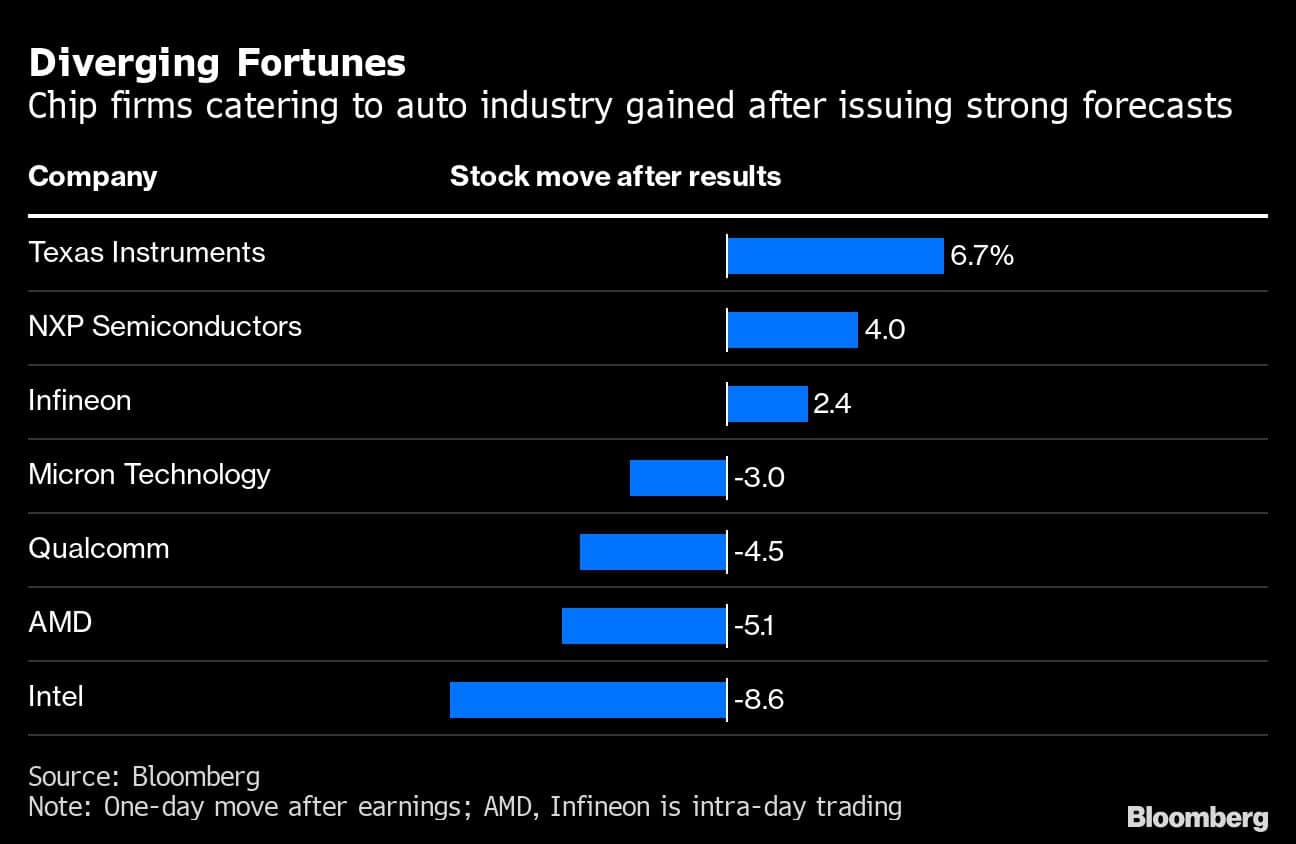

The results are playing out in the stock market, with Infineon Technologies AG and Advanced Micro Devices Inc. the latest examples. Infineon shares rose Wednesday after the company increased its revenue forecast thanks to auto-industry demand, while AMD fell after saying a slump in the personal-computer business will crimp revenue.

“We always had people making a blanket statement for chips in general,” said Dan Morgan, a senior portfolio manager at Synovus Trust Co., which has about $21.7 billion in assets under management. “You can draw a line in the sand right now.”

Sales of both memory and PC chips got boosts during the pandemic as demand surged for mobile phones, computers and other work-from-home electronics. The catalysts driving those products are now fading, said Morgan.

A string of companies have reported in line with the divergent trends.

Texas Instruments Inc. and NXP Semiconductors NV issued bullish forecasts last month on strong demand for industrial and auto products, and their shares have risen since then. Apple Inc. supplier SK Hynix Inc. and Qualcomm Inc. announced underwhelming outlooks tied to a dip in demand for consumer electronics, and their stocks have fallen. Memory-chip maker Micron Technology Inc. is an outlier, with its stock gaining since June 30, when it published a surprisingly downbeat forecast.

Intel Corp., the biggest maker of personal-computer processors, last week also slashed sales and profit forecasts for the rest of the year. The stock is down about 10% since then.

“Intel suffers from significant overshipping in the PC channel in past several quarters,” Tristan Gerra, an analyst at Robert W. Baird & Co., wrote in a note. “Shift in consumer patterns away from Covid-times at-home entertainment devices, combined with weak first-half seasonality, suggests no PC recovery near-term.”

Intel also shocked Wall Street with an unexpected 16% drop in revenue from expensive server chips that power data centers, a sector that is still seeing healthy demand but heightened competition from the likes of AMD and Nvidia Corp.

Global semiconductor revenue, which jumped by more than 26% last year, will increase 7.4% in 2022 and drop 2.5% next year, according to research firm Gartner, with chip sales from personal computers set to fall 5.4% in 2022.

With a slowdown on the horizon, chip stocks are already one of the cheapest sectors in the Nasdaq 100 Index. Among the least-expensive stocks in the tech-heavy benchmark are Micron at 9.2 times estimated earnings for the next year, Qualcomm at 11 and NXP at 13, versus the index at 22 times.

“Right now it’s better to focus on the areas of the semiconductor industry that are seeing faster growth, like data center, while auto-focused chips should also continue to be a good market despite supply shortages,” said Margaret Patel, senior portfolio manager at Allspring Global Investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.