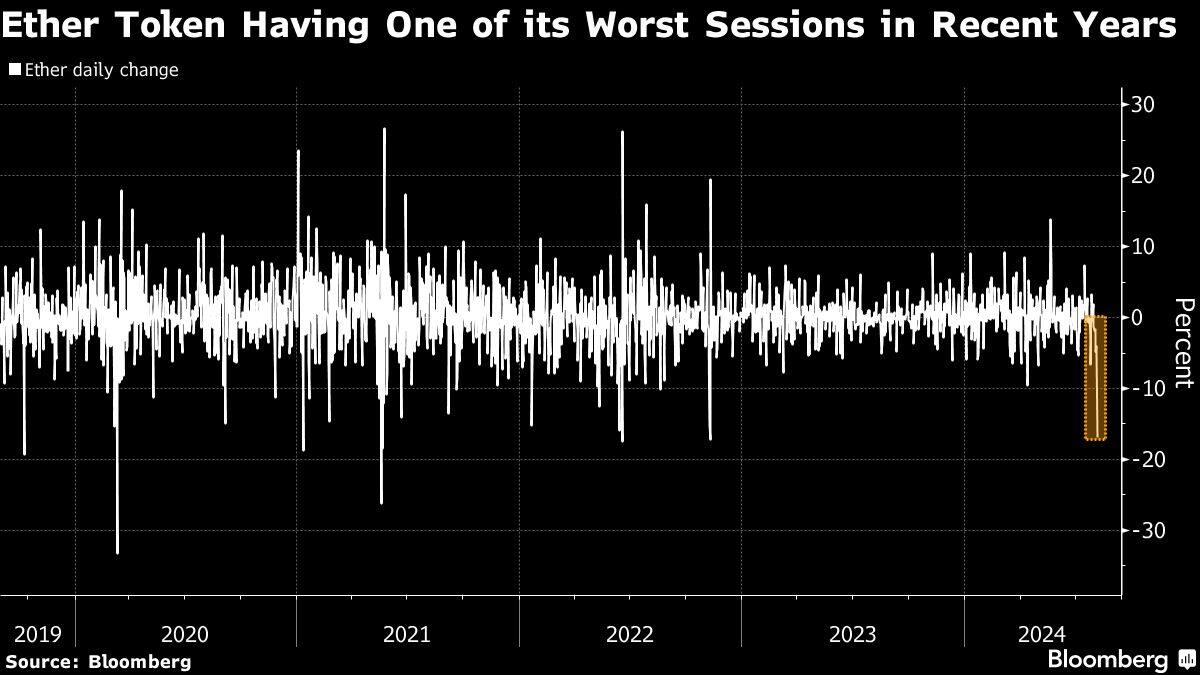

Cryptocurrencies reeled from a bout of risk aversion in global markets on Monday, sending Bitcoin down more than 14% and saddling second-ranked Ether with the steepest fall since 2021.

Top token Bitcoin’s retreat to $50,900 as of 7:20 a.m. in London added to a 13.1% drop last week that was the worst since the period when the FTX exchange imploded. Ether shed over a fifth of its value before paring some of the slide to change hands at $2,286. Most major coins were deeply in the red.

The declines come as a global stock selloff intensifies, reflecting concerns about the economic outlook and questions over whether heavy investment into artificial intelligence will live up to the hype surrounding the technology. Geopolitical tension is rising in the Middle East, adding to investor skittishness.

US exchange-traded funds for Bitcoin suffered their largest outflows in about three months on Aug. 2. One question is whether the products will attract dip buyers when they resume trading, or succumb to deeper exits.

Carry Trade

Digital assets are a victim in part of the unwinding yen carry trade, as speculators adjust to higher interest rates in Japan, according to Hayden Hughes, head of crypto investments at family office Evergreen Growth.

“Those investors are also fighting a drastic increase in hedging costs based on the volatility in the US dollar-Japanese yen trading pair,” Hughes said.

Bitcoin has been buffeted by a range of factors since hitting a record of $73,798 in March. That includes US political flux as pro-crypto Republican Donald Trump and Democratic opponent Vice President Kamala Harris — who has yet to detail a digital-asset policy stance — lock horns in the presidential race.

Also hanging over the market are possible sales of Bitcoin seized by governments and the risk of a supply overhang from tokens returned to creditors through bankruptcy proceedings.

Fed Outlook

Bond traders have amplified bets on US interest-rate cuts beginning in September to support economic expansion. The prospect of less restrictive monetary policy is actually “a good thing for crypto,” argued Sean Farrell, head of digital-asset strategy at Fundstrat Global Advisors LLC.

The Bitcoin retreat at its nadir Monday left the token at levels last seen in February. Ether, meanwhile, earlier fell back to prices previously seen at the turn of the year. Similar to Bitcoin, one unknown is how investors in new US spot-Ether ETFs will react.

Ether

Ether

Justin D’Anethan, head of Asia-Pacific business development at market maker Keyrock, said the crypto rout appeared somewhat Ether-led, flagging social-media rumors of institutional-selling of Ether-related assets.

About $790 million of bullish crypto positions using derivatives were liquidated in the past 24 hours, Coinglass data show, a sign of leveraged bets coming unstuck.

Khushboo Khullar, a venture partner at Lightning Ventures, which invests in Bitcoin-linked companies, said the broad stock slump had caused some “panic,” spurring investors to rush for liquidity to settle margin calls. She argued the crypto retreat is a “fine buying opportunity.”

Bitcoin’s year-to-date advance has moderated to approximately 16%, compared with an 18% climb in gold and an 8% jump in a gauge of global stocks.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.