Crypto mining firms listed in Toronto expect more turmoil and a lingering crisis of confidence in digital assets after the collapse of Sam Bankman-Fried’s FTX.

Bitcoin dropped as low as $15,804.76 on Monday and has lost nearly a quarter of its value since Nov. 5, shortly before FTX began to unravel. The falling price of the largest cryptocurrency, as well as smaller ones, is squeezing overleveraged miners and hedge funds that have lent money to the sector, according to the executive chairman of Hive Blockchain Technologies Ltd.

“There are still many more bankruptcies” to come, Frank Holmes said in a phone interview. FTX’s stunning tumble into bankruptcy has even affected already-insolvent firms like Voyager Digital Ltd., a crypto brokerage that filed for Chapter 11 in July and for which FTX had made a takeover offer, he noted. Voyager announced Friday that it’s reopening a bidding process as part of its own bankruptcy proceedings.

“I just don’t know who’s next. Maybe this is the Lehman Brothers event,” said Holmes, likening the FTX collapse to that pivotal moment in the global financial crisis of 2008 when the Wall Street firm toppled.

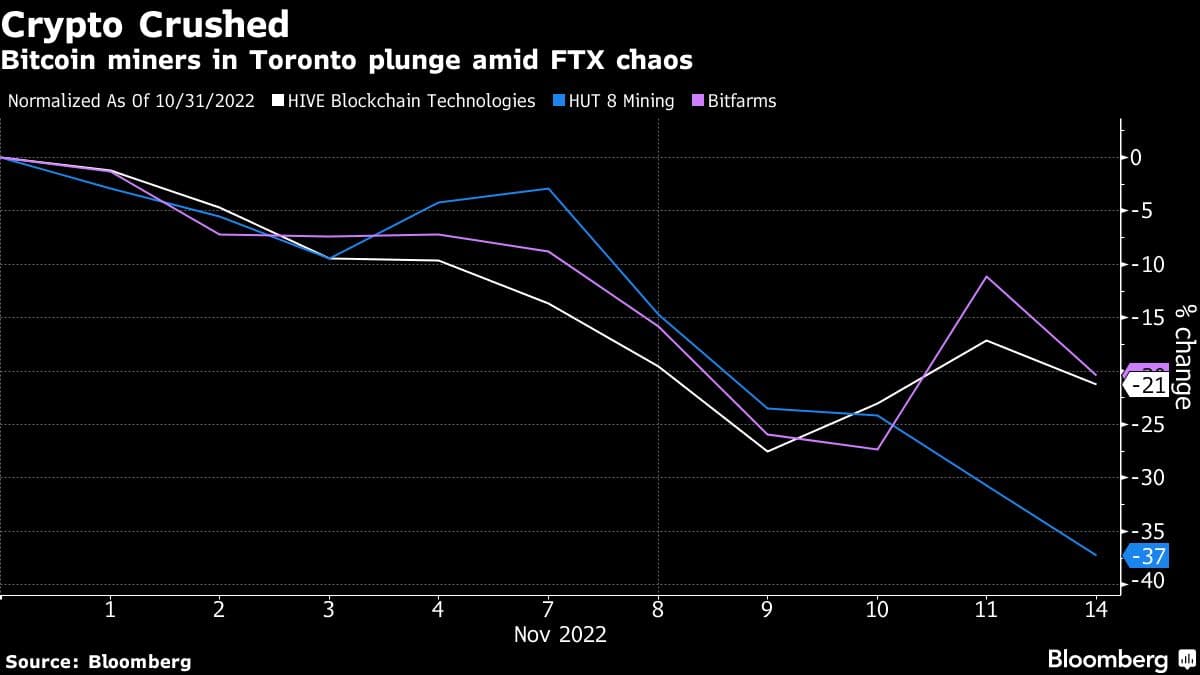

Toronto-listed crypto miners have plunged as the FTX saga has unfolded. Hut 8 Mining Corp. has led the way, plummeting 37% this month, while Hive has fallen 22% and Bitfarms Ltd. 24%.

All Bitcoin miners’ margins have been compressed, Bitfarms President Geoffrey Morphy said Monday during an earnings call that focused on the company’s attempts to keep costs low to survive the “crypto winter.” For miners, high energy costs are compounding the problem of falling crypto prices.

For many crypto entities, the capital markets are now firmly shut. “In the coming weeks and months, we will uncover how many executives and insiders knew what was happening under the hood,” Ether Capital Corp.’s CEO Brian Mosoff said in an email, noting that he expects “many dominos” to fall.

“Companies -- startups or established -- looking to raise capital in this environment will likely be met with resistance,” Mosoff said. “I expect this will take months, if not years, to play out.”

Hive Blockchain is organizing webcasts and meeting with investors to address concerns about investor sentiment. Part of the message: the Vancouver-based company has never used FTX as a trading firm and doesn’t leverage its crypto holdings, and any exposure Hive might have to FTX is “de minimus,” Holmes said.

Pulling FundsBitvo Inc., a Calgary-based cryptocurrency trading platform, has given assurances to customers that it continues to operate. FTX announced plans to buy the firm in June, but the deal did not close.

The trading platform operates on a full reserve basis and doesn’t lend money, CEO Pamela Draper said by phone. While “volatility” on the platform has increased, the company hasn’t paused deposits or withdrawals.

“It hasn’t affected our platform at all,” she said. For now, Bitvo is still bound by the FTX acquisition agreement, but the company will disclose “when or if” that’s canceled, Draper said.

The crash of Bankman-Fried’s empire has fueled outflows across global crypto exchanges, with users pulling $3.7 billion worth of Bitcoin and $2.5 billion of Ether from Nov. 6 to Nov. 13, according to data provider CryptoQuant.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.