Investors are increasingly convinced that central banks across Asia will follow the Federal Reserve in swiftly closing out this policy tightening cycle and are bracing for interest-rate cuts later this year.

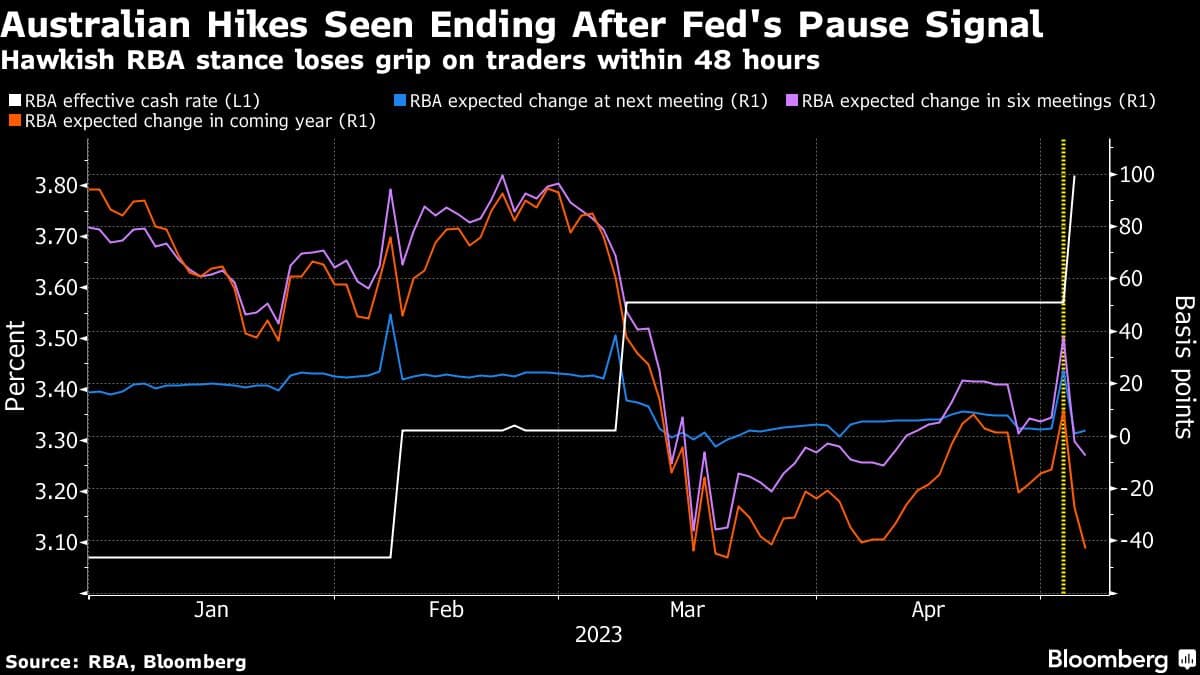

Australia, which serves as a proxy for risk sentiment across the region, snuck in a surprise rate hike less than 40 hours before Powell & Co. delivered what very well could be their last of this cycle. Overnight index swaps show investors expect a quick end to the Aussie hikes.

Malaysia notched a one-and-done rate increase for this year less than a half a day before the Fed. And policymakers in the Philippines last week said they’re ready to lower their inflation forecasts, which means less pressure to stay on the tightening path.

For Indonesia and South Korea, which have already paused their hiking campaigns, the cuts could be nearer. Bloomberg Economics sees Indonesia cutting before year-end amid a resilient rupiah, and the country’s 2-year bond yields fell in Wednesday’s session to their lowest since February. Traders bet Korea could cut within 12 months.

There is an exception: New Zealand’s central bank is seen hiking rates again on May 24 before pausing for the remainder of 2023.

Traders are looking at signs of a global downturn, including the weakness in China’s export-oriented data — like its unexpected manufacturing purchasing managers index drop — as signals of a steep decline in demand across the global economy.

The bets are showing up in rallying US Treasuries and commodity markets. Crude and copper prices are reflecting estimates that a crash in orders is on the horizon, with the Bloomberg Commodity Index at its lowest since June 2022.

Morgan Stanley economists see inflation across much of Asia returning to policymakers’ comfort zones as inflation decelerates, allowing central banks in the region to begin cutting interest rates in the final three months of this year.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.