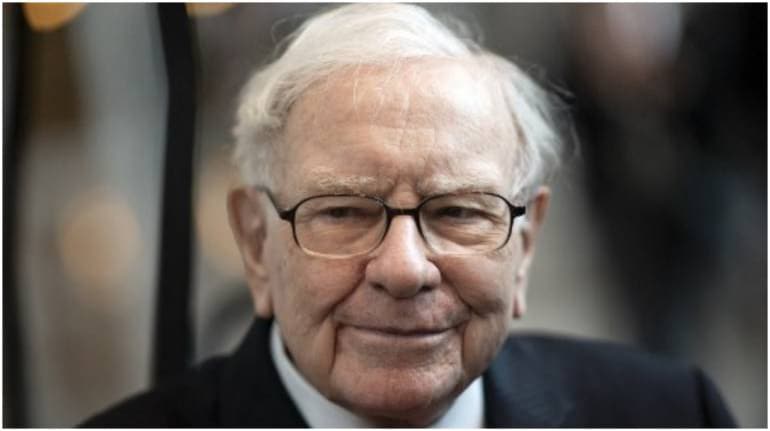

Veteran investor Warren Buffett believes that people should not become preoccupied with finding the perfect time to invest in stocks.

Instead, they should just buy them, keep an eye on the market and decide whether they want to sell or buy more, Warren Buffett had said at annual shareholders meeting of his company Berkshire Hathaway last month, according to CNBC.

Buffett said this strategy, which his business partner Charlie Munger also follows, will, to some extent, save investors from the stress of having to predict the stock market.

Buffett added that this investing skill can be learnt in “fourth grade” but schools do not teach it.

He also reflected on how when he tried to predict the market twice -- once at the start of the coronavirus pandemic in March 2020 and a second time during the Great Recession of 2008 -- his company suffered.

“We were optimistic in 2008 when everybody was down on stocks,” Buffett was quoted as saying by CNBC. “We spent a big percentage of our net worth at a very dumb time. We spent about $15 or $16 billion, which was a lot bigger to us then than it is now.”

Buffett has also advised people to start investing early and see how compounding interest boosts their wealth.

On one occasion, he compared compounding wealth and to a snowball gathering mass as it is rolled down a snow-covered hill.

“I started building this little snowball at the top of a very long hill," Buffett was quoted as saying in a CNBC article. The trick to have a very long hill is either starting very young or living to be very old.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.