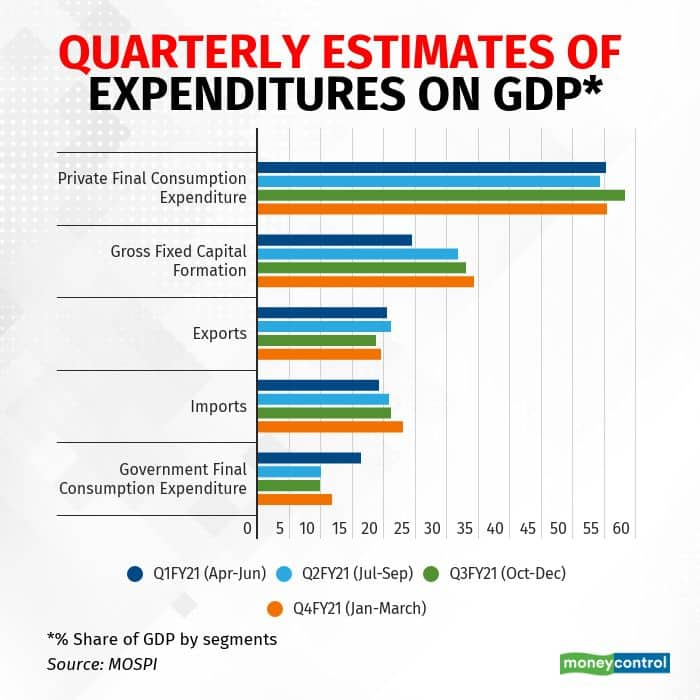

Gross fixed capital formation (GFCF), which is an indicator of the level of investments in the country, fell by 10.8 percent during the financial year 2020-21 as compared to a rise of 5.4 percent during the previous fiscal.

GFCF is 31.2 percent of gross domestic product (GDP) in 2020-21, compared to 32.5 per cent in the previous year. However, on a quarterly basis, GFCF rose by 10.8 percent compared to the fourth quarter of the previous financial year.

GFCF was 34.3 percent of the GDP in the January-April quarter of 2020-21 compared to 33 per cent in the October-December quarter of 2020-21, and 31.5 per cent a year ago as per the data released by the National Statistical Office on May 31. The country's GDP rose by 1.6 percent in the fourth quarter, as compared to 0.5 percent in the third quarter and 3 percent in the fourth quarter of 2019-20.

On the other hand, Government Final Consumption Expenditure (GFCE) rose by 2.91 percent to Rs. 15.86 lakh crore in FY21, up from Rs 15.41 lakh crore in the year before.

GFCF is an indicator for gauging the fixed capital formation. A downward trajectory in gross fixed capital formation would indicate that the fixed capacities are not being ramped up.

Though the country had recorded the largest number of COVID-19 infections, second only to the United States, the COVID wave had affected India severely hitting its economic and investment climate. However, the central government is of the opinion that the economic impact will be minimal compared to last year, as lockdowns are looser this time and growth in manufacturing and exports is higher.

Finance Minister Nirmala Sitharaman had said last week that no decision has been taken for another stimulus package. She hinted about having limited space due to a drop in tax collections and a rise in public debt. As an effort to boost investments during the pandemic, the government had extended Rs 111 lakh crore National Infrastructure Pipeline to cover 7,400 projects by 2025. The Centre had also announced that a sum of Rs 20,000 crore has been provisioned in the Budget to launch the National Asset Monetisation Pipeline.

Click here to follow our live blog on GDP data.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.