Investments of about $2 billion have been postponed by auto component sector on uncertainty over how long it will take for demand to revive as over a lakh have lost their jobs already.

Deepak Jain, President of Automotive Component Manufacturers Association (ACMA), said the slowdown has forced several companies to put on hold their capacity expansion plans.

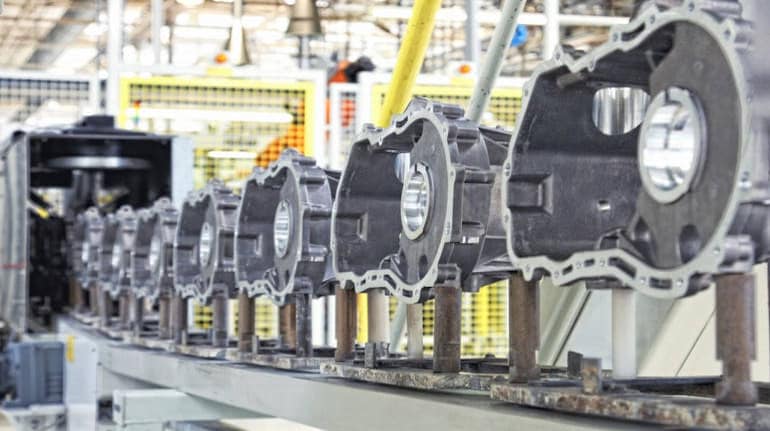

“I don’t know of any company which is investing. The component sector is sitting on capacity. Their plants are running at 50-55 percent capacity utilisation. So, obviously a lot of companies are not investing on capex,” he stated.

Bharat Forge, for instance, has cut down on investments, including capex, in FY19 and projected a similar cut in FY20 as well. It will instead sweat its assets this fiscal.

Hit by one the worst slowdowns in automotive history, sales during April-October fell 16 percent to 13.91 million units, including a 27 percent year-on-year fall in sales of cars to 988,806 units, data shared by the Society of Indian Automobile Manufacturers (SIAM) shows.

“In Q1 FY19, the growth rate in the industry was 15 percent, with a lot of companies running their plants at 85-90 percent utilisation. A number of companies invested in newer capacities in anticipation of bringing forward of buying due to Bharat Stage-VI, but now those capacities are idle,” Jain added.

Maruti Suzuki, Tata Motors, Hyundai, Hero MotoCorp, Honda Motorcycles, Ashok Leyland, Volkswagen, et al had to shut down their plants to avoid oversupply of stocks to dealers. The dealer community had to lay off an estimated one lakh employees over the past one year.

“This slowdown is very unique. This is one of the longest slowdowns and even after a year we have not exited it. It never so happened that all segments have fallen at the same time. This is because there were structural and cyclical changes. There have been job losses of about a lakh and most have been contractual in nature,” Jain said.

Auto component companies are also responsible for widening of the fiscal deficit, despite increasing exports. India has been net importer of automotive components and its fiscal deficit has been widening.

“We imported $17 billion last year and exported $15 billion. Our deficit estimate for H1 FY20 stands at $600 million. We have always been a net importer and our deficit has increased over the last two years mainly because of the shift in electronics,” Jain stated.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.