One quick thing: Amazon Pay has been fined Rs 3.06 crore by the Reserve Bank of India for not complying with the KYC norms and some of the provisions of Prepaid Payment Instruments (PPIs).

In today’s newsletter:

- SoftBank CEO plans India visit

- Lending startups top funding charts

- Nilekani predicts data-driven lending boom

You're invited to Moneycontrol's India Fintech Conclave. We have a star-studded lineup featuring a Union Minister, RBI official, policymakers, bankers and top founders who are reshaping the fintech landscape in India.

- It's happening on March 7 in Mumbai. RSVP here.

Was this newsletter forwarded to you? You can sign up for Tech3 here

Top 3 stories

Top 3 stories

SoftBank CEO plans India visit

SoftBank chief Masayoshi Son is planning to visit India next week, sources tell us.

- The founders of the tech investor's portfolio companies, both public and private, have been asked to be on standby to meet him during his short visit

- This will be Son's second visit to India, and one of his first international tours outside of Japan since Covid

His itinerary in Delhi is likely to coincide with OYO founder Ritesh Agarwal's wedding reception, where the who's who of India Inc will congregate, and PM Modi is an invitee. However, it is unclear whether Son will attend the celebrations.

Funding winter

Despite being one of the biggest backers of Indian startups, SoftBank has tightened its purse strings in the last year.

- SoftBank’s funding for Indian startups fell 84 percent in 2022, and it hasn’t made any bets as yet in 2023

- The Japanese conglomerate has invested around $15 billion in Indian companies so far, of which $11 billion have been in the last six years

Lending startups top funding charts

Fintechs have dominated venture capital and private equity funding this year. Is it, however, fintechs or a niche category of fintechs?

If we look deeper, there's another bias here.

Driving the news

Lending-focused startups are taking up the larger chunk of funds going into fintech startups

- Investors are largely staying away from pure tech-oriented deals in a scarce funding environment

- While PhonePe, which also raised two large rounds, does not currently offer lending on its platform, it intends to use the funds to do so

The regulatory tussle

The increased funding comes at a time when the regulator has started to pay attention to the segment.

- RBI and MeitY have cracked down on digital lending apps due to "national security" concerns in the recent past

In February, MeitY blocked 94 ‘unregulated’ loan apps over alleged links to China

"People who play fast and loose with the regulation struggle in India because they think that they can get around but that is not the way Indian regulators work,” said Piyush Kharbanda, general partner, Vertex Ventures, a backer of Kissht that was also briefly banned by the regulators.

Go deeper

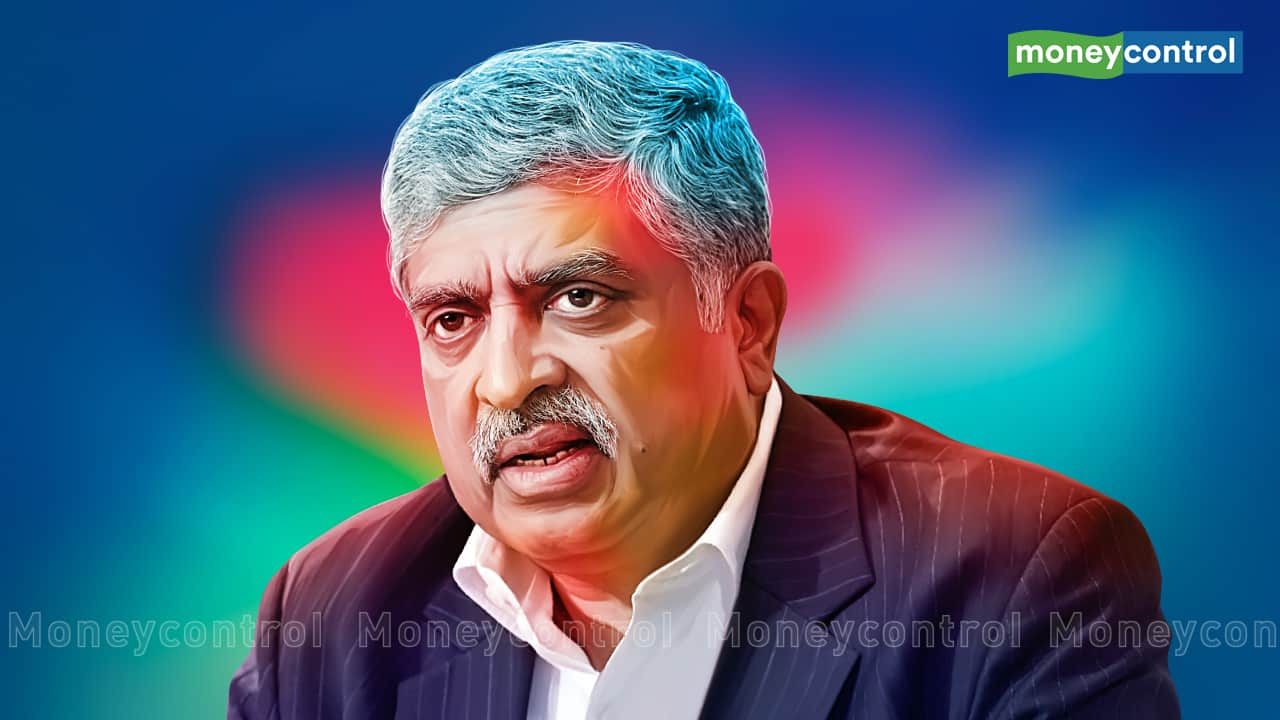

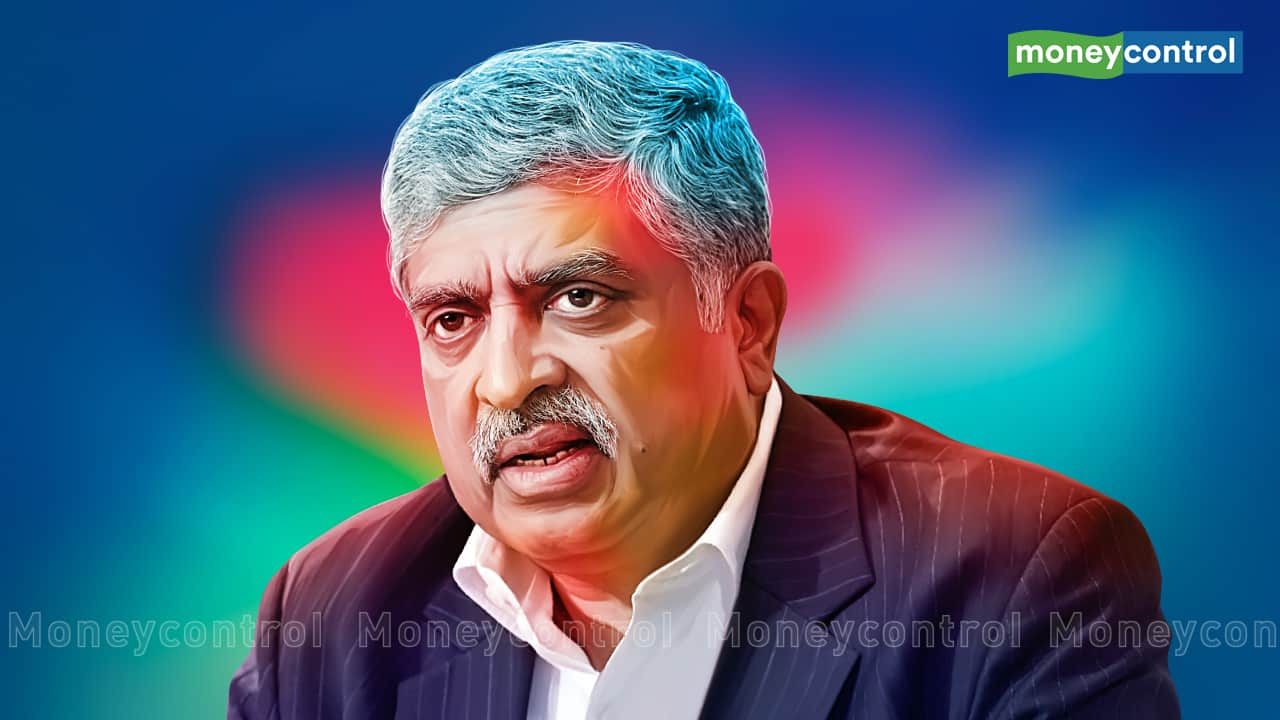

Nilekani predicts data-driven lending boom

Why is this significant?

First off, Account Aggregator (AA) framework is a data-sharing system developed by RBI that is required for making investments or accessing credit, among other financial services.

- As a lender, thus AA is basically formalising credit and solving the issue of quality and access

As a consumer, you can decide whom to share your data with and for how long. The concept was introduced by the Reserve Bank of India (RBI) in September 2021.

Tell me more

Nilekani also said that while insurance and pension plans may take time to pick up, except for products like embedded insurance products, credit will be the next big thing in India.

"Insurance and pension are push products and will take time to pick up, maybe the different models will evolve...But credit and lending will grow massively," Nilekani said.

Go deeper

This week in AI: A new era of intelligence

Artificial intelligence (AI) has long been trying to mimic the remarkable capabilities of the human brain, but the complexity of this human processor continues to baffle scientists to date.

A team of international researchers, led by Johns Hopkins University, appears to have taken a unique approach by proposing "organoid intelligence," a combination of a brain and a computer. The idea is to grow small clusters of brain cells using samples of human tissue, which could be used in place of traditional silicon computer chips.

The efficiency of the brain in processing and storing information is a key reason for turning to biological computing. Fun fact: The human brain can store an incredible amount of information - an estimated 2,500 terabytes!

The possibilities of this research are intriguing, but it is not without ethical concerns. Using human cells to create computers raises the question of whether it is ethical to do so. Additionally, there is concern about whether a computer made of human cells could develop consciousness.

The pursuit of replicating the human mind through AI is an intriguing and exciting prospect, but it is not without its challenges. Regardless, the possibilities that this research presents are fascinating and thought-provoking. It will be interesting to see what the future holds in store for the intersection of biology and computing. (Picture credit: DALL-E)

Here's what Infosys cofounder Narayana Murthy has to say about the AI vs. humans debate.

More from the world of AI: