SoftBank Group Corp, one of the prolific private tech market investors in India, has cut its investments in the country by more than 84 percent in 2022 versus a year earlier as it turned extremely selective in capital deployment amid macroeconomic headwinds.

Source: Venture Intelligence

Source: Venture Intelligence

The company, which has backed nearly a fifth of India’s over 100 unicorns, invested about $500 million into Indian startups this year, down from over $3.2 billion it invested in the whole of 2021, according to data compiled by Moneycontrol. SoftBank has also participated in only about six deals so far this year, compared to 17 in 2021.

This year’s amount is also significantly less than the previous six years’ average of $1.875 billion, according to the data.

Its average cheque size has also dropped to $83.3 million in the first 11 months of this year compared to over $185 million in the whole of 2021, the data showed. SoftBank has invested more than $11.2 billion in Indian companies since 2017 with its Vision Fund investment units. In 2017 itself, it invested more than $4.1 billion, and that too, across just three deals.

Investment landscape

SoftBank has invested close to $15 billion through its Vision Fund investment units over the years, sources said. In 2021, SoftBank participated in at least three rounds of more than $500 million.

The Japanese investment conglomerate participated in Flipkart’s $3.6 billion round, Eruditus’s $650 million round and Meesho’s $645 million round. It also participated in Unacademy’s $440 million funding round and Swiggy’s $451 million round, according to data compiled by data intelligence platform Venture Intelligence (VI).

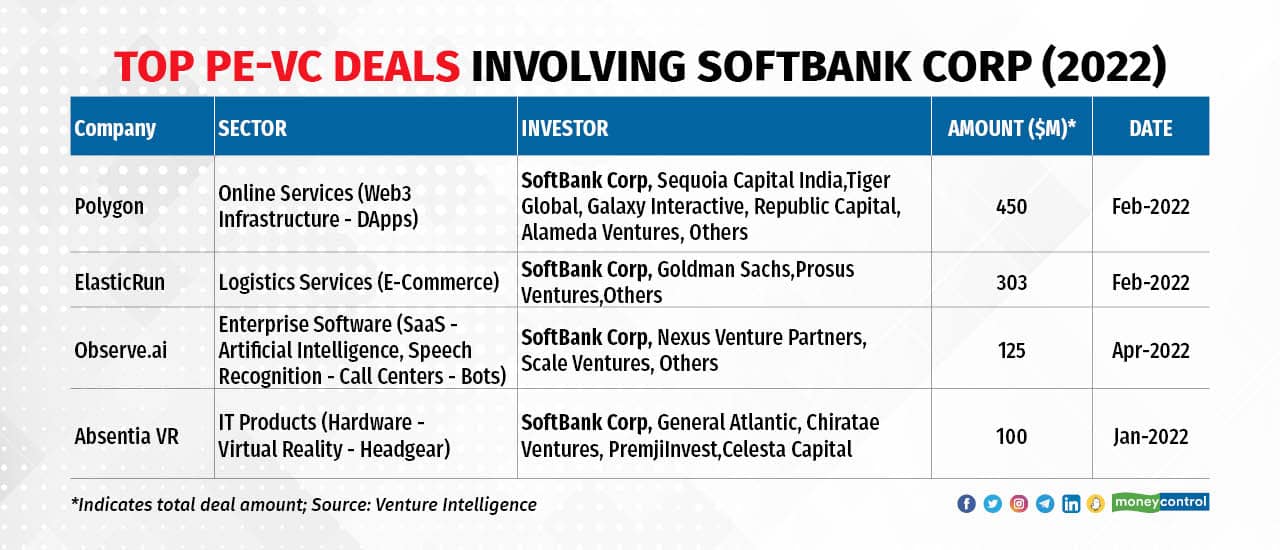

However, in 2022, SoftBank has not participated in a single round of more than $500 million. Its largest round was Polygon’s $450 million fundraise that happened in February this year. Besides Polygon, SoftBank invested in three rounds ranging from $100-$303 million.

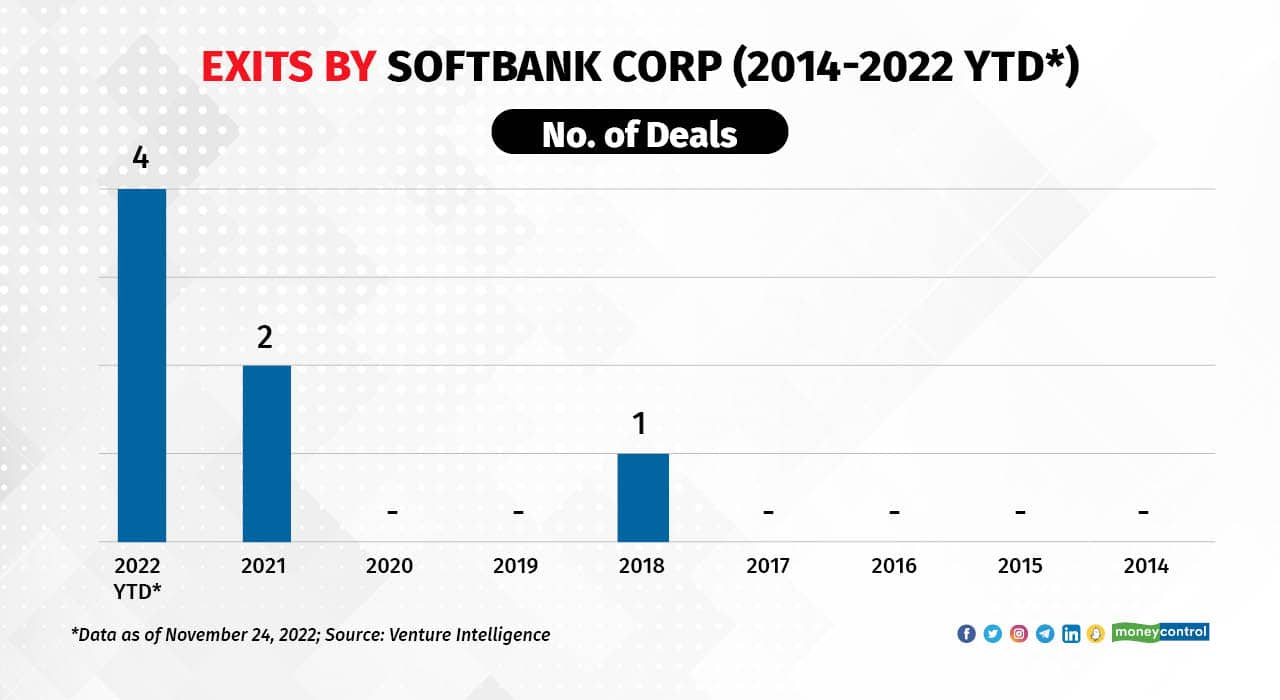

SoftBank has, however, made four exits this year, the most for the Japanese investment conglomerate in the past eight years. According to the VI data, SoftBank had sold shares only in three of its portfolio companies before 2022.

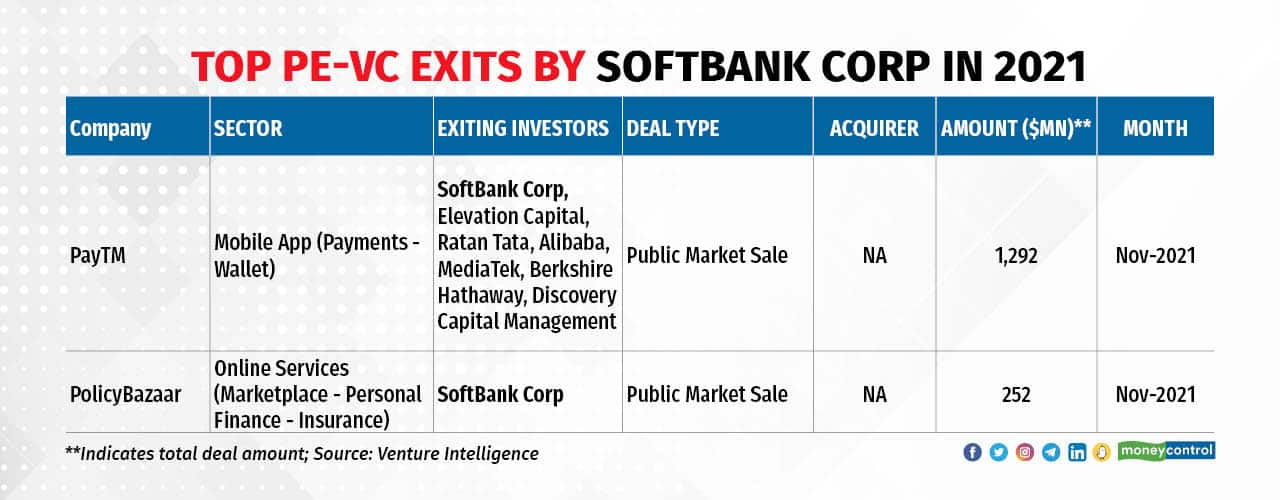

Two of the three exits happened last year when Paytm’s parent One97 Communications and Policybazaar’s parent PB Fintech. This year, SoftBank sold shares in logistics unicorn Delhivery, another portfolio company of the Japanese investment conglomerate that got listed in May.

To date, the company has garnered $6 billion through exits in Indian startups, sources said.

Besides Delhivery, SoftBank further sold shares in Paytm through block deals and open market operations. It also exited Firstcry.com by selling its stake to Premji Invest and sold its stake in Blinkit (Grofers) to Zomato.

SoftBank declined to comment on the data.

Worsening funding winter

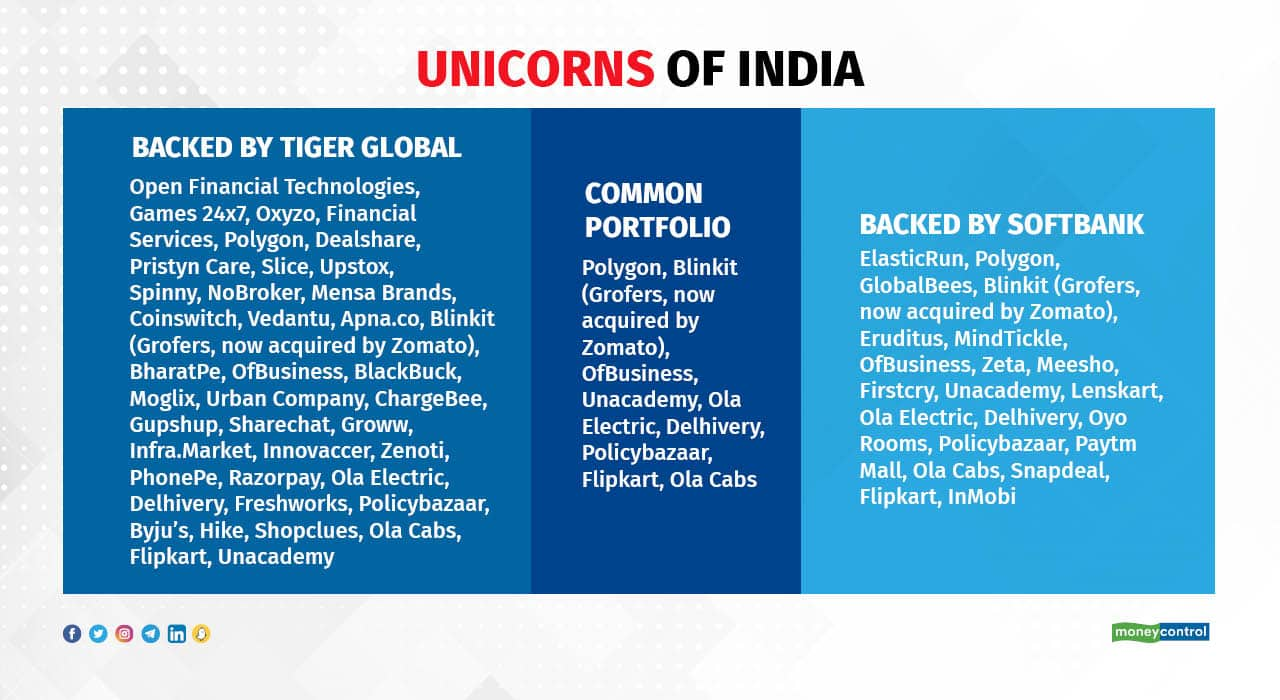

SoftBank was not alone to cut its investments this year in India. The New York-based hedge fund company Tiger Global Management, too, has gone slow on capital deployment. Moneycontrol reported last week how Tiger Global slashed its investments by more than 70 percent as of November this year over 2021.

SoftBank and Tiger Global have together backed nearly half of the country’s 107 unicorns and the two aggressive investors going slow on capital deployment in the country highlights the sorry situation of India’s private markets, which, unlike its public markets, have not been able to disassociate themselves from global peers.

Industry observers believe that India’s private markets do not have the cushioning of domestic investors, unlike the country’s public markets that have the Rs 40 lakh crore-mutual fund industry, which absorbed the selling pressure of overseas investors this year.

However, while Tiger Global’s investments have dropped, the company has continued to deploy capital, by doing smaller deals. The company’s partners have also expressed optimism in India as they have come down to the country at least four times in 2022 to explore early-stage investments.

But that does not seem to be the case with SoftBank. The Japanese group has sounded very cautious about investing in high-growth technology companies this year and has thus also participated in very few rounds.

SoftBank’s cautious approach

To be sure, SoftBank’s approach on investments has changed in India over the last four years. The Japanese investment conglomerate, which was once recognised as the 800-pound-gorilla in the startup world, transformed since 2018 when it hired Sumer Juneja as its India head.

The investment conglomerate adopted a more cautious investment approach in India and has made less risky bets. While SoftBank did invest aggressively in the country last year, it was largely due to favourable macroeconomic conditions, industry observers said. The company’s ‘cautious approach’ has been more evident this year as it participated in deals worth only $978 million.

“There’s been nothing this year from SoftBank,” said Anand Lunia, founding partner, India Quotient, a homegrown venture capital firm that has backed close to 90 startups in the country, including social media unicorn Sharechat.

“This year has to be the worst for Indian startup investments since 2017 at least. The data that you have (on SoftBank’s investments) is skewed because the first three months of 2022 were still decent. Also, the first three months deals closed last year, just the filings happened this year. Otherwise, there’s been absolutely nothing,” Lunia added.

Masayoshi Son, the Japanese investment conglomerate’s chief, also sounded extremely cautious in his three post-earnings speeches since April this year. In his last speech in November, which would also be his last post-earnings speech for SoftBank, Son batted for monetisation and said that the current market downturn was the third biggest after the dotcom bust and the Lehman crisis, and SoftBank will monetise ‘whatever it can’ to survive this economic downturn.

However, in November, Moneycontrol reported that SoftBank would not hasten its exit from its public-listed portfolio companies in India after the lock-in period for its shares ended in November.

Son also said in May that the company would cut its investments to a fourth in 2022, due to macroeconomic headwinds. The company also cut about 150 jobs globally at its Vision Fund Investment units to cut costs. The 66-year-old billionaire has also stepped away from day-to-day activities while shifting his focus on building chip design firm Arm.

SoftBank and Son’s cautious approach has come at a time when the Japanese investment conglomerate lost $913 million in the first six months of the financial year 2022. SoftBank follows an April-March calendar. SoftBank reported its biggest-ever quarterly loss of over $23 billion in the April-June quarter. SoftBank made a profit in July-September, which helped it narrow its loss in April-September.

The Japanese investment conglomerate that has invested in poster boy startups in India like hotel aggregator firm Oyo, payments and lending platform Paytm, insurance aggregator platform Policybazaar, and online test preparation platform Unacademy, also suffered losses on its investments in the country.

According to SoftBank’s last available financials, the fair value of SoftBank’s $1.4 billion investment in Paytm was $0.9 billion as of September 30. The fair value of the company’s $0.2 billion investment in PolicyBazaar was $0.3 billion.

In September, the Japanese investment conglomerate had reportedly internally marked down the valuation of IPO-bound Oyo—another big bet for SoftBank—by 20 percent. Oyo, however, had denied the development.

SoftBank has been a prolific technology investor in India for years, and its cautious outlook could potentially hint at a prolonged funding winter for startups in India, especially for late-stage startups.

“The actual pain will be felt next year if Tiger Global and SoftBank continue to go slow on investments, as by that time, the multi-million dollar rounds that most unicorns raised last year would exhaust,” Lunia said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!